As we look back at 2025, it’s fair to say the wall of worry was higher than ever. We started last year with pundits warning that the “delayed” recession was finally arriving. We saw massive volatility around “Liberation Day” in April, where the S&P 500 nearly fell into a bear market. We heard constant chatter about an “AI Bubble” bursting and political turmoil scrambling expectations.

And yet? The S&P 500 gained a total return of 17.9% for the year. International stocks did even better, surging more than 30% in both emerging markets and development international. Even bonds finally had their moment, delivering a solid 7.3% return, the best year since 2020.

Once again, the crowd panicked at the worst time, but your Carson Investment Research team stuck with the fundamentals and not headlines. Although it was lonely in April, the data suggested better times were coming, because we followed the facts, not the feelings.

Now, as we start 2026, the question changes. We aren’t just trying to catch the wave anymore. We are on it. The challenge now is staying on the board.

Welcome to “Riding the Wave.”

A Foundation of Earnings

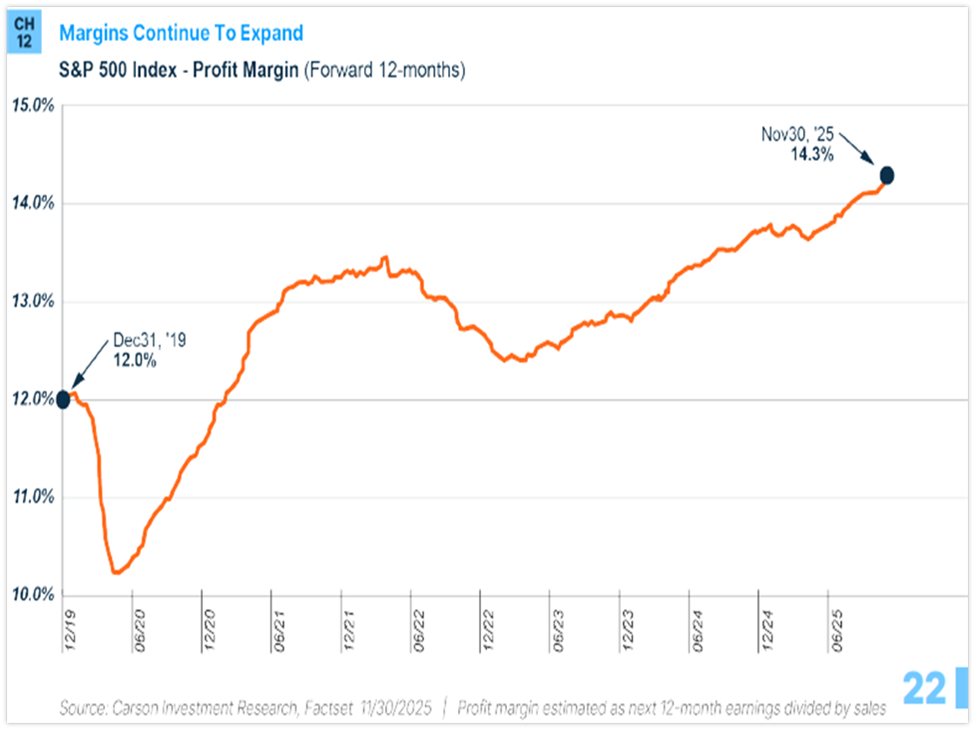

It is easy to look at three years of a bull market and assume we are “due” for a pause or even a crash. However, the fundamentals tell a different story. Right now, the energy beneath this bull market is stronger than ever, thanks to robust corporate earnings.

S&P 500 earnings are expected to grow by approximately 14% in 2026, a number we think is quite attainable. This isn’t just hype; profit margins are expanding and hitting cycle highs as well. When companies are making more money per dollar of sales, that is a tailwind hard to bet against.

