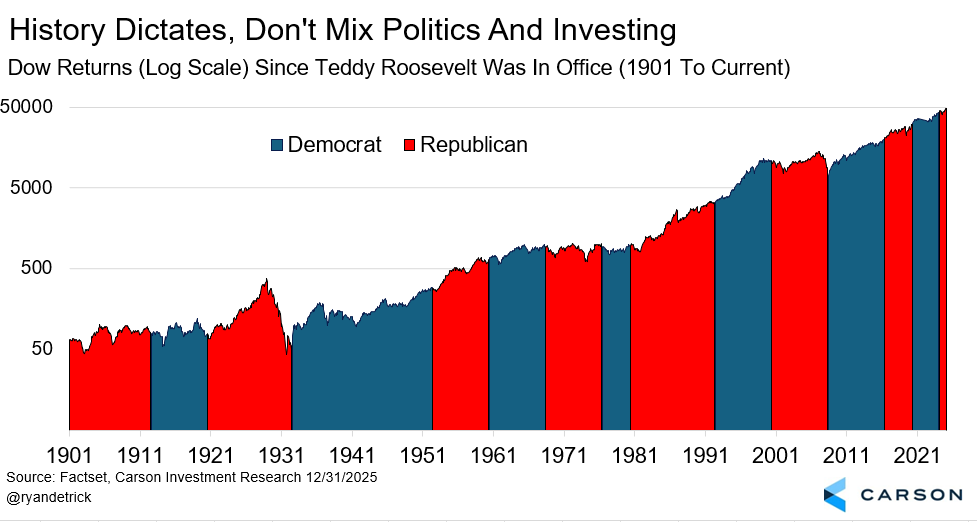

As my colleague Ryan likes to always remind us, politics and investing don’t mix — it’s not about red or blue, it’s about green. Markets have gone up (and down) during Democratic and Republican administrations. Stocks have bull markets and bear markets under both parties. As Ryan wrote recently, many investors said they didn’t like President Obama and missed out on eight great years. Many didn’t like President Trump 1.0 and they missed out on four good years. Or didn’t like President Biden, again missing out on solid gains. Same with Trump 2.0.

Still, it’s always tempting to make big policy predictions after a new election, especially a presidential election that sees a big ideological switch. And then make predictions about certain sectors and themes that could benefit from these policies.

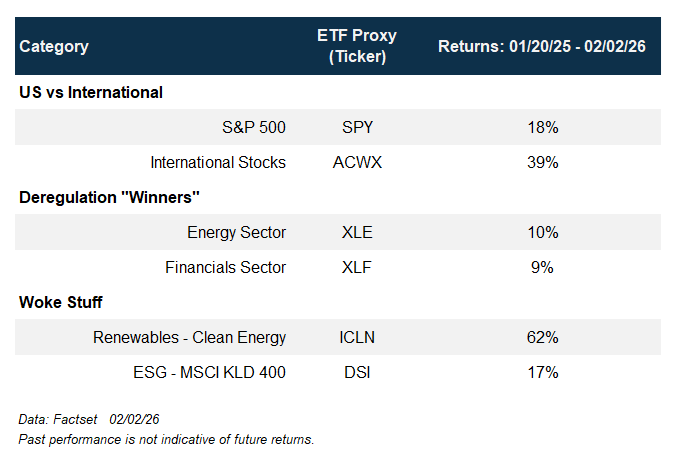

After President Trump’s re-election, there were several seemingly intuitive opportunities to “take advantage of” with the new administration, including:

- An American resurgence, implying buy America and fade international, more so with America’s added economic “leverage” that allowed/allows it to dictate terms

- A wave of deregulation favoring financial and energy companies

- Pulling back from renewable energy, implying fade renewables

- The end of woke, so sell all that ESG stuff

Long story short, it didn’t quite work out this way. In fact, it was the opposite. Since Inauguration Day in 2025, US stocks underperformed international stocks, energy and financials underperformed the broad S&P 500 index, and clean energy stocks and ESG stocks outperformed the sectors that might have been expected to outperform.

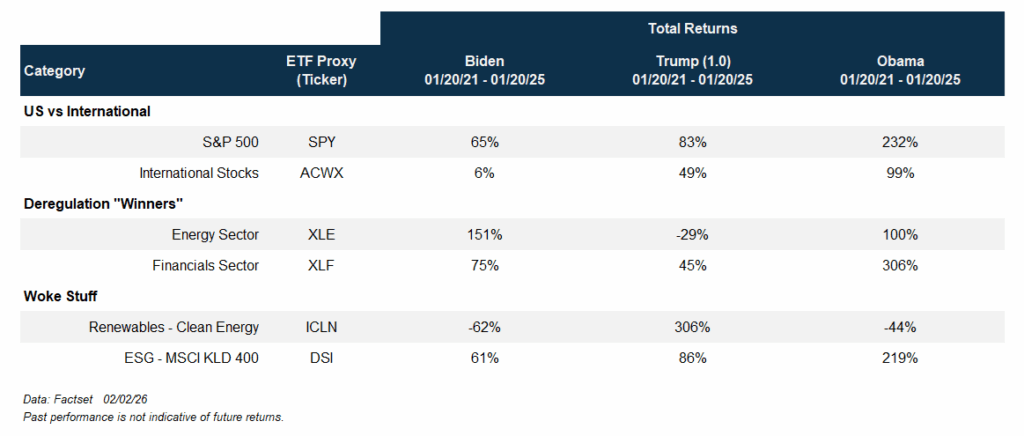

It’s not just the past year. We saw this same story play out during the Biden, Trump 1.0, and Obama administrations.

- US stocks outperformed international stocks by a much larger degree during the Obama and Biden administrations.

- Financials outperformed during the Biden and Obama administrations, and underperformed a lot during Trump 1.0.

- Energy outperformed significantly during the Biden administration (the other side of this was inflation), but was terrible during Trump 1.0 and did better during the Obama administration (despite the crash from 2014-2016 as the shale bubble burst).

- Clean energy stocks had returns about 3.7x the S&P 500 during Trump 1.0, while they fell significantly during Biden’s and Obama’s terms.

- ESG stocks also outperformed during Trump 1.0, while underperforming during the Biden and Obama administrations.

I’d have gone back to the GW Bush administration but it was sandwiched between two recessions, and politics didn’t seem so salient then (within the investing realm), plus, betting on all these different themes and sectors was harder. But even during the eight years of the Bush administration (2001-2009) things didn’t quite play out as one might expect under a Republican administration. From January 20, 2001 through January 20, 2009:

- US stocks underperformed international stocks: the S&P 500 fell 31% while the MSCI All-Cap World Ex US Index gained 1.5%.

- Financial stocks fell 65% (remember the financial crisis?).

- Energy stocks did outperform, gaining 63% in a “lost” eight years for stocks, but this was driven by foreign demand for oil rather than anything that happened in the US (shale happened after 2009).

All this to stay, be careful of political narratives and policy-driven market predictions, especially immediately after an election. There’ll be plenty of that this year considering it’s a midterm year. As my colleague Barry Gilbert, VP, Asset Allocation Strategist, likes to say, with this stuff you need to not just get the policy right; you also need to the get the policy implications for companies right, and then the potential impact on their stocks. As with everything related to investing, what really matters is what is or isn’t priced in, and that’s not easy to figure out.

The good news is that that stocks tend to go up irrespective of who the president is, unless you get a big recession that upends profits. But that’s not our base case now, as we outlined in our 2026 Market Outlook: Ride the Wave.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

8752435.1. – 3FEB26A