Back in 2023 when we were writing our 2024 Outlook, we decided to call it Seeing Eye to Eye, with a bit of a pun on “AI to AI.” We knew then that the AI impact was coming but also knew we were in early days. In fact, we expected relatively little direct impact on the economy in 2024 at all. Well, here we are, just two years later, and there’s been so much chatter about the “AI Bubble” already that I’ve seen articles on the “bubble in articles about the AI bubble.” You know there’s something going on when the coverage becomes part of the story.

Yes, there is a lot going on. Yes, it’s probably not too soon to talk about an AI bubble, but there’s a whole lot that still has to play out and still a lot of unknowns. The question isn’t really whether we’re in a bubble. It’s such a vague term that whether we’ll be talking about an “AI bubble” in 10 years can only be known in hindsight. The real question is how long the current trend in AI spending will last and how bad the fallout will be when it ends. What’s clear right now is that something massive is happening in the economy and it’s useful to understand the dynamics behind that, and the potential risks. Let’s take a look.

You generally hear about how AI is going to impact businesses, and the economy, in a big way in the near future. It’s already having a massive impact on the stock market. ChatGPT was publicly released on Nov 30, 2022. It was initially a free “research preview” but took off from there. Since then, through October 8th 2025, here are returns for the S&P 500, the tech-heavy Nasdaq, and the Dow Jones (which has “only” a 20% allocation to Technology stocks):

- S&P 500: +71.6% (white line)

- Nasdaq: +111.3% (green)

- Dow Jones: +42.2% (orange)

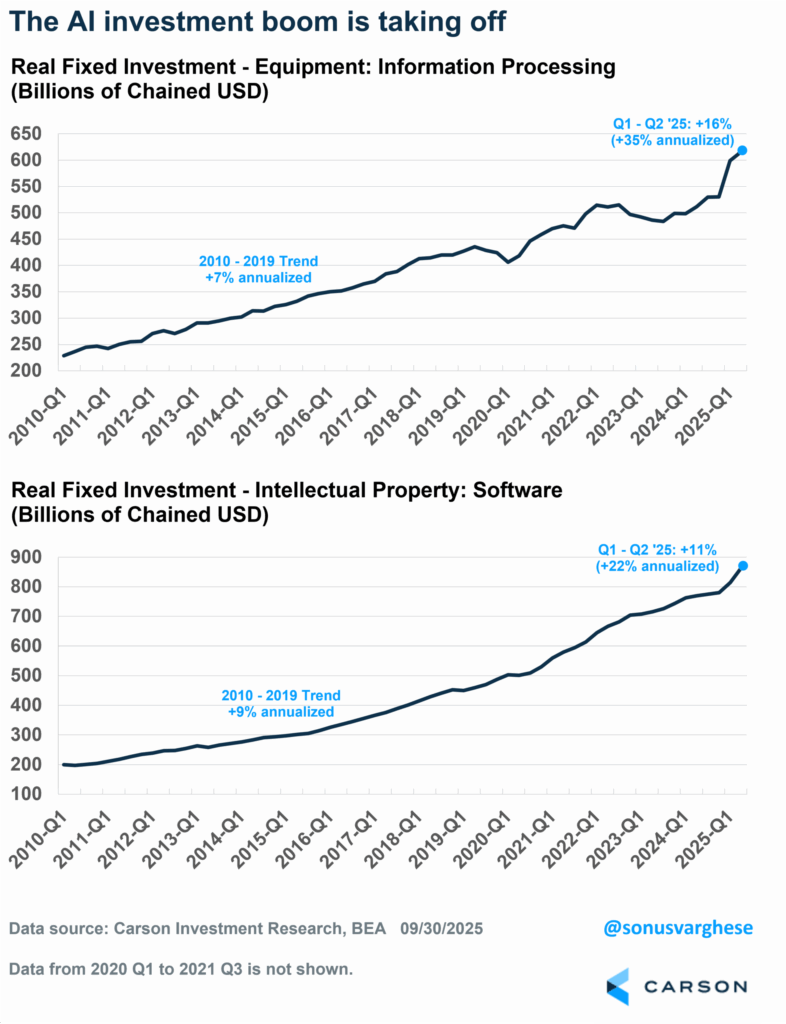

Here’s the thing: AI is already having a massive impact on the economy. Specifically, investment, i.e. spending on AI-related hardware and software. In real (inflation-adjusted) terms, here’s how AI-related investments rose in the first half of 2025:

- Information processing equipment:+16% (+35% annualized pace)

- Software: +11% (+23% annualized)

