“Being diversified is always having to say you are sorry.” Old investment axiom

One of the bigger mysteries of 2025 is what exactly is with the whole “six seven” thing all the kids keep saying? I have kids and I hear it all the time, but I’ll admit, I still don’t understand it and that appears to be the whole point. It might be nonsensical, but it was named the Dictionary.com Word of the Year.

In honor of the word of the year, in today’s blog I will list six (or seven) reasons to be thankful as investors.

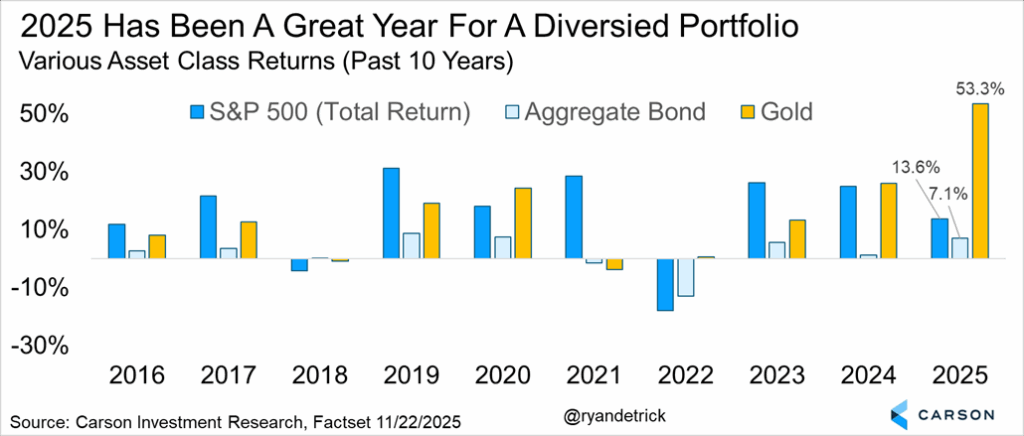

1) It’s Been a Great Year for Various Asset Classes

Yes, the S&P 500 is up about 14% this year, which is strong, especially considering it was up 25% back-to-back years, but it doesn’t stop there, as all 11 sectors are higher on the year and most global stock markets are up even more than the US. In fact, Emerging Markets are up 26% and Europe, Australasia, and the Far East (more well known as EAFE) is up 23%.

What about bonds? They are looking at their best year since 2020 and gold is having its best year since 1979. All in all, this has been a very nice year for portfolios and for once you don’t have to say ‘sorry’ for being diversified.

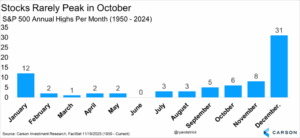

2) Stocks Rarely Peak in October

The S&P 500 peaked on October 28, right before the Federal Reserve Bank cut interest rates the next day. Obviously, we’ve seen a good deal of volatility in November so far. After a 38% rally, giving back about 6% doesn’t seem so extreme to me.

We remain optimistic this bull market is far from over and we could see a strong year-end rally, with likely new highs before 2025 is said and done. That is quite normal, as only six times did the S&P 500 peak for the year in October and we don’t think this will be seven. Did you get my weak attempt at a six seven joke?

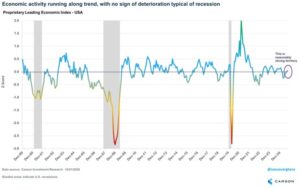

3) The Economy Is Improving

All we hear is how bad things are out there, but we are thankful the US economy appears to be improving and growing above trend.

Here’s our Carson Investment Research Proprietary Leading Economic Index (LEI) for the US and it shows indeed our economy is improving under the surface. Take note, this LEI never predicted a recession in 2022 and 2023 like so many other indicators did.

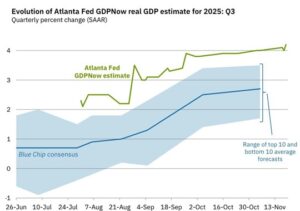

Add to this is the Atlanta Fed GDPNow is estimating a very impressive 4.2% GDP print in the third quarter and there is much to be thankful for from an economic point of view.

