An aggressive Federal Reserve (Fed) raised their target policy rate by another 0.75%, taking it to the 3.0-3.25% range. This was the third successive 0.75% rate hike by a Fed looking to get on top of inflation. While it was largely expected, the big surprise was how high they projected the interest rate to go over the next year. In short, there’s more tightening to come.

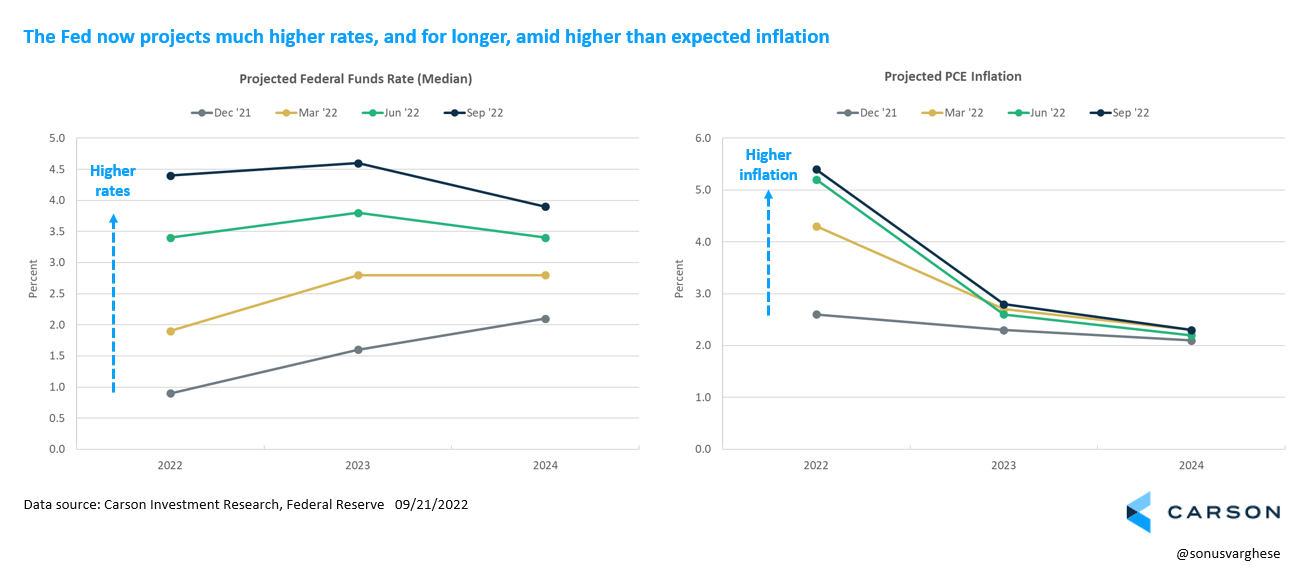

By the end of 2022, they project policy rates to get up to 4.4%, a full percentage point above what they projected just three months ago in June. And as of the end of 2023, they now expect the target rate to hit 4.6%, about 0.8% above their previous projection. These projections have risen rapidly this year amid 40-year highs in inflation. And crucially, they now project staying at these high rates through 2024 at least.

The Fed is strongly committed to bringing inflation back down and believe that is the key to sustaining a healthy economy and labor market over the long-term. However, they also believe there is no painless way to do it, and that really was a big takeaway from the meeting. It’s worth quoting Fed Chair Powell in full:

“We’re never going to say that there are too many people working, but the real point is that people are really suffering from inflation. If we want another period of a very strong labor market, we have got to get inflation behind us. I wish there were a painless way to do that. There isn’t.”

