The largest deficit reduction bill since 2011 has crossed the finish line. President Biden signed the Inflation Reduction Act into law August 16, and despite its name, it’s not expected to impact inflation in a meaningful way, particularly over the short term. Rather, it addresses the energy sector, taxes and health care costs, and signifies a massive shift in U.S. policy. Let’s break down the big questions.

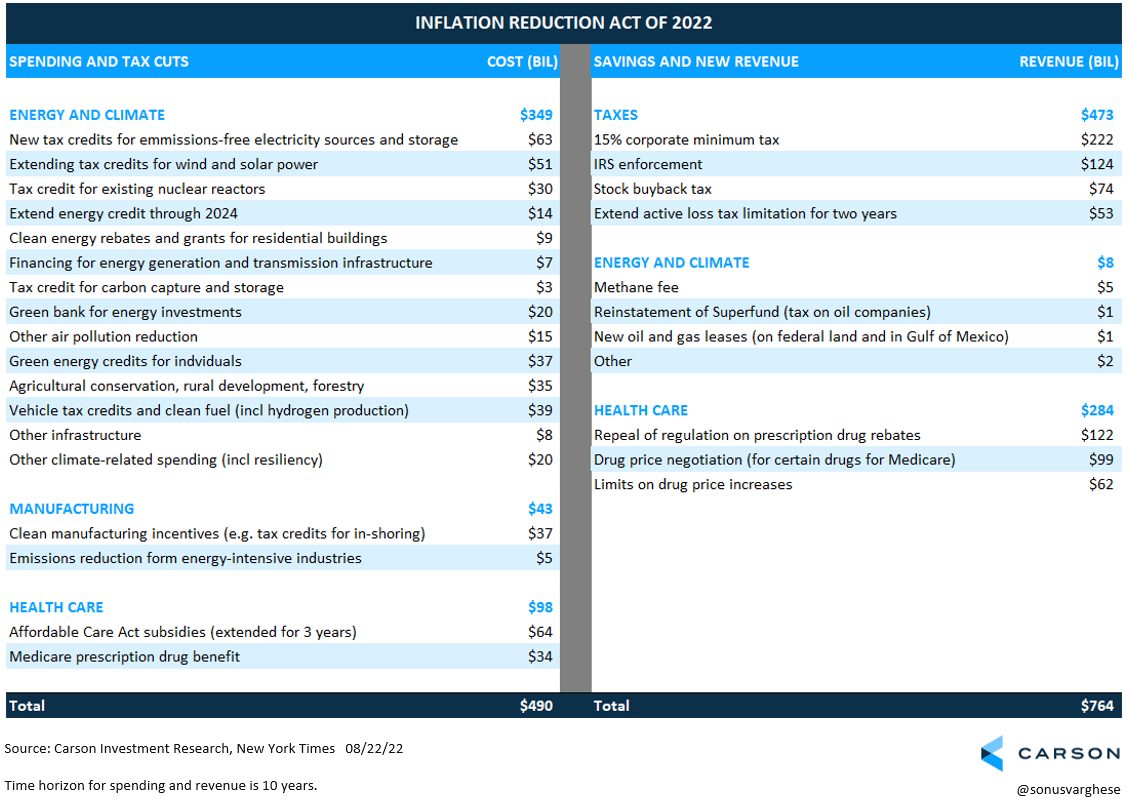

The size of the bill is significantly scaled down from what the Democrats had originally envisioned. The bill spends just under $400 billion on clean energy and climate resilience, in addition to reducing some drug prices, temporarily subsidizing costs of health insurance on exchanges and raising some taxes to offset the spending. Over the next decade, this law increases spending by $490 billion while raising $760 billion in revenue, thereby reducing the federal deficit by about $270 billion.

What impact might the provisions have on the inflation stress Americans are facing? In general, pulling money out of the economy is expected to be deflationary. The problem here is the timing.

For example, the law allows Medicare to negotiate lower prices on certain prescription drugs – which is a big deal since Medicare is one of the largest healthcare purchasers. But this provision will not go into effect until 2026. On the other hand, the law extends subsides for insurance premiums through 2025, and will cap the out-of-pocket spending on prescription drugs for Medicare beneficiaries to $2,000 starting in 2025. People could potentially spend that extra money elsewhere in the economy, which may be inflationary.

