“The future ain’t what it used to be.” Yogi Berra

We’ve noticed a recent trend: nearly no one is looking for stocks to do much in 2023. As Yogi said many years ago, the future ain’t looking too good.

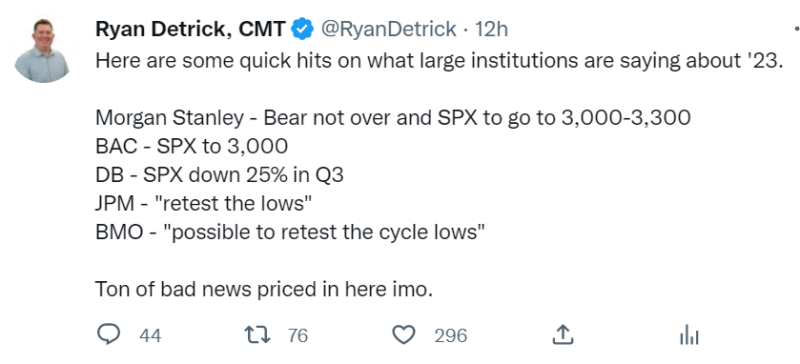

The general consensus is that the first half of next year could be very rough, with many banks and investment shops expecting stocks to go back to new lows. Here’s a tweet I did summarizing some of the recent calls.

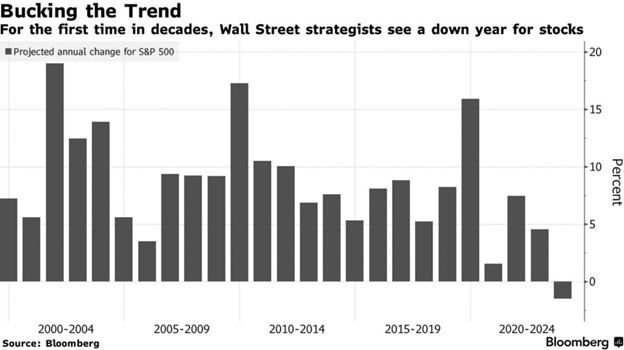

Adding to this, for one of the first times ever, Bloomberg data showed that Wall Street Strategists expect negative returns for the S&P 500 next year. That just doesn’t happen, or it didn’t happen until now.

We’ve also noticed a considerable spike in put volume over the past week, another way of showing how potentially worried the masses are currently. Then yesterday, I saw this headline, adding to the festive mood.

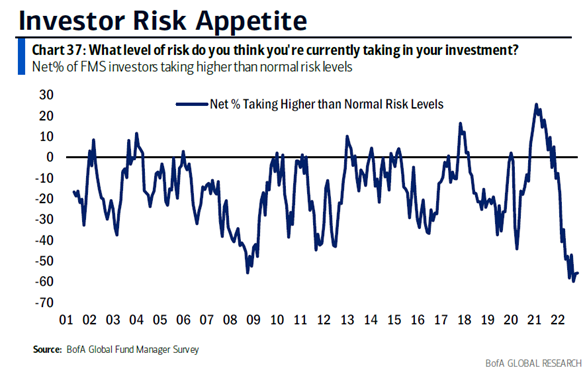

Here are two more signs of near-historic levels of skepticism. First, the recent Bank of America Global Fund Manager Survey showed a record low level of risk appetite. In other words, lower than the financial crisis and COVID.

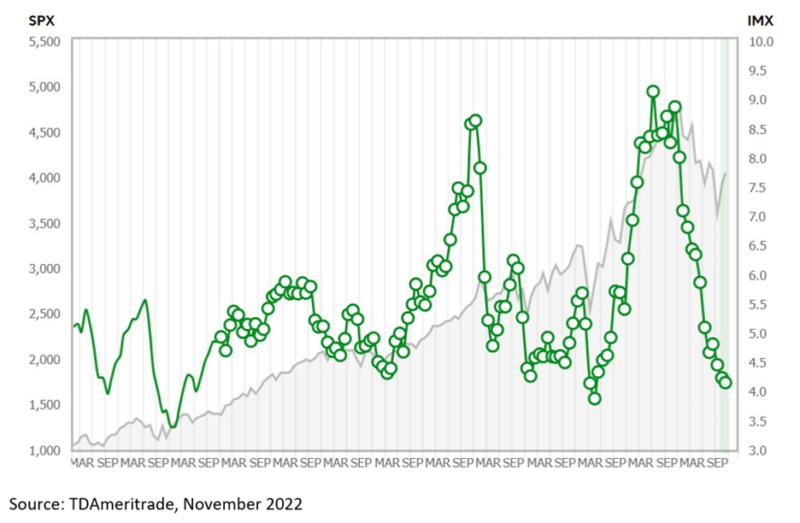

Second, our friends at TDAmeritrade have proprietary data showing retail investors near the lowest level of sentiment since April 2020. This is called the Investor Movement Index (IMX), which measures what investors are actually doing and how they are positioning in markets. Again, not a lot of excitement out there.

There’s an old Wall Street adage that it is hard to get hurt falling out of a basement window, and we think that could be the case now. Our take is that an incredible amount of negativity is priced into markets currently, and any good news could continue the recent strength off the October lows. Or, as General Patton said, “If everyone is thinking alike, somebody isn’t thinking.”

What could spark it? It’ll likely be better trends in inflation, which could open the door for the Fed to turn slightly more dovish. Coupled with what we continue to believe is a healthy and robust consumer, the economy may likely avoid the recession that many are expecting. We discussed better trends in inflation here and here.

It is hard for us not to keep pointing out that it is extremely rare for stocks to fall two years in a row. The S&P 500 was down two years in a row in ’73 and ’74 (one of the worst recessions ever), then three years after the tech bubble burst in the early 2000s, that’s it. Even during the financial crisis, stocks only fell in 2008 before a significant rebound in 2009.

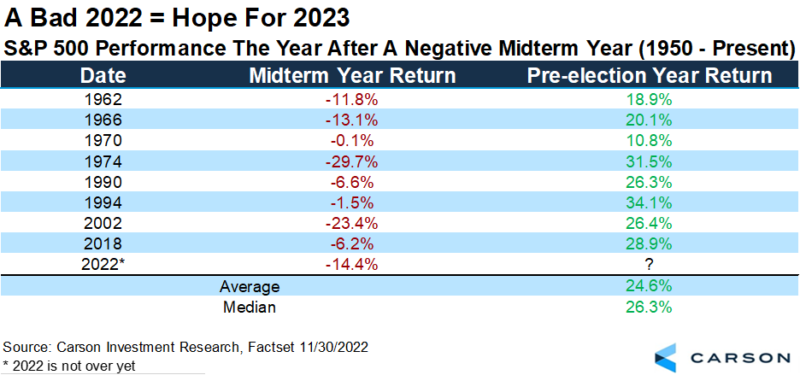

As the table below shows, it pays not to drive the car looking at the rearview mirror, as what just happened likely won’t happen again. As every time stocks fell in a midterm year (likely where we land in 2022), they bounced back the following year each time and gained 25% on average. Now, to be clear, we aren’t saying stocks will gain 25% next year… But we are saying it isn’t as crazy as it sounds.

Warren Buffett said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Things haven’t been good for investors this year, but there are many opportunities to plant some trees today and benefit from what we predict to be a surprisingly good year for investors in 2023.