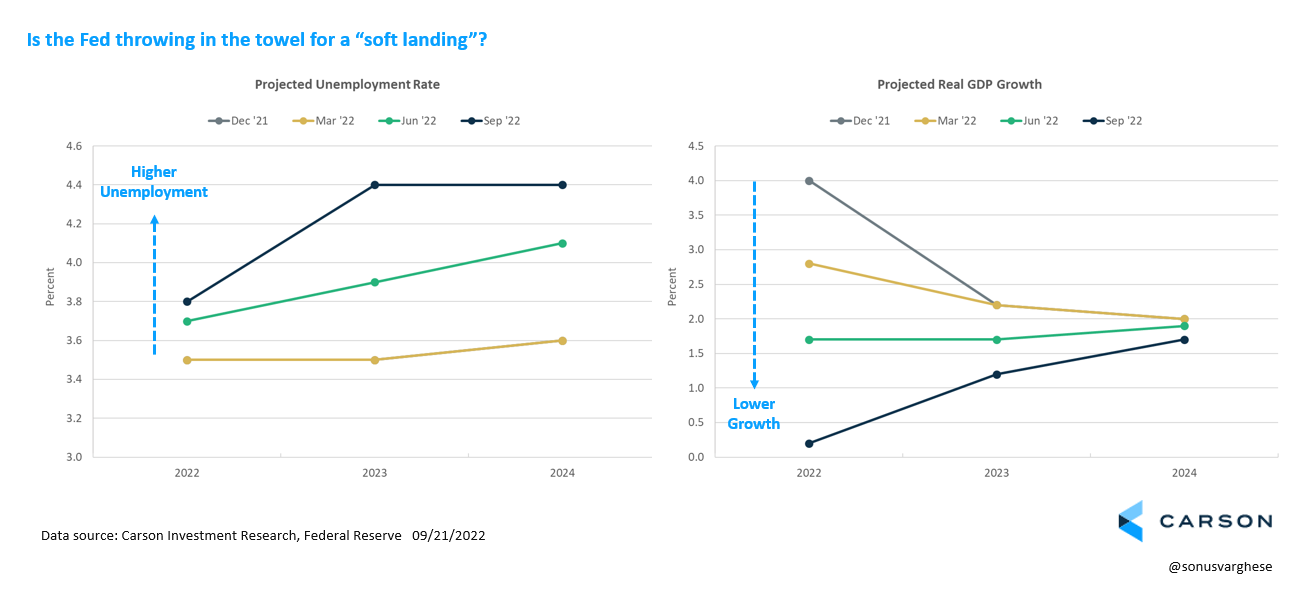

This came across in their latest economic projections. They slashed estimates of 2022 GDP growth from 1.7% to 0.2%, and for 2023, from 1.7% to 1.2%. They now expect unemployment to peak at 4.4% in 2023, up from their June projection of 3.9% (the rate is currently 3.7%). That translates to about 1.2 million more people losing their jobs.

Up until June, central bankers were clearly hoping to get away with small upticks in the unemployment rate, i.e. a “soft landing”. No longer. The latest projections basically amount to a recession. Though perhaps, a mild one. The problem is once unemployment starts to rise it’s not exactly easy to cap it at a particular number.

Are there any positives at all?

Chair Powell did lay out a scenario for a soft landing. It’s a challenging path, but not implausible in my view.

- The labor market is currently imbalanced, with demand outrunning supply. But job vacancies (representing demand) are at such a high level now that they could potentially fall without much of an increase in unemployment – though this would be a big break from what we’ve seen in the past, as falling vacancies have been associated with more layoffs. Also, as I wrote in a previous blog, workers quit their jobs at a much higher rate after the pandemic (for better-paying jobs), but that’s slowing down now. If this continues, it should also ease the supply-demand imbalance and associated wage pressures.

- Inflation expectations, both amongst consumers and market participants, have been well anchored. Which means there’s no expectations-related inflation spiral, e.g. if people expect higher prices in the future, they go make purchases now to get ahead of inflation, but that in turn drives up prices.

- Part of this inflation is caused by a series of supply shocks, beginning with the pandemic and then re-opening, and amplified by the Russia-Ukraine war. These weren’t present in prior business cycles. Of course, the Fed did expect to see supply-side healing by now, but it hasn’t happened yet.

The upward shift in rate projections is likely to be a one-time upward adjustment that reflects the current high inflation levels, as opposed to the beginning of a series of upward shifts. But as my colleague Ryan Detrick wrote, several leading indicators point to easing supply-chain pressures, and lower prices – it’s just going to take a little more time to show up in official inflation numbers. Just as an example, the producer price index indicates that margins for auto dealers are falling quickly, which means prices for used cars should follow in short order.

