The ‘American Dream’ of home ownership remains alive and well. Despite significant increases in mortgage rates in recent years and fears the housing market would tumble as a result, there are structural factors that may have played a crucial role in the resiliency of this housing market. We point to demographics and work from home trends as key support pillars for this rebound.

Recent data points, as detailed by Sonu Varghese, Vice President, Global Macro Strategist show the housing market has exhibited a remarkable turnaround. While home prices declined in the first half of 2022, they’ve experienced an uninterrupted eight-month surge to reach new all-time highs as of October (data from Bloomberg). This quick ‘U-turn’ in home values stands in stark contrast to the last housing downturn beginning in 2007, which saw years before home prices recovered to previous levels. This recovery in prices occurred even as inventory levels normalized, moving from below two months of supply in late 2022, to 3.8 months as of October (data from Bloomberg).

The forward-looking data also point to no significant slowdown coming soon in the market. Both single and multi-family housing units under construction reached new highs as reported by FactSet (data as of 11/17/2023). To the surprise of many, this market remains resilient.

As investors, we’re tasked with asking what’s fueling this market and anticipating future fundamentals. We would point to demographic factors and the work-from-home trends that may have supported this housing cycle and why they’re likely to remain.

Demographics, being immutable, often align with secular growth stories. Those born in 1990 are now turning 33, for example, and no one can change that. This cohort born around 1990 is also the largest generation in recent history, and they’re entering prime household formation years. This population growth is likely to continue to aid the home building market.

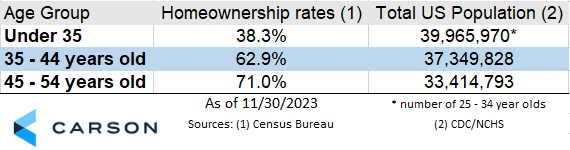

Census Bureau data indicates that the most significant increase in homeownership rates occurs between the ‘Under 35′ and ’35-44’ age groups. It’s a critical period for household formation as young families move from landlocked urban apartments to spacious suburbs so their families can grow. As the data from the CDC shows, there’s a growing population in this age range that will likely continue to form households.

- Data from Census Bureau https://www.census.gov/housing/hvs/data/charts/fig07.pdf

- Data from CDC https://www.cdc.gov/nchs/data-visualization/natality-trends/index.htm

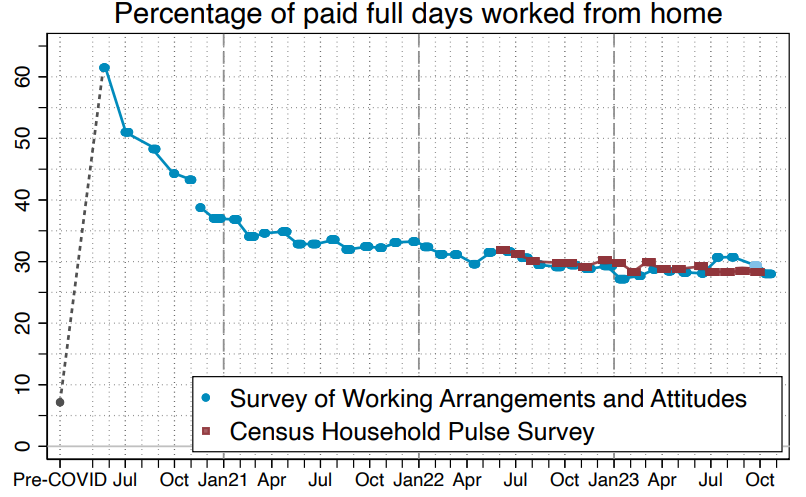

Simultaneously, the work-from-home trend, which has become increasingly prevalent post-covid, has also stabilized. Chances are, with people spending more time out of the office, they may be more inclined to invest in their home or move from an apartment to a home earlier in life. And with advancements in technology allowing for secure remote connections coupled with employers looking to attract the best talent with increased flexibility, we don’t expect this to revert to pre-covid levels any time soon.

Data from WFHResearch reveal that work-from-home trends have plateaued at just below 30% of paid full days worked from home. It’s a significant increase from pre-COVID levels of below 10% but suggests a lasting change in work patterns. In our view, this serves as a tailwind to household formation for the younger generation as they may transition from an apartment to a home earlier in life.

https://wfhresearch.com/wp-content/uploads/2023/11/WFHResearch_updates_November2023.pdf

In conclusion, the current state of the housing market marked by resilient growth and stability can be attributed to a confluence of factors. We would point to a growing demographic age cohort and the enduring impact of the work-from-home trend as some of the most important factors. As households continue to form and adapt to evolving work patterns, the housing market appears well-positioned for strength in the coming years. It’s a bright outlook for the enduring allure in the ‘American Dream’ of home ownership.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

2008168-1223-A