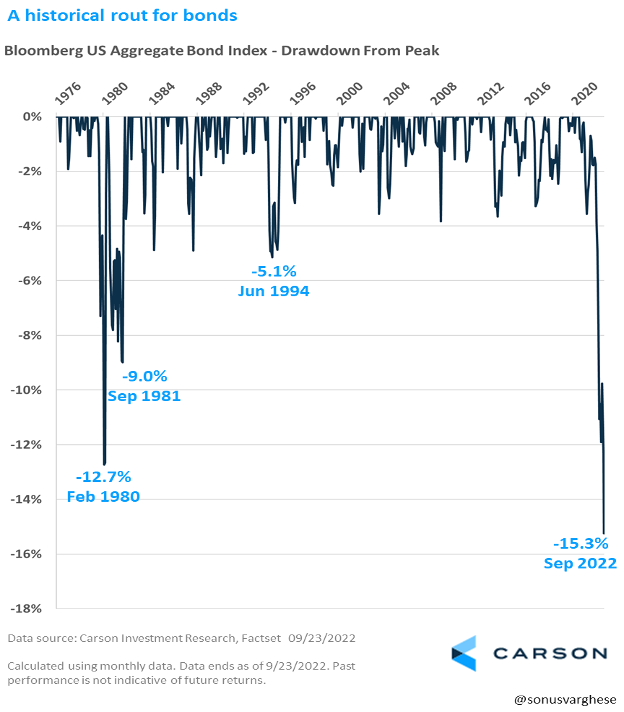

This is probably one of the biggest questions we are getting, and with good reason. The Bloomberg US Aggregate Bond Index is set for two consecutive years of negative returns and is currently amidst its worst ever peak-to-trough drawdown, a 15.3% pullback from its most recent high (back in July 2020).

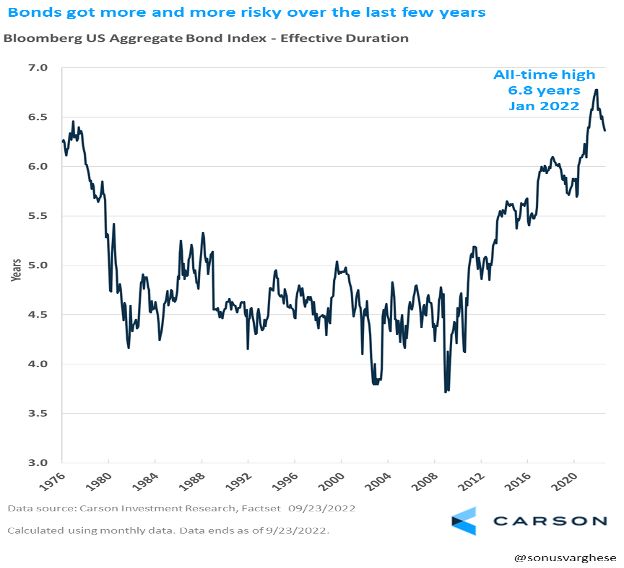

While we expect equities to be volatile, the amount of volatility in bonds is not something that is typically touted as the “conservative” option. But the risk was always present, and a good way to capture that is “duration”.

Duration is the average time over which a bond investor expects to receive all the cash flows of a bond, weighted by the present value of those cash flows. If the yield on a bond is low, the duration will be longer – since you get relatively smaller payments before final maturity. And duration is lower if the yield is higher because you get relatively more payments prior to maturity. Also, longer maturity bonds have longer duration since it takes longer to get all the payments. And vice versa.

The most practical use of duration is that it can give you a good idea of how the price of a bond will change when interest rates change. For example, if a bond has a duration of 3 years, the price of the bond will fall by 3% if interest rates rise by 1%. And by this measure, bonds were at their riskiest level in history at the beginning of 2022, with a duration of about 6.8 years.

