By Michael Barczak, CFA®, VP, Investment Due Diligence

Carson Investment Research’s 2026 Market Outlook is almost here, and in the meantime the Investment Research Team wanted to look at how active managers have performed in 2025, what may be the causes were of any trends we noticed, and what our views for 2026 suggest about the landscape for active managers next year.

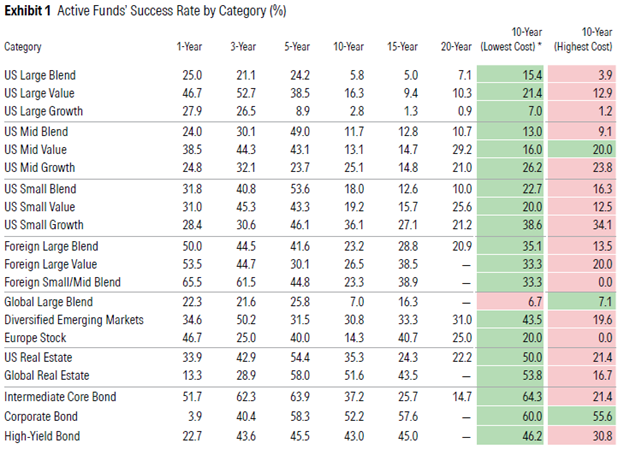

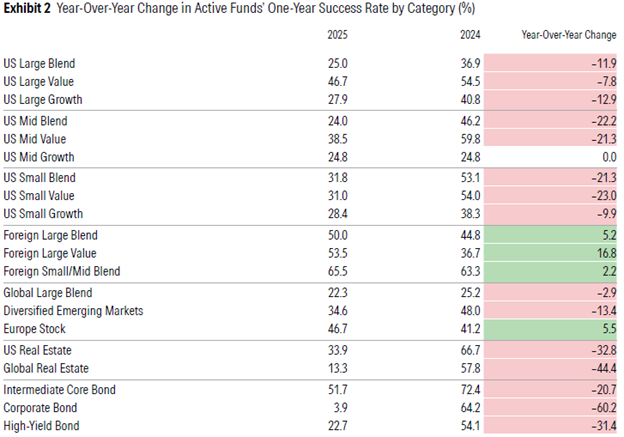

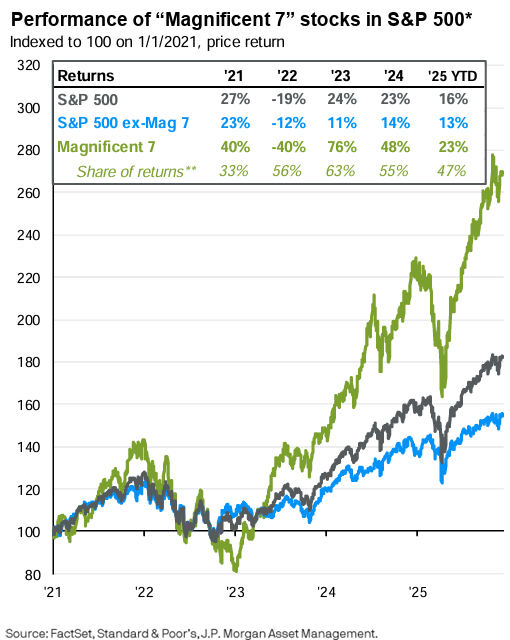

2025 has been a year characterized by uncertainty, volatility, and increasing market concentration. Active managers have struggled this year to find consistent outperformance, with ~67% of managers underperforming their passive peers over the past 12 months, a 14 percentage point decline from the prior year, per Morningstar’s Active/Passive Barometer. There have been multiple hurdles to managers over the past year, most notably:

- Highly efficient U.S. large-cap markets.

- Narrow leadership in equities.

- Challenging fixed-income dynamics.

- Policy uncertainty (Fed, Tariffs, etc.)

Source: Morningstar’s US Active/Passive Barometer

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Source: Morningstar’s US Active/Passive Barometer

Source: Morningstar

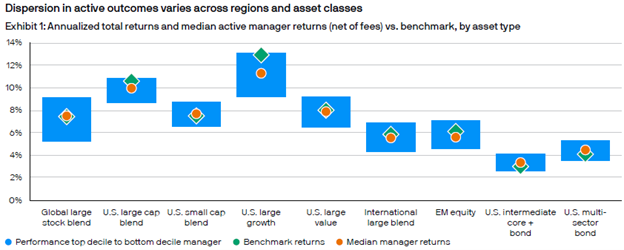

U.S. equities and fixed income were the hardest hit asset classes. In the US equity space, mega-cap tech and AI leaders dominated returns, leaving most other stocks far behind. While passive investors benefited automatically, active managers who were even modestly underweight the top performers had difficulty keeping up.

Bond managers also faced systemic headwinds with rate volatility, policy uncertainty, tight credit spreads, and high starting yields all leading to a more level playing field. A significant number of managers, anticipating a more dovish Fed, added to their duration positioning (interest rate sensitivity) early in the year and were caught wrong footed when the bond market pushed back strongly against Liberation Day tariffs over the summer.

Despite many headwinds, active managers fared better in both the international equity and real estate asset classes. Managers in these spaces were able to more consistently select higher quality investments that could outperform in challenging times, putting a premium on security selection skill.

Despite the difficulties in 2025 for active management, the investment research team believes 2026 is likely to present a more fruitful landscape for active managers to find alpha opportunities.

- Market Leadership Is Likely to Broaden – International equities, small- and mid-cap stocks, and value-oriented sectors may contribute more meaningfully in 2026. Greater dispersion supports the case for skilled active management.

- AI Adoption May Create Clear Winners and Losers – The next phase of AI integration may increasingly differentiate companies. This uneven evolution creates opportunities for active managers to identify true beneficiaries.

- Inflation Volatility May Reward Thoughtful Positioning – As inflation becomes less predictable and policy paths diverge globally, asset prices are likely to show more dispersion—creating opportunities for active strategies across sectors and regions.

- Fixed Income Should Offer More Selective Opportunities – Expected rate cuts and a normalized yield environment should improve the reward for duration decisions, credit selection, and security-level research.

- Fragmentation Is Reshaping the Global Landscape – Geopolitical shifts, evolving trade patterns, and resource competition are creating new winners globally. Active managers are better positioned to capitalize on these emerging dynamics.

Our team sees all of these factors as potential levers active managers can take advantage of to find excess return opportunities, the types of opportunities that are inherently missed by passive strategies. There will likely be support just from some normalization of equity market concentration and fixed income rate spreads, but we may also see potential for healthy rotation in leadership among market securities. Add in lower levels of policy uncertainty and 2026 could present a renewed opportunity for active strategies to demonstrate their value.

8671290.1. – 17DEC25A