This post is part of a series discussing the findings of the 2022 State of Women in Wealth Management Report by Mary Kate Gulick and Julie Ragatz, Ph.D. The 2022 study is based on survey data and interview input from a wide selection of cross-channel financial advisors.

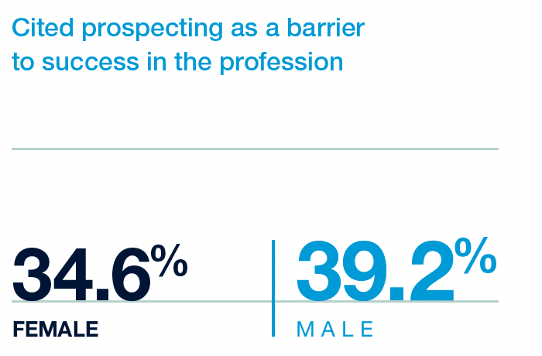

Within the industry, there’s a pervasive belief that prospecting clients is one of the core challenges women in wealth management face and a barrier that keeps them from entering the industry. However, only 34.6% of women surveyed cited prospecting as a barrier to success in the profession. Men were slightly more likely (39.2%) to label prospecting as a barrier to success for women.

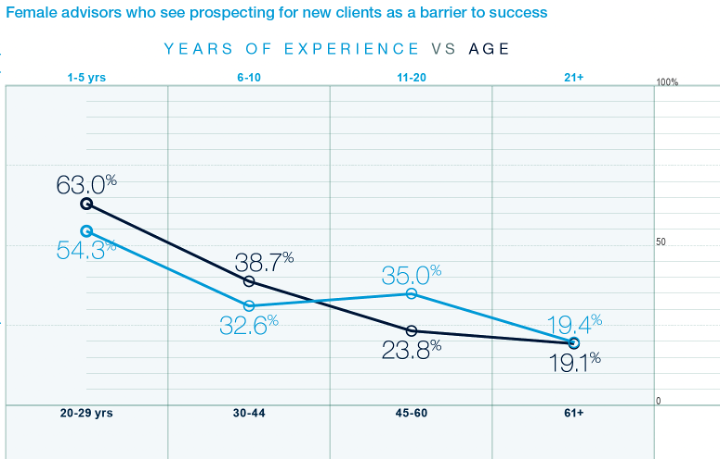

When this data is broken down by age and tenure within the industry, a more nuanced story emerges. While concerns about the ability to successfully engage in business development were high among young female advisors (with 63% of women in their 20s either agreeing or strongly agreeing that prospecting was a barrier to success), this number declined significantly for women aged 30-44 (39%) and continued to decrease as women aged (24% for women between 45-60 and 19% for women over 60).

This indicates what all seasoned advisors know: Developing your client acquisition pipeline gets easier over time, not only because the advisor becomes a more skilled prospector who better understands what types of clients will most benefit from her practice, but also because the advisor’s social and professional network compounds over the years, creating more opportunities for referrals.

It also indicates that the fear of prospecting may, in fact, serve as a barrier to entering the profession for female students. Naturally, everyone wants to pursue a career that aligns with their skills and aptitudes. If a student is uncertain in her ability to “sell” her services and expertise, as most college graduates (male and female) are, she’s less likely to pursue that career path.

What’s to Be Done?

This presents the industry with an opportunity to educate female students entering the profession that business development not only gets easier, but also may not actually be the obstacle that they think it is.

Understanding that this perception that prospecting is difficult declines as advisors gain more experience, focused mentoring around prospecting can help address this issue. More and more firms are developing a “team” approach to prospecting, with junior advisors as client relationship managers or servicing advisors. Many successful female advisors in the interviews talk about how impactful it was to have their lead advisors (usually men) provide them valuable introductions and mentor them on prospecting early in their careers.

The great part? Mentoring on prospecting should be part of every new advisor’s training – women and men. If this isn’t a part of standard onboarding at your firm, it’s key to a great start now, retaining your talent and their long-term success.