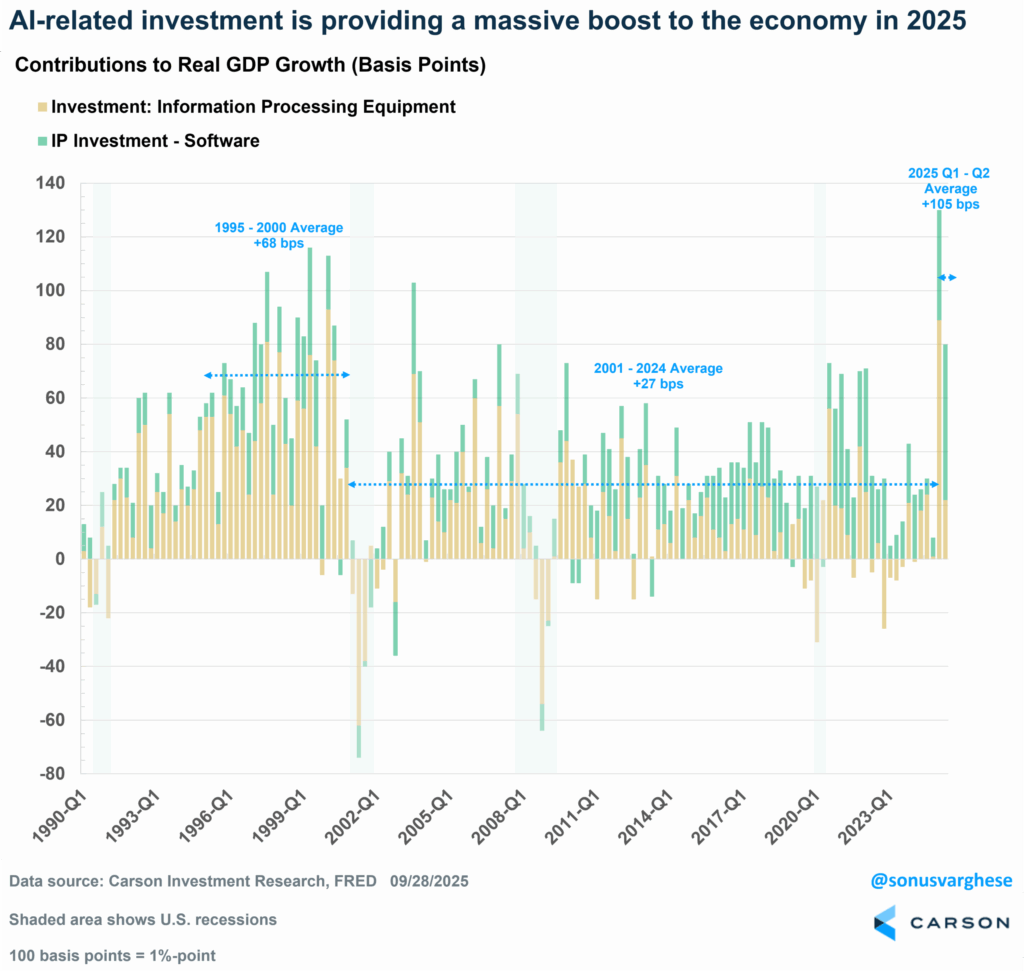

As a result, AI-related spending made a huge contribution to GDP growth in the first half, averaging a whopping 1.05%-points (105 basis points or “bps”) across two quarters. For perspective, here’s how investment in information processing equipment and software contributed to GDP across the mid-to-late 1990s dot-com bubble and the 24 years after that (2001-2024):

- 1995 – 2000: +68 bps average per quarter

- 2001 – 2024: +27 bps average per quarter

Of course, it’s early days yet but the numbers are simply massive. The Q1 investment contribution to GDP (of 130 bps) was larger than during any quarter in the mid-to-late 1990s. While the Q2 contribution (+80 bps) was larger than the average quarter during that prior boom.

One note of caution here is that a lot of this investment spending was on imported goods, and so it technically doesn’t count towards “gross domestic spending.” Plus, there may have been a great deal of tariff front-running in Q1. It’ll be interesting to see how things evolve, and settle down, over the next several quarters.

