When asked why he robbed banks, Willie Sutton replied, “Because that’s where the money is.”

I wish I knew why, but August is a month that tends to have a lot of out-of-the-blue scary events pop up and with that comes a good deal of market volatility. Who could forget last August? Stocks fell more than 1% on the first Thursday and Friday of the month, and then on Sunday, August 4, we went to sleep knowing that Japan was crashing (having its worst day since the Crash of 1987) and US futures were down huge as well. That Monday saw the VIX spike to 50 and stocks fell 3% for one of the worst days in years.

After more selling into the middle of the week and incredible amounts of fear, stocks bottomed that Wednesday and actually finished up on the month. Still, if you were there you remember how frightening it was, and sure enough it happened in August.

Something About August

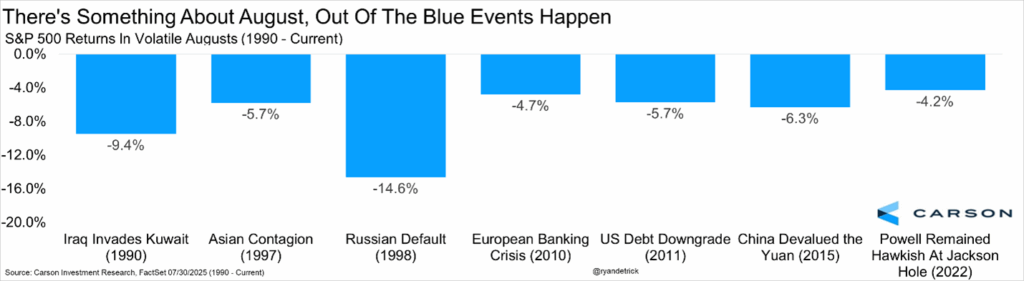

Going back to 1990 when Iraq invaded Kuwait, August is notorious for big events and market weakness. 1997 had the Asian Contagion, 1998 the Russian Default, and 2010 the European Banking Crisis. The next year saw the first US debt downgrade and a near bear market in just a few days. 2015 had the first 1,000 Dow point drop ever after the surprise Chinese yuan devaluation. Then in 2022 Jerome Powell surprised markets in August by turning quite hawkish at the annual Jackson Hole Economic Symposium. All of these times saw big drops, proving once again there is something about August.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Buckle Up

By no means are we saying this bull market is over. It isn’t. But after a 28% rally off the April lows, we’d suggest being open to some potential volatility this August, as this is a month known for it.

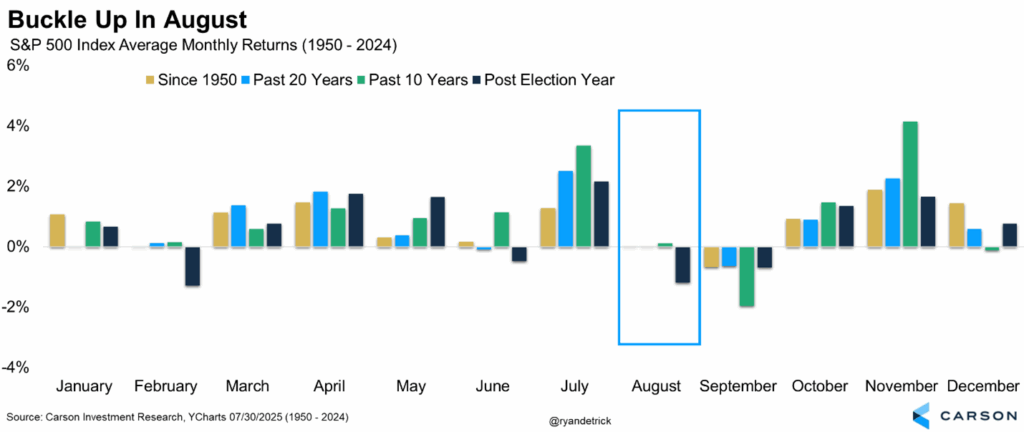

Since 1950, August is the third worst month on average and in a post-election year only February is worse. No, we don’t suggest ever investing purely on seasonality, but it is important to have a plan and we’d say planning for some August turbulence is the way to go.

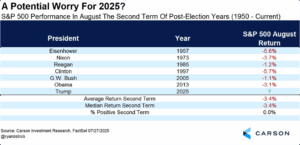

Another reason to buckle up? August hasn’t been higher under a second term President in a post-election year back to when Eisenhower was in office, down six times in a row.

There Is Good News

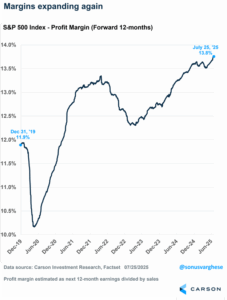

Let’s be clear, we still expect stocks to be higher by year-end than they are now. But that doesn’t mean we won’t have a few scary moments this August, so start preparing for them now. Why are we optimistic? Earnings are hitting record levels and profit margins are hitting new cycle highs. We’ve talked about these two things for years now and called them the dual tailwinds to this bull market and the good news is nothing has changed. If there is some August weakness use it as an opportunity not to panic.

Thanks so much for reading and I hope you have a great weekend. For more of my thoughts on August, I was honored to join Frank Holland on CNBC bright and early this morning. You can watch the full interview here.

8233791.1.-07.31.25A

For more content by Ryan Detrick, Chief Market Strategist click here