Nvidia’s latest quarterly results exceeded both the company’s and investor expectations. The company posted quarterly revenue of $57.0 billion which exceeded the $54.0 billion of revenue the company guided for. This $3 billion beat was their strongest beat ever and underscores the demand the company is seeing. Earnings per share (“EPS”) of $1.30 exceeded the FactSet consensus estimate of $1.26. And, perhaps most importantly, the company forecasted next quarter’s revenue to fall between $63.7 to $66.3 billion, a range that is higher than FactSet’s consensus expectations of $62.2 billion.

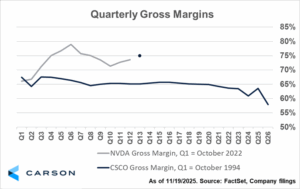

Investors may also take comfort in Nvidia’s gross margin result and outlook. Gross margin helps investors quantify how much value a company adds to raw materials. In my opinion, higher gross margins often signal competitive advantages and a higher willingness to pay from customers, among other factors. This metric can be an early indicator that demand may not be as robust as it has been in the past if it begins to deteriorate. This quarter, Nvidia’s non-GAAP gross margin continued it ascent higher to 73.6% relative to 72.7% last quarter. Further, the company guided for next quarter’s gross margin to be roughly 75% (as shown by the dot below). This positive trend may reassure investors, at least for now, that Nvidia’s pricing power remains strong.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Nvidia’s financials remain far healthier than Cisco’s during the DotCom era. The combination of Nvidia’s robust growth and expanding gross margin should help investors see that, at least for now, the AI frenzy is much different than the DotCom bubble. As shown above, Cisco’s deteriorating gross margin during the late 1990’s may have been one of the early signals that warned that DotCom-driven demand was waning. With high and expanding gross margins posted and forecasted by Nvidia, it at least gives investors a strong signal that recent demand remains robust.

That’s not to say investors won’t remain skittish, however. Nvidia entered this report amid conflicting demand signals. On one hand, Mr. Huang used Nvidia’s latest GTC conference in October to detail that the company sees a path to $500 billion in cumulative orders between 2025 and 2026. At the time, FactSet consensus expectations called for roughly $440 billion of revenue in this timeframe, so this guidance represented a significantly bullish outlook. On the other hand, Microsoft CEO Satya Nadella noted on a recent podcast that Microsoft has “a bunch of chips sitting in inventory that [they] can’t plug in” due to shortages of physical infrastructure.1 Commentary like this from one of Nvidia’s largest customers might spook investors that even if Nvidia achieves their potential revenue, it could be a result of excess shipments prone to subside.

To help assuage investor concerns about potential oversupply, CEO Jensen Huang used the company’s earnings call to reaffirm the company’s unique computing capabilities that are spurring growth. Mr. Huang noted “AI has reached a tipping point with major transitions underway. AI is transforming existing applications while creating entirely new ones. And a new AI wave is rising in agentic AI systems, which mark the next frontier of computing. Our customers continue to lean into [these] platform shifts, fueling exponential growth for accelerated computing.” With AI appearing set to become even more ingrained in our lives, the recent volatility in the price of AI-related stocks may have simply been a pause of buying after a rapidly ascending year.

Nvidia posted its largest revenue beat in recent history. The company’s gross margin did and is expected to expand. And earnings per share continue to grow. Amidst some questions and skepticism from investors, the company delivered a healthy earnings report. While there may likely continue to be anecdotes from customers about their ability to install and ultimately monetize Nvidia’s chips, much of the forward-looking commentary from the company should help put investors at ease that their products remain at the forefront of technological innovation.

Carson Investments, 11.20.25, All things AI w @altcap @sama & @satyanadella. A Halloween Special. BG2 w/ Brad Gerstner. YouTube. https://www.youtube.com/watch?v=Gnl833wXRz0

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here

8621768.1.-20NOV25A