In today’s episode of Framework, Jamie talks with Michael Kitces, the Head of Planning at Buckingham Wealth Partners and the founder of Kitces.com. Michael is a regular contributor to financial planning publications and has co-founded several FinTech companies.

When Michael was young, he mowed lawns for people in his neighborhood to earn money. Over time, he gained a lot of clients so his dad financed a new lawnmower that would help him work faster, but he had to give his dad a cut of each lawn he mowed. From that first money experience, he learned a lot about how work and money go together.

After trying various paths in college, Michael found his way into the financial services industry. Since he didn’t formally study finance in college, he immersed himself in learning everything he could and realized that teaching others what he was learning and observing could add value to the industry.

Michael talks with Jamie about how a 60-year-old insurance policy set him on the path to where he is today, why mindset is critical, and why you shouldn’t feel guilty about delegating.

(36:19) “The breakthrough that came for me was this realization and recognition: I’m going to be really good at this thing that I do. But part of that reason is because other people aren’t necessarily good at that. They’re good at other things. For everything that I can’t stand doing, there’s someone else out there that loves doing that.” ~ @MichaelKitces

Main Takeaways

- Opportunities that change your life can come from completely random or unexpected encounters. Train yourself to spot opportunities and seize them when they are available to you.

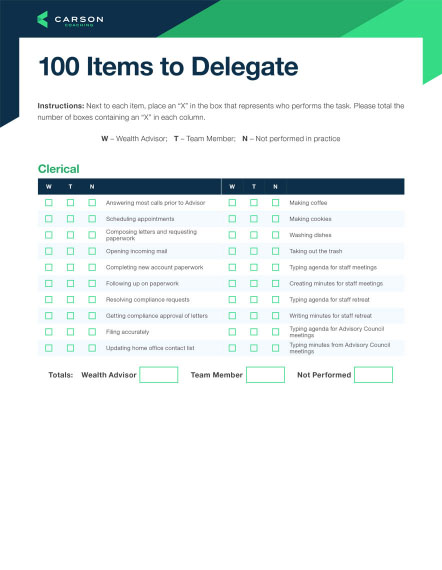

- If you are good at doing something, there is someone out there who is good at doing the things you are not good at doing. Learn to delegate to those people when you find yourself not enjoying or struggling with a task.

- “When do you stop being a salesperson and start being an advisor?” is the fundamental regulatory question the industry is facing right now.

- There’s a difference between people who implement because they are there for the sale and people who implement because they are there for the plan. But it’s the plan that guides you to what your clients truly need.

Links and Important Mentions

Get Your Free Blueprinting Guide

The first step to setting up the framework of your business is to have the right blueprint. But knowing what goes into that blueprint is half of the battle. We put together a free resource that you can use to set your firm down the right path.

Go to CarsonGroupCoaching.com to get your free blueprinting guide.