By Blake Anderson, CFA®, Associate Portfolio Manager

The Initial Public Offering (“IPO”) window reopened in 2025. IPOs are seen as the lifeblood of public capital markets and a measure of risk sentiment, with IPOs often the largest funding round in a company’s life, enabling the companies to vastly expand their investor base. IPO volume largely returned to average levels in 2025, and post-deal returns broke records which speaks to the underlying investor appetite for new issues. 2025 has set the stage for a potential robust 2026 IPO schedule.

Activity Grows to a Normal Level

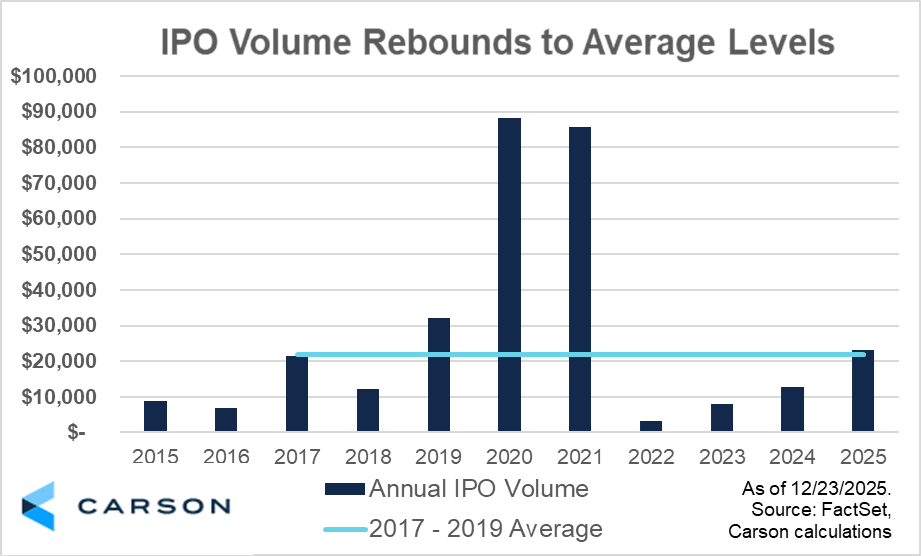

IPO volume in 2025 returned to pre-Covid average levels. The total volume of IPO deals that raised above $500 million in 2025 stands at $23.0 billion through December 23rd, 2025. This represents a return to the average deal volume level seen in the 2017 – 2019 timeframe, when annual IPO volumes averaged $21.9 billion, as shown below.

After bottoming in 2022 at $3.2 billion, IPO volumes have grown each year as the bull market in major indices has continued and investor risk appetite has grown. 2025’s total volume is nearly double that of 2024’s $12.8 billion level. While volumes have grown to return to just ‘average’ levels, the first-day returns of IPOs in 2025 have broken records.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Strong Returns Signal High Demand

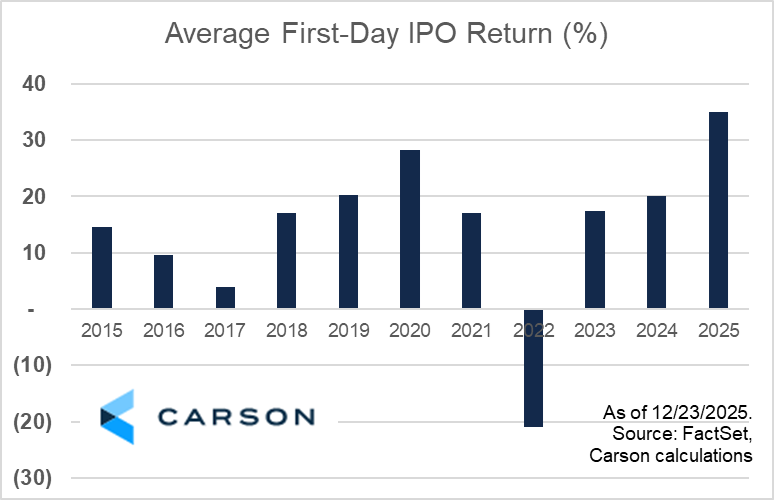

Despite just ‘average’ deal volume in 2025, the first-day returns of IPOs surpassed recent records. On average, IPOs in 2025 returned an astounding 35% at the end of the first day of trading compared to the deal offer price. This marks the highest average first-day return in the past decade, eclipsing 2020’s level of 28%. While first-day returns are often positive – as bankers want to entice new investors after the deal is struck – the magnitude of this year’s first-day average return signals stronger-than-expected demand.

The data is noisy, however, given the low number of observations, but it does show that when market sentiment is high (such as in the second quarter of 2025), first-day returns can be robust. Circle Group and Figma were this year’s big winners and drove a majority of the upside to the average. The first-day returns for these companies registered 168% and 250%, respectively, with both deals finalized during the second quarter of 2025. It signals rising risk appetite among investors for perceived high growth and disruptive companies.

A Look to 2026

With IPO activity returning to average levels, and first-day returns breaking records, it should come as little surprise that investors view 2026’s IPO schedule as robust. Rumors of potential deals include OpenAI, SpaceX, and other high-flying companies that are looking to capitalize on reportedly strong fundamentals and healthy investor appetite for new issues.1

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.

8683221.1. – 29DEC25A