Nevertheless, focus on the size of the bill and its inflation-fighting potential misses the fact that the energy and climate-related provisions are a big deal. Net U.S. greenhouse gas emissions are expected to fall to about 3.8 billion tons by 2030, mostly by accelerating adoption of clean electricity and vehicles. This would be 32% below 2021 levels and 42% below 2005 levels, which is not far from the U.S. target of reducing emissions to 50% of 2005 levels by 2030.

But even beyond that, the bill has major implications for the economy. Here are three major takeaways.

-

The Inflation Reduction Act takes a practical approach to the transition to clean energy.

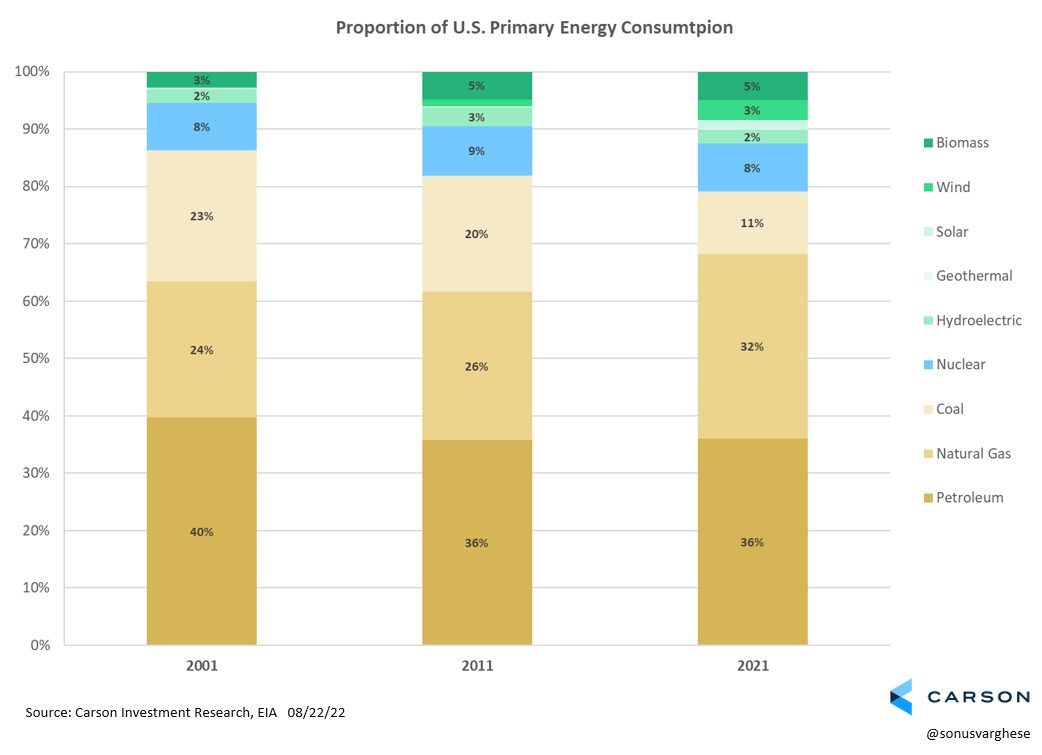

The bill is the most significant piece of climate-related legislation, particularly for green energy. However, the bill also recognizes that 79% of U.S. energy consumption is made up of fossil fuels, versus 8% for nuclear and 13% from renewables (as of 2021). Combine that energy makeup with concerns over energy security and the cost of transition away from that mix, we ended up with a more practical approach that considers the different sectors.

The bill offers tax credits for expanding nuclear power. It is also quite favorable for the oil and gas industry, allowing those companies to transition toward decarbonization at a slower pace. The bill will allow for new oil and gas leases, and as part of the deal that brought about this bill, Congress is expected to push through faster permitting for pipelines that traverse federal lands – allowing for more natural-gas infrastructure. The goal is to promote investment and increase fossil fuel supply in the near-term, to allow for a smoother transition to renewables down the road.

-

The Inflation Reduction Act shifts away from taxes to tax credits and subsidies.

A decade ago, climate-related policy revolved around taxing carbon, which would have resulted in consumers and businesses paying more for fossil fuels. The thinking was that it would promote a shift toward renewables. But this is no longer politically tenable, especially amid high gas prices. This bill shifts away from taxes, toward tax credits and subsidies, which means the government is taking on the cost of transition. Increased government spending is not a bad thing if it results in productive investments, and in this case, there’s reason to believe it will.

The subsidies will make alternative energy sources – like wind, solar, hydrogen – more economical than they would have been otherwise. Adoption of these alternatives should accelerate as clean energy and clean vehicles become cheaper.