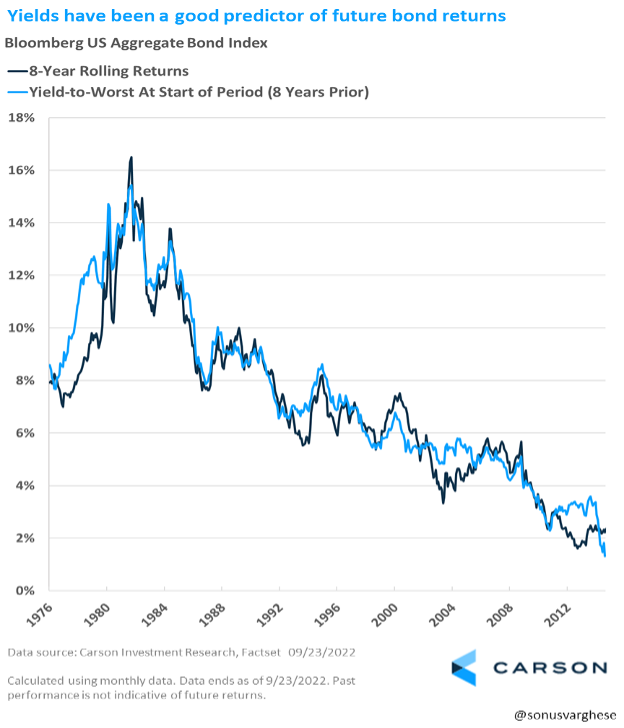

A big reason for duration to rise as much as it did was that yields were falling, hitting record low levels of just over 1% in 2020. This is important because, for bonds, yield-to-maturity is the best predictor of future returns (or yield-to-worst, which is used for bonds with callable options). The chart below shows 8-year rolling returns for the Aggregate Bond Index against the yield-to-worst at the beginning of the period (8 years prior).

The good news is that with bonds repricing amid the interest rate surge this year, yield-to-worst for the bond index has increased to 4.6% – it was 1.75% at the end of 2021. And duration has reduced to about 6.3 years now.

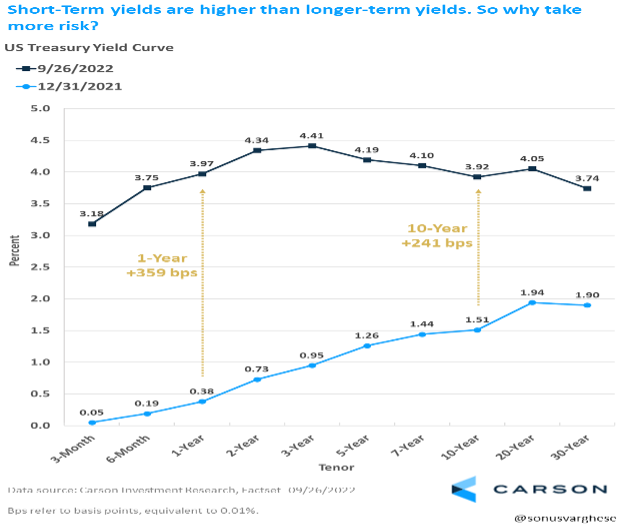

But wait, aren’t short-term yields higher than long-term yields?

The short answer is yes. Both short- and long-term interest rates have surged this year thanks to an aggressive Fed looking to get on top of inflation.

Short-term interest rates are typically keyed off current Fed policy, while long-term rates can be thought of as the market’s expectation for the future path of policy rates (to a first approximation). With the Fed being as aggressive as they are, there’s a risk that the economy goes into a recession, and they will have to reduce interest rates in response. So long-term interest rates have not risen as much as short-term rates. At this point rates for 1- through 7-year treasuries are higher than 10-year and 30-year rates.

Which begs the question: why should an investor take more risk, i.e. buying long-term bonds, which have higher duration/risk, for a lower yield (or future return)?

And we agree. On the Carson Investment Research Team, we are heavily underweight long duration bonds.

