Nvidia and I have at least one thing in common: a stellar summer of 2025. I was fortunate enough to take a sabbatical and travel for several weeks. Meanwhile, Nvidia added roughly $1.2 trillion in market cap since May 23rd (the last close before Memorial Day) through yesterday’s close (FactSet data). Those are fairly comparable in my eyes – joking, of course! Summer is nearly bookended by Nvidia’s earnings report, and the company’s results last night reinforce the fundamental strength of the largest company in the S&P 500.

Firm Fundamentals

Nvidia posted total revenue of $46.7 billion, equating to 55.6% growth year over year. While that growth rate is lower than last quarter’s 69.2% annual revenue growth, this quarter’s results reflect $8 billion of lost potential H20 revenue intended for Chinese customers that had to be scrapped due to export restrictions. Adding back in this scrapped product to topline revenue would yield $54.7 of revenue and show a growth rate of 82.2%, an acceleration from last quarter on an ‘adjusted’ or more like-for-like basis. Those are impressive growth rates for a company of this size.

Nvidia’s revenue guidance also confirms this fundamental strength. The company guided for the next quarter’s revenue to be “$54.0 billion plus/minus 2%.” This is probably the main reason the stock is roughly flat in trading today as this figure is slightly below the FactSet consensus estimate of $54.3 billion. If this guidance is achieved it would represent 54% year over year growth, nearly the same growth rate as this quarter’s result, and that reflects firm fundamentals for a company of this scale.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

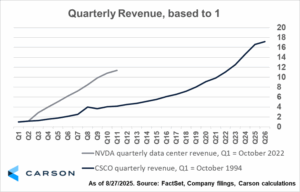

Both Nvidia’s results and the company’s outlook paint a consistent picture: their product is in high demand. While technology skeptics have questioned the sustainability of the AI Boom – likening it to a speculative bubble akin to the late 1990s period – Nvidia’s financial results remain substantially better than what Cisco, a posterchild of the DotCom era, produced during the time. As shown below, Nvidia’s quarterly data center revenue has grown more than tenfold since the AI Boom began eleven quarters ago in the fall of 2022. By contrast, eleven quarters into the DotCom boom, Cisco’s quarterly revenue had ‘only’ grown by 3.2x. Nvidia’s impressive financial results underscore how critical the company’s chips are to AI development in this new technological revolution.

A Record Run

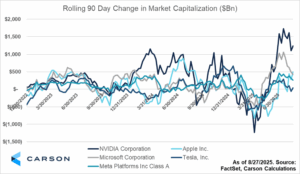

What made Nvidia’s summer so stellar was the record-setting surge in its market cap ahead of this earnings report. Nvidia added roughly $1.2 trillion in market value in the most recent 90-day period, which is a record for any company ever, as shown below. By comparison, the next closest large-cap growth company over this most recent 90-day stretch was Microsoft, which added about $400 billion in market cap (and over $1 trillion at their most recent peak). At Nvidia’s recent peak, the company had gained more than $1.6 trillion in market cap over the 90-day period ending August 8. This run eclipsed the prior market-wide record (which Nvidia also owned) of just over $1 trillion in market cap added during a period which ended in early 2024 (all FactSet data). That certainly qualifies as a stellar summer in my book.

Nvidia’s performance this summer reflects the company’s central role in powering the AI Boom. Its revenue growth, even after accounting for export-related headwinds, demonstrates both scale and resilience. The market’s willingness to reward that fundamental performance with a record-breaking capitalization gain speaks to the belief that AI may not be a passing fad, but a lasting shift in the way businesses and consumers will operate. While skeptics may continue to draw comparisons to bubbles of the past, Nvidia’s fundamentals tell a very different story, at least for the time being. Nvidia and I both had summers to remember—mine filled with travel and reflection, theirs filled with record-breaking results.

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here

8335511.1.-08.28.25A