The Economy Stands Tall

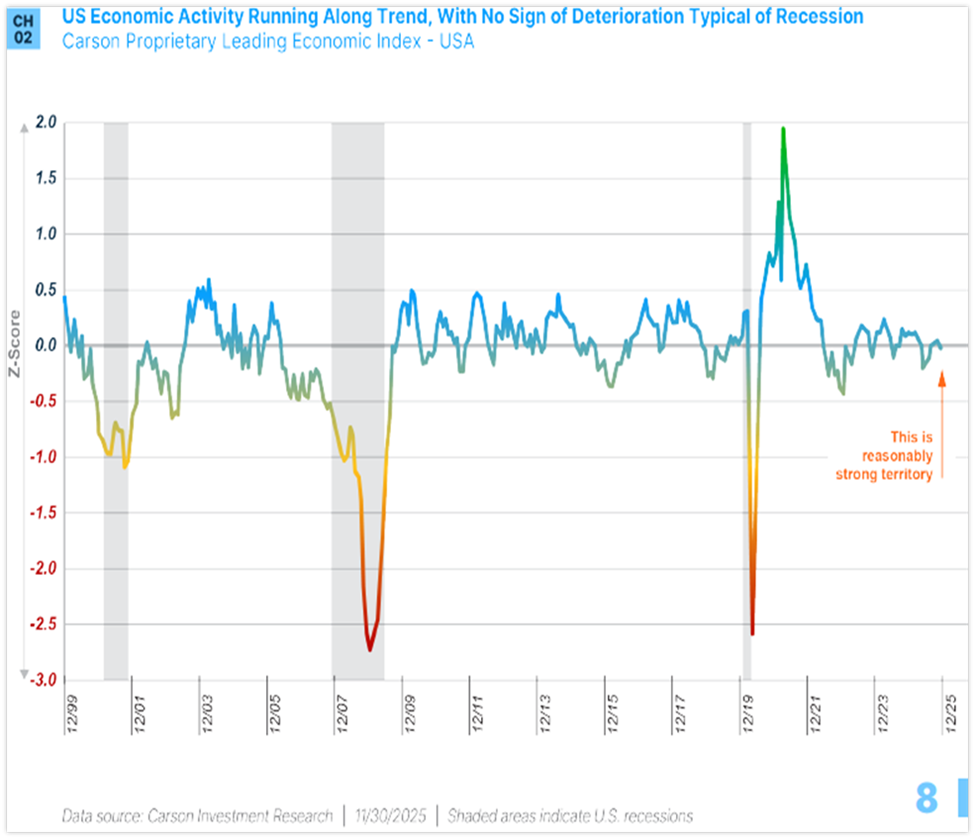

What about that recession everyone has been promising since 2022?

Our proprietary Carson Leading Economic Index (LEI) never pointed to a recession over the last three years, even when other popular indicators were flashing red.

As we enter 2026, the signal remains clear: The U.S. economy is growing near trend with no sign of a major slowdown. In fact, we are seeing a “global fiscal reflation” story, where growth in Europe and Emerging Markets is picking up, providing a favorable tailwind for U.S. multinationals.

Three Things to Watch in 2026

While we remain overweight equities, “riding the wave” implies that balance and skill are required. Here is what we are watching:

- The AI Buildout: We believe the AI boom is built on substance, not just speculation. Tech giants are expected to spend a record $515 billion on capital expenditures in 2026 to build out this infrastructure. Unlike in the dot-com era, these companies are massive cash flow generators and creating huge profits. We believe we are still in the mid-innings of this cycle.

- The Global Handoff: For years, the U.S. was the only game in town. In 2025, we saw a global bull market with most of the rest of the world outperform the U.S.. We think remaining overweight equities, but keeping a diversified global portfolio is more important now than it has been in a decade.

- Volatility is the Toll We Pay to Invest: 2026 is a midterm election year. Historically, these years can be choppy, often seeing peak-to-trough corrections of more than 17%, the most in the four-year presidential cycle. But remember, volatility is the toll we pay to invest. A 10 to 15% drop sometime this year doesn’t mean the bull market is over; it likely means an opportunity is forming for longer-term investors.

This Bull is Young

It is easy to think that a three-year-old bull market is getting tired. But history suggests otherwise, as the average bull market since WWII has lasted more than five years.

We aren’t saying this run has another two years guaranteed, but we are saying you shouldn’t fear old age just yet. The data shows that the fourth year of a bull market tends to be quite strong.

The Bottom Line

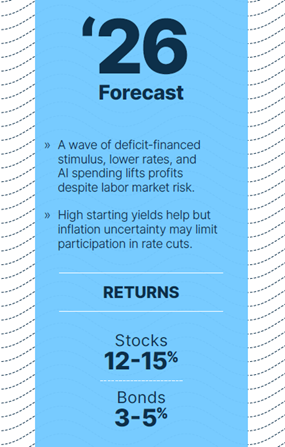

We believe there is an opportunity for a “virtuous cycle” where AI investment, fiscal policy, easing monetary policy, and global growth sustain this expansion. But waves can be unpredictable. The easy gains of “just showing up” might be behind us; 2026 will be about sector selection, global diversification, and holding your nerve when the water gets rough.

We dive deep into all of this in our full 2026 Outlook: Riding the Wave, covering our sector preferences, our view on the Fed, and why we believe bonds and other diversifiers have a place in portfolios.

It is available for download below. Hopefully, it serves as a useful compass for you as we navigate these exciting waters together.

Ryan Detrick, Chief Market Strategist, and Sonu Varghese, VP, Global Macro Strategist, break down our entire 2026 Outlook on the latest Facts vs Feelings podcast, complete with some of our favorite charts. You can watch it all below, enjoy!