4) The US Isn’t Top Heavy

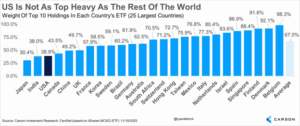

We hear constantly how the US is top heavy and only a few stocks account for the gains. This simply isn’t true if you look at the data, as we’ve noted time and time again the past year plus.

Yes, the top 10 stocks in the US account for nearly 40% of the overall market cap of the US. Here’s the thing, it was 39% last year at this time and things have done just fine. But looking around the globe shows the US is actually one of the least top heavy countries! In fact, only Japan and India are less top heavy. We don’t have the same worry about this as others, but when you show it this way it really hammers home the US isn’t as top heavy as they make it seem.

5) Earnings Drive Long-Term Stock Gains

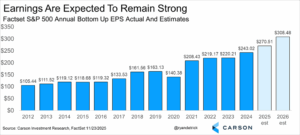

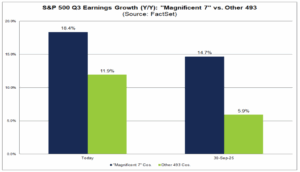

We are wrapping up a very strong earnings season, which we think is justifying the move we’ve seen in equities. At the start of the quarter, S&P 500 third-quarter earnings were expected to be up 7.9%, but that is up to an incredible 13.4% currently. Revenue has done much better than expected as well and is the highest it has been in three years.

FactSet’s John Butters does amazing work on earnings and he found that Mag 7 earnings were up 18.4% this quarter, a very strong number and much better than expected two months ago. But what many seem to consistently ignore is how well everyone else is doing. That’s right, the 493 has seen earnings up nearly 15%! Yes, those big seven (not six, but seven) names make a LOT of money, but the other 493 are doing just fine.

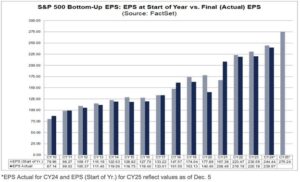

Lastly, John found that analysts tend to do quite well with their EPS targets. Yes, if you have an outlier year like 2001, 2008/09, or 2020 then things can be off, but we don’t see a recession next year, so things should be more ‘normal.’ Looking at those normal years (and excluding the outliers) the average difference between what analysts expect earnings to be at the start of the year and the end of the year was just 1.1%. That’s a tiny number and one that says we could be looking at another year of low double-digit earnings growth next year when all is said and done, another reason to be thankful.

6) The Consumer Is Doing Ok

All we hear day after day is how bad the consumer is doing, awash in a sea of debt. Is this true? Well, certain consumers are clearly struggling, but on the aggregate things aren’t so bad.

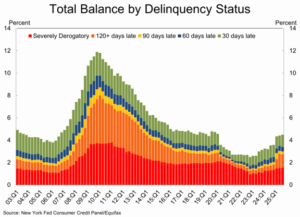

Recent data from the New York Fed showed that 95.5% of all debt is paid on time. This is down from 95.6% last quarter, but it is still above the 95.3% in Q3 ’19 or the 93.3% in Q4 of ’07. Peeling back the onion even more showed that 120-day delinquencies actually improved and those that were severely derogatory were flat.

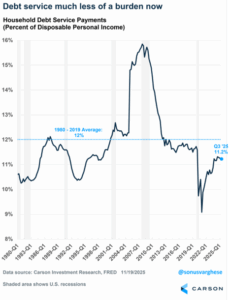

Yes, overall we have more debt than we had a year ago, 10 years ago, 50 years ago, etc. That’s the headline we hear all the time, but what about the denominator? The overall and average wealth and income levels are much higher and this usually gets lost in the shuffle. Household debt service payments as a percentage of personal income it is 5.3%, the same as last year and well beneath the more than 15% before the Great Financial Crisis or even before Covid.