But there are also credits to incentivize the move toward greenification. For example, it provides money for investments in decarbonization and transmission infrastructure, including new technologies that capture, transport and store carbon dioxide before it enters the atmosphere. The subsides will make those processes more viable in emission-heavy industries like refineries and power.

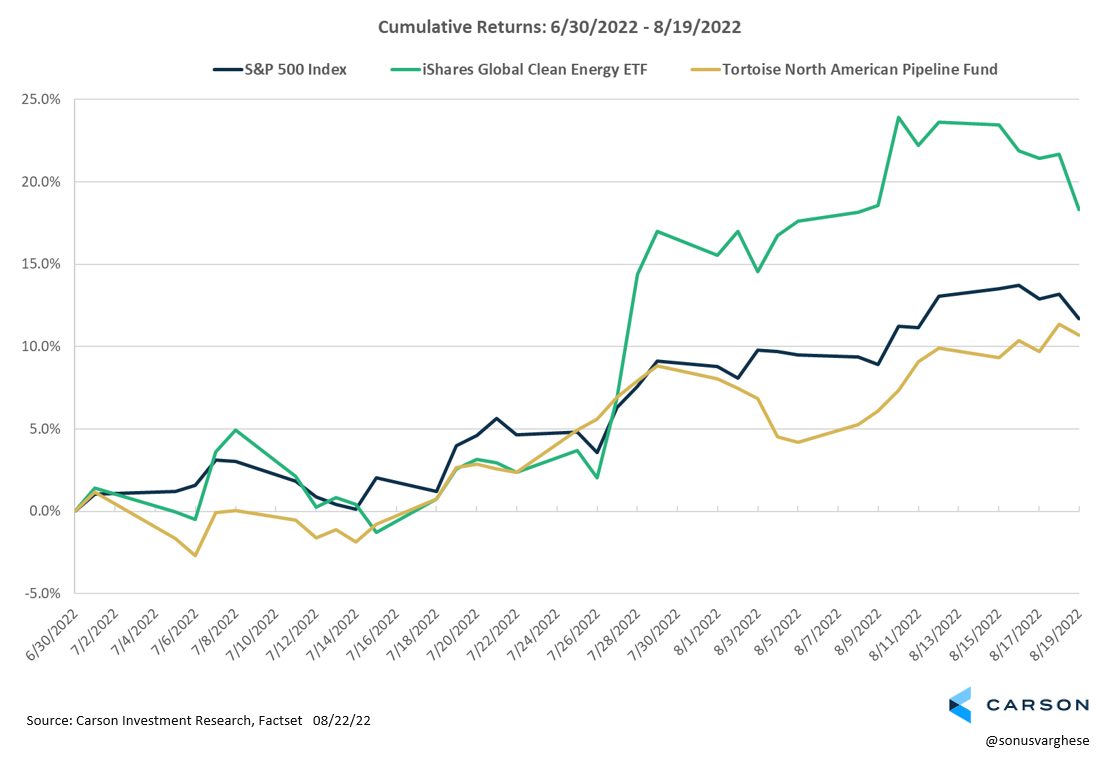

While much of this is positive for clean energy stocks – which surged after the bill was initially announced – we believe it also benefits traditional infrastructure companies including midstream pipeline companies. Traditional energy pipelines could play a key role in transporting hydrogen as well, in addition to liquids and gas.

Past performance is not indicative of of future results

-

Inflation Reduction Act provisions are designed to revive U.S. manufacturing and counter China.

The energy subsidies and tax credits also mean the U.S. government is engaging in industrial policy in a much bigger way than we have seen in recent decades. The idea is to revive industrial activity in America, with incentives for in-shoring.

For example, the electric vehicle tax credits only apply to cars made by companies that relocate supply chains out of China and out of other countries with which the U.S. does not have a free-trade agreement. The bill requires that cars be assembled in North America and use critical minerals and components that are sourced domestically or within free-trade partners.

These provisions work in conjunction with the “CHIPS and Science Act”, which President Biden signed into law on August 9. It includes $52 billion in subsidies to incentivize buildout of new semiconductor factories in the U.S., along with a 25% investment tax credit for companies that expand or upgrade existing plants.

Then there is another $200 billion for programs to drive innovation, including 20 regional technology centers and money for the National Science Foundation. This provision alone would be one of the largest climate-related actions taken by the U.S. government, with about $65-70 billion directed toward leading-edge clean-energy technologies.