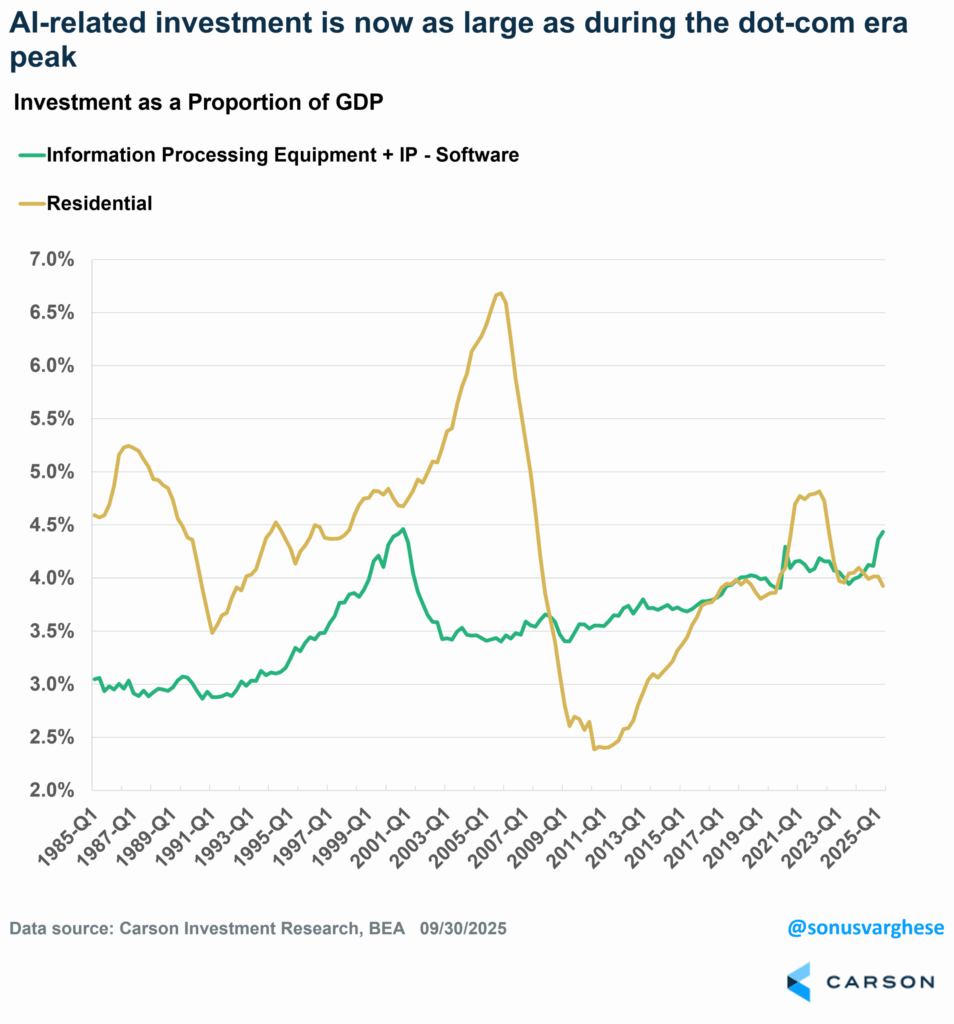

What’s amazing is that AI-related investments contributed the exact same amount as consumer spending in the first half of 2025 (105 bps on average per quarter). Keep in mind that consumer spending makes up 68% of the economy, whereas the AI-related categories account for just 4.4% of GDP. That’s actually as high as it got during the dot-com boom. In the chart below, I also included residential investment for comparison, since that’s a category that has had huge ups and downs over the past decade. Right now, it makes up less than 4% of GDP, well below the peak of near 7% at the height of the housing bubble.

It’ll be interesting to track how large, as a proportion of GDP, AI-related investment becomes, though if the shutdown continues, we’re not going to get Q3 GDP data anytime soon.

Of course, that’s the macro data. It’s worth looking under the hood of all this activity to try to gauge whether it can continue, and the risks.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Can This Investment Boom Continue?

Short answer: I have no idea, and I don’t think anybody else does either. Of course, when Google co-founder, Larry Page, says “I’m willing to go bankrupt rather than lose this race,” you kind of have to think this could go on for a while—it’s hard to imagine Google (Alphabet) going bankrupt, but even if that was goal, I’m sure it would take years.

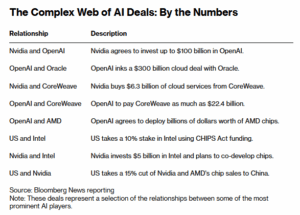

I was being flippant above, but the reality is that almost every day now it seems like there is a new AI-investment related announcement, with OpenAI in the center of it. This week it was OpenAI and AMD. OpenAI, valued at $500 billion recently, is spending a lot of money on infrastructure and chips (and talent)—they’ve signed about $1 trillion in deals this year, with the large technology companies.

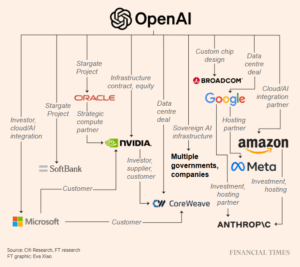

Here’s a handy illustration from the Financial Times that shows the intertwined nature of all the companies that are piggy-backing on OpenAI’s ambitions.

