“The waiting is the hardest part.” — Tom Petty

Today is the annual Jackson Hole Economic Policy Symposium and with it will likely come a good deal of media fare and potential volatility. This time a week ago we were looking at more than an 85% chance of a Federal Reserve Bank (Fed) cut next month, but that is less than 70% ahead of Jerome Powell’s highly anticipated speech.

Given I’m writing this before his speech is out, I’ll focus on rate cuts in general. But don’t worry, Sonu Varghese, VP Global Macro Strategist, will write a lot about what Powell says and how it all relates to future Fed policy and markets.

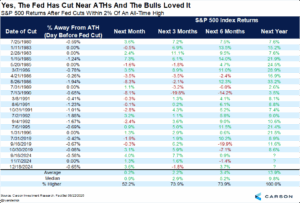

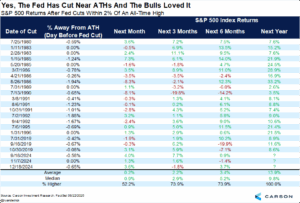

Earlier this week I noted that the Fed indeed has cut with stocks near all-time highs and that can be a very good sign, as stocks were higher a year later 20 out of 20 times. Then add in the three cuts near all-time highs (ATHs) late last year and this very well could be 23 for 23 when all is said and done. No, we don’t know if the Fed will cut in September and we don’t know if stocks will be near ATHs when they do, still this is something to prepare for in my opinion.

The other thing that caught my attention this week while I was thinking about the Fed was it has been a long time since they last cut rates. Again, they cut three times for a total of 1.00% late last year, but should they cut next month that would be nine long months since they last cut 0.25% on December 18, 2024.

I looked for other times the Fed took a long pause in between cuts and the good news is just like Tom Petty told us, the wait will be the hardest part, but it is worth it.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Looking at pauses between 5 and 12 months, I found that stocks were higher a year later 10 out of 11 times with a very impressive median return of 14.5%. Yes, 2001 is in there (skewing the returns), but that time of course was during the bursting of the tech bubble with 9/11 and a recession on the horizon. The majority of the other times saw solid gains a year later, with seven out of 11 times up more than double digits.

Thanks for reading and stay tuned for our thoughts on Jackson Hole next week. For more on all of this, be sure to watch our latest Take Five video, as Sonu and I discussed what a Fed cut could mean.

8315566.1.-08.22.25A

For more content by Ryan Detrick, Chief Market Strategist click here