A recession hedge

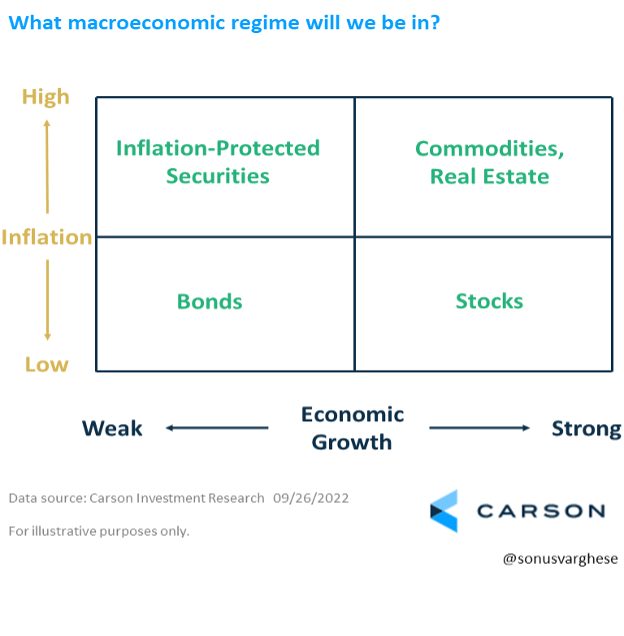

At the same time, we have not completely eliminated these bonds from our portfolios. The reason is that we cannot say for certain what economic environment we will be in. The schematic below illustrates the type of asset classes we would like to hold in different economic and inflationary environments. In a low growth, low inflation environment like in the last decade, a stock-bond portfolio works quite well. But in a high inflation environment, we would add commodities and real estate, if growth is high, or inflation-protected securities if growth is weak.

The problem is that we cannot say for certain what regime we will be in going forward. A Fed that raises rates too fast and too high could very well put the economy into a recession, an environment in which consumer incomes fall and inflation pulls back. Obviously, the Fed would prefer for this not to happen, but it is a risk. And for that reason, we want to hedge against that risk.

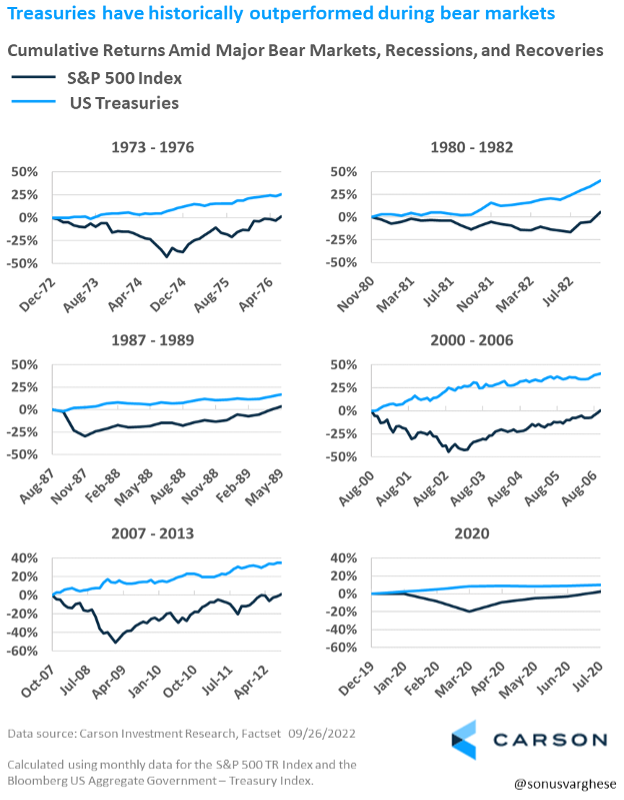

Typically, longer-term bonds, especially US treasuries have zigged when stocks have zagged. The chart below compares the cumulative performance of the S&P 500 and US treasuries amid the last six major bear markets and subsequent recoveries. Five of these coincided with major recessions (1987 was the exception). As you can see, treasuries have had a positive return when equities were sinking. Even in the 1970s and 1980s – part of the reason is that the bond yield was very high at the time, which helps returns (as I discussed above).

Stocks and bonds have obviously gone in the same direction this year. However, none of the major economic indicators suggest the economy is in a recession right now. That could obviously change over the next year, but in that event, I think the historical evidence suggests that treasuries will provide ballast to the portfolio.

Information provided in this article is for informational and educational purposes only and should not be construed as investment advice or an offer of investment products.