“We cannot direct the wind, but we can adjust the sails.” Thomas Monson, American religious leader

Do you have a fear of heights? This is known as acrophobia, which is something many, many investors have. That’s right, I’ve done this for more than two decades and new highs create a very uncomfortable feeling in the belly of many investors. Studies show the fear of failure hits much harder than the feeling of success. This is why we always remember our favorite sports team’s tough losses much more vividly years later than the big wins.

If you’ve done this long enough then you recall there indeed was one final new high in 2000, right before stocks were cut in half. Or there was one final new high in 2007, right before another 50% haircut. Not to mention both of those times took years and years to even get back to even.

In today’s blog I’ll show why new highs are simply part of investing and they are nothing to fear. There are always worries and concerns, but a fear of heights shouldn’t be one of them. Just a reminder, be sure to check out our just released Midyear Market Outlook 2025: Uncharted Waters if you haven’t had a chance yet, as we discuss why we remain optimistic about the second half of 2025.

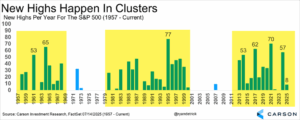

New Highs Happen in Clusters

The S&P 500 broke out to new all-time highs in 2013 and I’ve been on record since then that we were in a major structural bull market that would likely last a decade or more. Well, 12 years into it and I still feel there is plenty left in the tank. I love the quote above about how we can’t control the wind, but we can adjust the sails. The good news is we’ve had the wind at our back for many, many years and it has been a great time for investors.

Another way to put it is don’t get cute when you have the wind at your back.

You see, new highs happen in clusters that can last a decade plus, but the flipside is many years can also occur without any new highs, like when we saw a total of 13 new all-time highs in the 12 calendar years from 2000 through 2012. We call this a secular bear market and they are the unfortunate part of longer-term investing.

Here’s a nice chart that shows new highs happen in clusters that can last a very long time, and we remain optimistic that many more new highs are still left in this secular bull market.

Some Stats on New Highs

The S&P 500 became 500 stocks in 1957 and it has made a total of 1,249 all-time highs over this period. Incredibly, that comes out to a new high 7.2% of all trading days, or a new high every 14 trading days, approximately. That is a new higher every three weeks! In other words, new highs happen a lot and being scared of new highs isn’t going to benefit your portfolio.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Don’t Be Scared

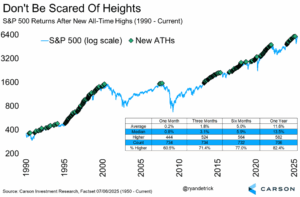

Lastly, should you buy at an all-time high? This is always a hard question. You didn’t have to think about this three months ago, and we were writing at the time that it was the time to potentially scope up some great deals. Now with stocks up more than 25% it is harder, but the bottom line is new highs tend to lead to more new highs.

Since 1990, the S&P 500 was higher a year after an all-time high 82.4% of the time and up a median return of a very impressive 13.5%. For every peak in 2000 or 2007, there are literally hundreds of other new highs that weren’t a major peak. And the good news? We don’t think the most recent new high is the peak just yet!

As always, thanks for reading. We know you have a lot of places to get advice and it isn’t lost on us you are reading our blog. For more of our thoughts on the latest with the economy and bull market, be sure to watch our latest Facts vs Feelings below.

For more content by Ryan Detrick, Chief Market Strategist click here

8176337.1.-07.16.25A