We are excited to announce the three firms named the winners of Carson Coaching’s 2019 Firm of the Year Awards.

- Compass Capital Management of McAlester, Oklahoma, won the Elite Firm of the Year Award.

- Endeavour Wealth Management of Winnipeg, Manitoba, Canada, won the Emerging Firm of the Year Award.

- FFP Wealth Management of Bayonne and Hazlet, New Jersey, won the Cultural Leadership Award.

The winners were first announced May 10 during Excell 2019 in Chicago. Carson Coaching annually honors member financial planning firms that have significantly enhanced service to clients and shown outstanding growth. Congratulations to this year’s recipients!

Emerging Firm of the Year

Endeavour Wealth Management

Firm name: Endeavour Wealth Management

Location: Winnipeg, Manitoba, Canada

Team size: 9

Total AUM: $203 million

The last year has been a big one for Grant White and his Canadian-based firm, Endeavour Wealth Management. His advisory team added two new advisors, left its bank dealer and started its own independent business. These changes validated that White had the right processes and branding in place to not only attract new clients but develop talent. Endeavour prides itself on mentoring new advisors, allowing them to focus on relationships with clients by handling all other aspects – marketing, portfolio management, etc – itself. The firm’s mentoring motto is to train people so well that they can work anywhere, but treat them so well they won’t want to work anywhere else. It offers new advisors a unique compensation structure with an extended salary, and it implemented a mentorship program so every advisor has a go-to person on the team. This focus on developing new talent has translated into great client experience. White and his team left their bank-owned dealer to remain unbiased and gain more options in the services it provides clients.

It hired more client-facing stakeholders and nurtured a culture of treating the client as they would like to be treated. White used Carson Wealth as a template for building his business, and lists his coach through Carson Coaching as instrumental in the firm’s success thus far. He said he’s learned to prioritize his life, putting family and friends before business, and has noticed the improvements both in life and the firm. He’s traveled to other wealth management firms around the world and implemented ideas he learned. He encourages Endeavour stakeholders to give back to their community and volunteer. The firm has a matching program for donations and later in 2019 will host a shark-tank style event to raise awareness and donations for local charities. Giving back to the Winnipeg community is almost a prerequisite for being an Endeavour stakeholder. From 2017 to 2018, Endeavour has experienced tremendous growth across the board. It increased in AUM by more than 181 percent; increased in gross revenue by 100 percent; and increased in the number of client households by more than 157 percent.

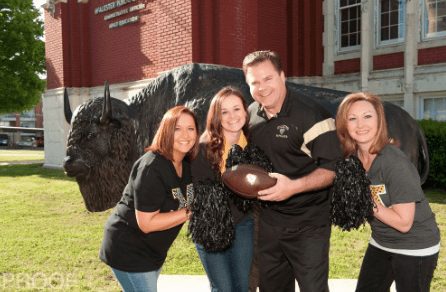

Elite Firm of the Year

Compass Capital Management, LLC

Firm name: Compass Capital Management, LLC

Location: McAlester, Oklahoma

Team size: 5

Total AUM: $184.5 million

When it comes to the satisfaction of their clients, Compass Capital Management does not mess around. Founder and President Jimmy J. Williams said Compass advisors are claimed fiduciaries to their clients. The team is client-focused in all decisions that it makes. Its Advisory Council members have even informed the firm that they work with Compass because of the openness and integrity in which the firm provides services. Williams said that the only thing Compass sells is “peace of mind.” Williams and his team understand that the market can be unpredictable, which is why they’ve re-launched an improved client event strategy and provided more communication and education on the Family Index Number. The needs of their clients are diverse and challenging. The confidence that Compass exhibits and communicates to its clients creates a culture of community that continues to foster a greater number of introductions. 2018 was a big year for Compass Capital Management. It completed the establishment of a new website, podcast, blog and even a book that is currently being published. Williams notes that these are wins because they enhance the firm’s credibility. The firm’s specialty, retirement planning, is recognized by its target communities as a needed growth area. The firm also has used this last year to continue enhancing its technology. Currently, it is improving its dashboard for “client-facing” presentations. Williams said that the firm owes the tremendous growth and vision to Carson Coaching.

The systems, communications and strategies that Carson Coaching provides improve direction and leadership that is critical to success. Williams has worn the cover off his copy of Ron Carson’s “Tested in the Trenches” book by utilizing it as a measuring stick for the team. Williams worked for more than nine years with another coaching group prior to joining Carson Coaching. As a team, Compass could immediately see the impact of the difference between a coaching group that provides advice and Carson Coaching, which provides advice, proven marketing methods, client deliverables that are first-class and ongoing coaching with an individual that truly cares about the firm’s success. Through his participation at Carson Coaching, Williams has realized a tremendous dream he has held since his career began – the freedom to spend his time and treasure in the areas of life that are most important to him. Williams has been given the freedom to establish a scholarship program for children lacking support to attend college. This is Williams’ way to “pay it forward” based on his own lack of support when he attended undergraduate school. Williams does not consider himself to be simply a “member” of Carson Coaching, but a true disciple that recruits actively for others to experience what he calls a life-altering process.

Cultural Leadership Firm of the Year

FFP Wealth Management

Firm name: FFP Wealth Management

Location: Bayonne or Hazlet, New Jersey

Team size: 14

Total AUM: $747.65 million

Creating a strong culture is not about holding the most parties or being able to quote the company’s values. It’s about building a team that is actively working to improve; engaged in their careers; and working together on a common, understood mission. FFP Wealth Management has earned this culture. Joseph Graziano and his firm develop and nurture close relationships with accountants in their community to increase their value proposition. From this unique partnership, FFP advisors see a holistic view of their clients’ financial situation and goals, which ultimately results in better solutions. It’s no surprise that clients come first when it comes to business. FFP requires team members to go through extensive service skills training so they feel empowered when working with clients. The firm recognizes and rewards team members who go the extra mile for their clients with “Above and Beyond” gift cards. FFP has a designated community outreach team – FFP Cares – that’s dedicated to finding and organizing local volunteer opportunities for the team. They’re regulars at the Monmouth County Fulfill Food Bank and hold a yearly Christmas Charity event for families in need, providing gifts, cookies, and even bringing in Santa Claus! In addition to supporting the community at a firm level, FFP is always willing to jump in and support causes that are important to its stakeholders.

Last year, the firm sponsored and participated in the Ashley Lauren Foundation’s 5k, an event that was near and dear to one of their representatives. It’s not just giving back to the community that makes FFP a standout in cultural leadership – the firm is dedicated to the professional growth of its team members and welcoming the next generation of talent. Stakeholders are encouraged to continue their development through FFP University, which finds and organizes training on special topics, and through company-paid outside courses and programs that the stakeholder would find beneficial. FFP has an ongoing internship program that connects them with local undergraduates interested in the financial services industry, a program that has led to full-time hires. While FFP is clearly a leader in the area of culture, the firm could also easily compete with other elite firms in the areas of business execution and growth. Since joining Carson Coaching, FFP refocused its management style to measurable objectives. It has implemented advisor and firm scorecards to review regularly, and team members have a clearer picture of their role and how they contribute to the overall success of the firm. The firm also used a Carson Coaching takeaway by relying on automation and systematization for its processes. All the insights and tools FFP has gleaned from Carson Coaching has made its team more empowered and accountable – and it has translated to fewer late nights at the office and more quality time with families.