Year to date, total debt is up 3.0% and credit card debt is up 1.8%, both to new highs, yet disposable income is up a very solid 3.5%, helping to justify (and offset) those higher debt levels. This is another reason to be thankful.

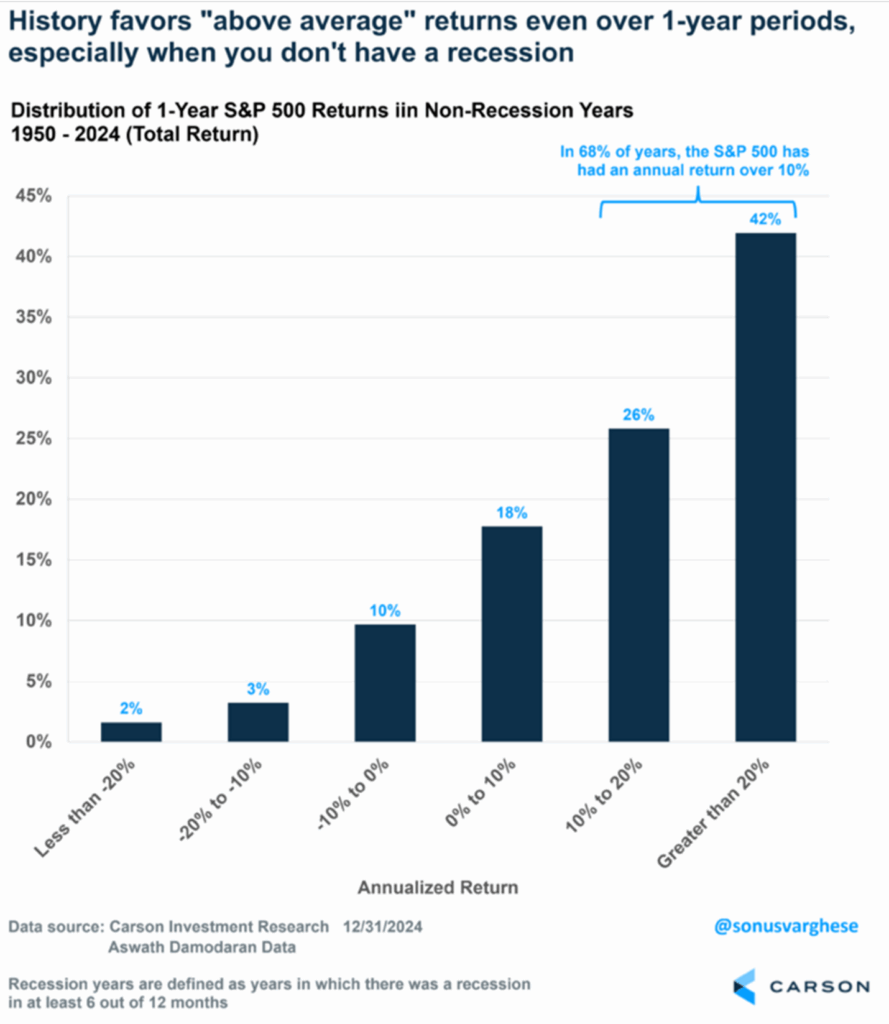

7) Bad Years Are Rare Without a Recession

Years without a recession (and we don’t expect a recession in 2026) rarely have big losses, as only 5% of the time stocks fall double digits. Taking it the other way, double digit gains happen 68% of the time and stocks finish the year higher an incredible 85% of the time. Should this all play out again, next year could be another solid year for investors. Something to indeed be thankful for.

Thanks as always for reading and for listening to what our team sees out there. You have many places to get advice and we are honored you take the time to listen to us. We wish everyone an awesome Thanksgiving holiday and may you eat that extra piece of pumpkin pie.

Lastly, I joined my friend Larry Sprung, Founder & Wealth Advisor at Mitlin Financial, on the Mitlin Money Mindset podcast to discuss why we remain bullish, my career, social media, why the RIA model works, AI, and so much more! Please watch it below.

For more content by Ryan Detrick, Chief Market Strategist click here

8633158.1.-25NOV25A