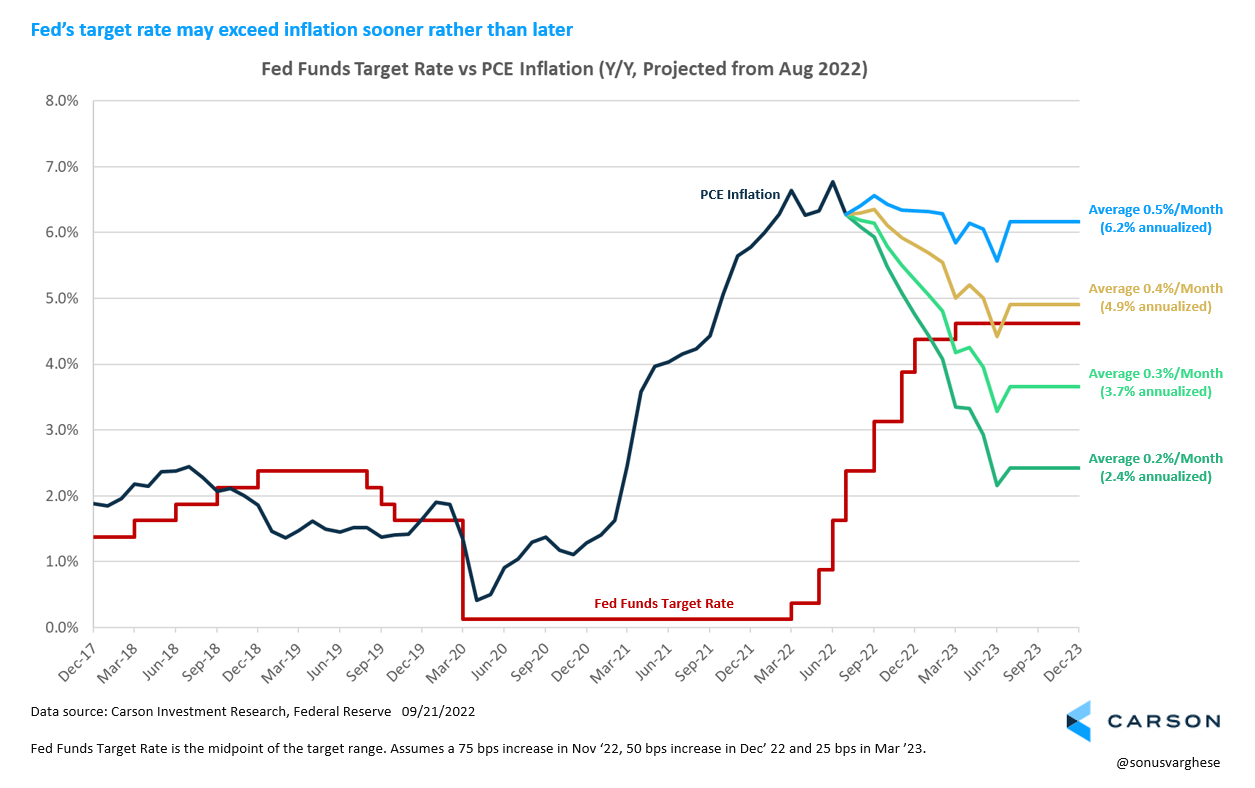

So, there is a high likelihood that the Fed funds target rate may rise above year-over-year inflation numbers within the first half of 2023. The chart below shows various projections for PCE inflation (the Fed’s preferred measure), based on average monthly price changes over the next 15 months. I assumed the Fed will raise rates by another 0.75% in November, 0.50% in December and 0.25% in March 2023. In my view, the scenario where price increases average 0.3% month-over-month is quite plausible – that would take PCE inflation down to 3.7% by mid-2023. Of course, this assumes there are no more shocks like the Russia-Ukraine war.

What does this mean for equities?

As I wrote in my last blog, equity returns can be broken down into 2 components: the change in valuation multiples and earnings growth.