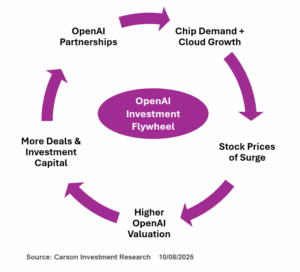

Of course, OpenAI doesn’t have anything close to this amount of capital to fund their capital expenditures, and AI is a very capital-intensive business. This is where the financing of these deals gets interesting, to say the least. What we are seeing is a set of circular arrangements between OpenAI and the largest tech firms in the world, where they provide the investments but also gain a customer. Here’s a simplified description of the AI investment flywheel:

- OpenAI forms partnerships with chip companies (Nvidia, Intel, AMD) and collaborates with “hyperscalers” who provide large-scale cloud compute capacity (Microsoft, Oracle, Amazon, Google).

- Chipmakers gain new orders and AI workload visibility, while hyperscalers see more cloud demand from AI workloads, while OpenAI gains preferential access to chips and compute infrastructure.

- Stock prices of chipmakers and hyperscalers surge on the back of investor optimism, while OpenAI’s valuation also rises as they’re viewed as the central player within the AI ecosystem.

- OpenAI gains easier access to funding and they use higher valuations and capital inflows to secure more exclusive chips, expand AI-related training and model deployment capacity, and enter new partnerships with hyperscalers and users.

- Repeat

All this continues to reinforce the AI-growth story, and rising valuations feed more optimism. Investors bid up stocks of…

- Chipmakers: in anticipation of continued AI demand

- Hyperscalers: in anticipation of AI-driven cloud profits

- OpenAI: in anticipation of platform dominance

All this keeps the wheel turning. What pops out of the chart above is that the bull market needs to continue for it to keep going. If stock prices pull back a lot, and valuations drop, that’s going to put sand into the gears of the flywheel. But at this point, the bet is that AI usage explodes higher and OpenAI can start generating serious profits. If that doesn’t happen, the funding stops and the wheel stops turning.

For now, the big tech companies expect to continue making AI-related investments. Looking at AI-related capex from Microsoft, Amazon, Alphabet, and Meta:

- 2024: $217 billion

- 2025 estimated: $338 billion

- 2026 estimated: $409 billion

While these firms are cash rich from other operations (like cloud and ad sales), some are starting to rely on debt to support spending. Bloomberg recently reported that Meta secured $26 billion in financing from lenders to fund construction of a massive data center in Louisiana, which will be the size of Manhattan. This deal is especially interesting because it keeps the debt off of Meta’s books, freeing up its balance sheet to continue making massive AI-related investments. As we move into 2026, expect this structure to become a more common way of financing data centers:

- The hyperscaler sits at the top, initiating the build.

- They create or partner in a joint venture (JV)/special purpose vehicle (SPV).

- The JV/SPV pulls in capital from REITs/infrastructure funds (equity) and private credit lenders (debt).

- The funding flows down into the real estate and power assets, which the hyperscaler then leases capacity from, with payments flowing back to the funds and lenders

The schematic below shows the capital structure, with black solid arrows showing funding flowing down (from REITs, private credit, and capex from hyperscalers) and green dashed arrows show cash flowing back up via lease payments, interest, and returns.

As you can see, the funds (REITs, private credit lenders) get steady contracted cash flows, but it also means yet another corner of the market is tied to the AI flywheel (in addition to energy/utility companies and construction and industrial firms facilitating the build-out). It also means that if the flywheel stops, these funds have a lot of downside even as the upside is limited (you just get the income from leasing assets). Whereas with the hyperscalers, the upside is unlimited (in theory) while the downside is limited, in that if the AI thing doesn’t work out they can fall back to selling ads and cloud services.

So, going back to the original question, could this continue? Based on what the companies say and what they’re doing—both on the deals front and with financing arrangements – it looks like this is going to continue for a while. The large tech companies also have low debt right now, which means there’s a lot more room to ramp up leverage. These companies are now locked in an arms race—they have to invest in AI-capex in a big way to keep up with their fellow competitors.

If you notice, I didn’t mention a thing about whether AI will be a massive technological force that seeps into everyday life at some point in the future. But that’s beside the point right now. If it happens (and I’m biased to think it will), it’ll be years from now. From an overall stock market perspective, what really matters is that higher investment spending is a source of rising aggregate profits. On top of that we have higher deficit spending, which is also positive from the profit perspective, as well as rate cuts. All tailwinds for the market, for now.

Ryan Detrick, Carson Chief Market Strategist, and I talked about all this in our latest Facts vs Feelings podcast. Take a listen below:

8477702.1.-08OCT2025

For more content by Sonu Varghese, VP, Global Macro Strategist click here