At the same time, the bill includes guardrails for firms that are thinking of expanding into China. Any recipient of U.S. funds cannot make new high-tech investments in China or “other countries of concern” for at least a decade. This is to counter China’s practice of forcing foreign companies to transfer intellectual property to Chinese partners.

The U.S. Commerce Department will play a key role in deciding which companies get funding. Commerce can also review future investments in China, with the option of clawing back funds from any firm that it sees as a “rule-breaker.” It will certainly complicate investment decisions for global semiconductor firms that will now have to rethink their China strategy.

This is a major rethink of the U.S. government’s role in industry. In some ways, it is a response to Chinese industrial policy, which has subsidized its high-tech manufacturing champions to a massive degree. But the pandemic also highlighted the need for having supply-chains that are more resilient, hence the goal of in-shoring production. This became even more apparent after the Russia-Ukraine conflict began, which sent commodity prices soaring. The possibility of conflict between China and Taiwan only adds to the urgency.

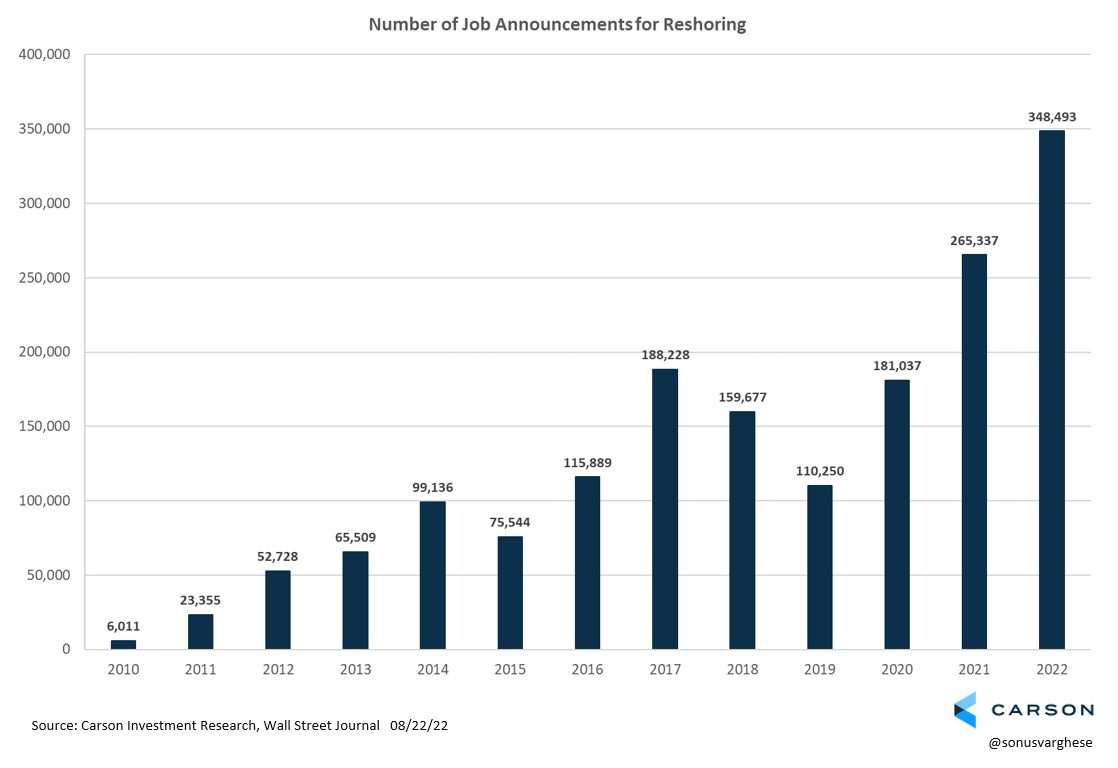

American companies have already acted to protect supply chains, with close to 350,000 jobs reshored in 2022 – which is almost four times the annual average between 2010 and 2019.

In short, globalization is reversing, with the U.S. government actively implementing policies that hasten that process. But it also means that companies are moving away from lower cost labor abroad to more expensive labor in the U.S. This shift could put further pressure on the labor market and inflation. On the other hand, it could incentivize more investment in technology and increase productivity, which would be good for all workers, let alone economic growth and corporate profits.

Look Past the Name

In examining its major provisions, the Inflation Reduction Act reflects a massive shift in U.S. policy that will impact the energy and industrial sectors in particular. Its influence on inflation, however, is overstated – or at least mislabeled. What’s in a name?

Want to know more about what’s driving the success of today’s fastest-growing financial advisors? Subscribe to Carson’s weekly newsletter, The Trend Line.