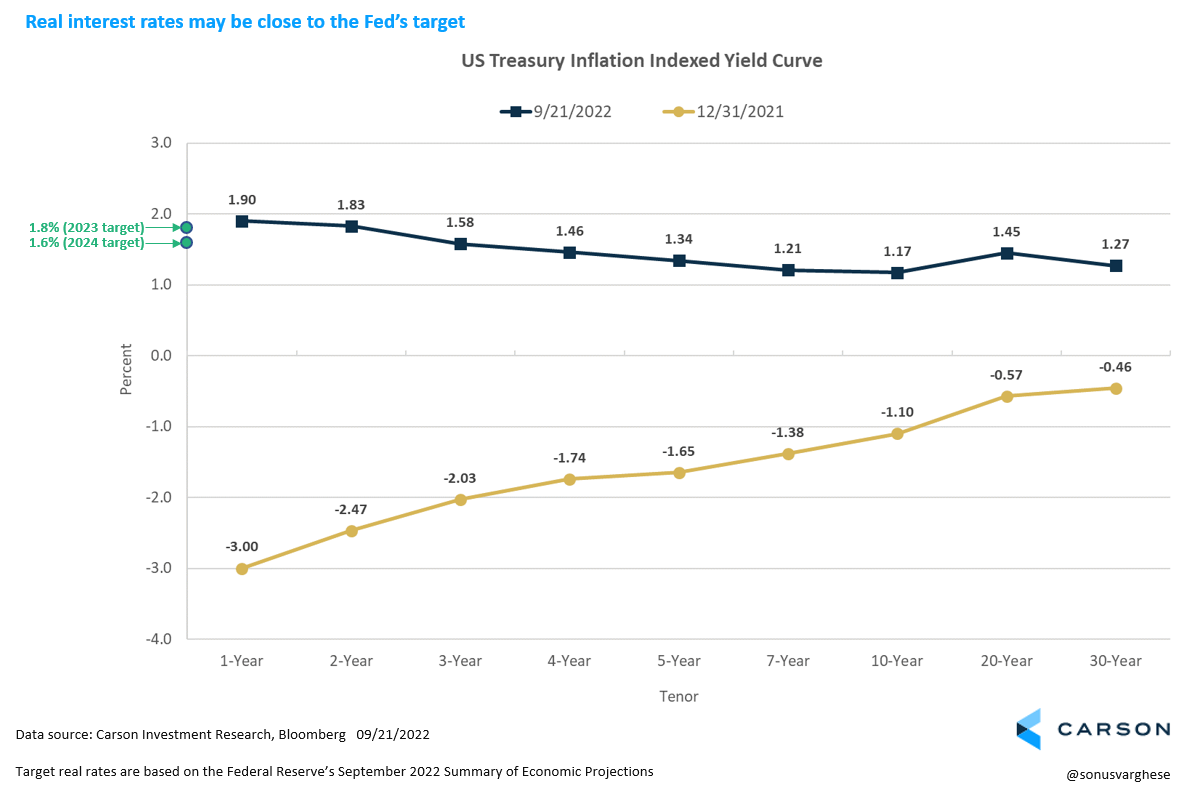

With respect to valuations, over the past 5+ years, we’ve seen that when real interest rates move higher, valuations fall, and vice versa. This year is a good example of falling valuations amid rising real rates. The Fed wants high real rates – their latest projections suggest real rate targets to be between 1.5-2.0% in 2023 and 2024. As the chart below illustrates, the “good news” is that short-term real rates are already in this range. They’ve moved up significantly since the end of last year when real rates were negative across the curve.

The big question is what happens to earnings. And that ultimately depends on how the economy does. There are pockets of the economy, such as housing, that are clearly suffering (and probably in a recession). Housing is feeling the immediate impact of tighter monetary policy by way of rising mortgage rates, which are now over 6 percent. But housing and related areas account for less than 10% of GDP.

For now, it looks like the broader economy may be able to weather the storm of higher interest rates. Plus, the projection materials show that there is significant divergence of opinion amongst Fed officials as to how they should proceed after 2023. Note that there are three more inflation data points before their December meeting – which we expect to be more positive than the last August report – as well as three more employment reports. So, we may yet see a few more shifts over the next 3-6 months.

However, as Chair Powell said, “Hope for the best. Plan for the worst.”