“The stock market is never obvious. It is designed to fool most of the people, most of the time.” Jesse Livermore

I’ve noticed a trend the past few weeks and that is since the mid-October lows most commentators say we are obviously experiencing a bear market rally in stocks. But is it really so obvious? Remember, as one of the greatest traders ever said, the market’s job is to fool the masses most of the time. Wouldn’t it be something if this was actually the start of a new bullish phase and not just another bear market bounce?

What’s a Bear Market?

First things first, what is a bear market rally? To me, it is when stocks bounce (potentially significantly), only to eventually move back to new lows. Think about the 17% rally the S&P 500 saw over the summer, only to roll back over and make new lows in October. That’s a bear market rally, which is what most think is happening now.

Calling This a Bear Market Rally Is Popular

Here’s the catch, most stocks actually bottomed back in June. That’s right, more 52-week lows took place in June than in October, so you could say we’ve been in a new bull market for five full months now. Not a popular take I’m aware, but one that could be happening. Not to mention small caps didn’t break their June lows back in October. Remember, there are a lot more small caps than there are large caps, again suggesting the real lows took place in June, not October.

Here’s a very quick Google search of ‘bear market rally’ and you can get a taste for what I mean about most thinking this is nothing more than a bear market rally.

I do a lot of social media, specifically Twitter, and I must say that the amount of anger when stocks go higher is about as high as I can ever remember. Bullish tweets or stats are simply crushed by an angry mob. Given this is a family website, I can’t share some of the comments, but let’s just say being remotely bullish is frowned upon by most investors and traders right now. Again, this is likely because some people believe it is so ‘obvious’ to everyone this is only a bear market rally, and new lows are a near certain but maybe it isn’t so obvious.

More Signs the Crowd Isn’t In a Good Mood

The great Stoic philosopher, Seneca the Younger said, “We suffer more often in imagination than in reality.” One might interpret that as we all worry too much and things really aren’t as bad as they seem. And this could be what is happening right now. We keep hearing how bad the economy is, yet as Sonu noted last week, the consumer is quite strong. In fact, the fourth quarter is expected to see GDP growth of more than 3% according to the Atlanta Fed. Speaking of Seneca the Younger, do you know who his father was? Seneca the Elder. I’m serious, that was his name. Gotta love Ancient Rome and its philosophers!

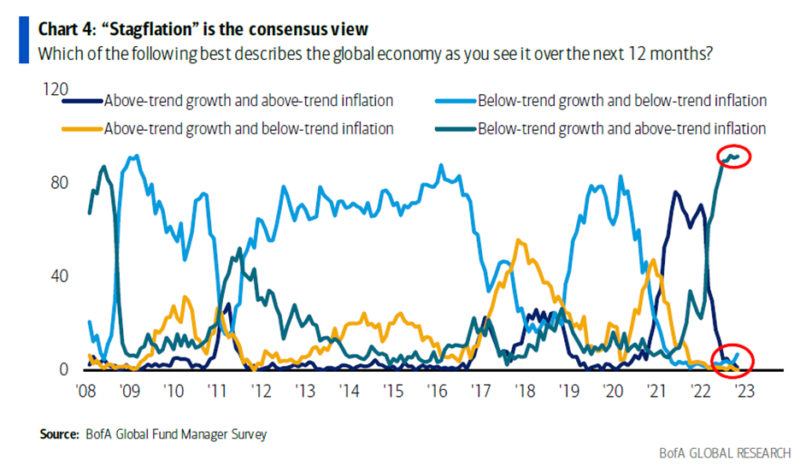

Enough Ancient Roman jokes and back to why this likely isn’t just a bear market rally, and why it could be the start to a new bullish move higher. One of my favorite surveys is the Bank of America Global Fund Manager Survey. This monthly survey asks real money managers what they expect and how they are positioned. The recent report showed cash was up 6.2% of a portfolio, near the highest level since 2001, while a net 77% of respondents expected a global recession within 12 months.

But my favorite stat was “0% were looking for a ‘goldilocks’ scenario.” Take note, this scenario would mean above-trend growth and below-trend inflation (See BofA Global Fund Manager Survey chart below). I agree it would be quite hard to expect that right here and now, but my takeaway is nearly no one is expecting good things to happen. Meaning expectations are historically low. As the chart below shows (focus on the yellow line), the last time it was this low was in late 2011, when all we heard about was the fiscal cliff drama out of Washington. Looking back, 2012, 2013, and 2014 were very solid years for both the economy and great years for the stock market. Given expectations got so low back then, good news then sparked a much better stock market and we think a similar situation could be in play again as we head into 2023.

George Orwell said, “To see what is in front of one’s nose is a constant struggle.” That is what is happening now, in my opinion. Things are getting better, yet people are focusing on the past and for some reason, angry about good news. My take is don’t be angry and embrace what could be better times and better news coming.

I hope everyone has a great Thanksgiving week and you all enjoy eating way too much food with family and friends! 🦃 🏠 🙏