“It’s tough to make predictions, especially about the future.” Yogi Berra, Hall of Fame Yankees catcher

I was honored to be included in the fifth volume of the Yahoo Finance Chartbook! This incredible report is compiled by Josh Schaefer, Markets Reporter at Yahoo Finance, and we think it is simply a must read for all investors.

Josh does this twice a year and he asks the top strategists and economists on Wall Street what is the one chart they are watching now that matters the most. This is one you want to bookmark and go back to over the coming months.

Josh had 35 charts this time around and you should look at all of them, but here are a few that caught my attention that I wanted to highlight. I’m a huge fan of Josh, Yahoo Finance, and the different perspectives their incredible research provides. It’s not intended to give you the answers, but it does a great job capturing some of the most important things to think about. Lastly, Josh and Ethan Wolff-Man, Senior Editor at Yahoo Finance, put out an amazing daily email each morning called the Yahoo Finance Morning Brief.

Let’s get charting! Seven charts ahead, each with some thoughts from the strategist who provided it.

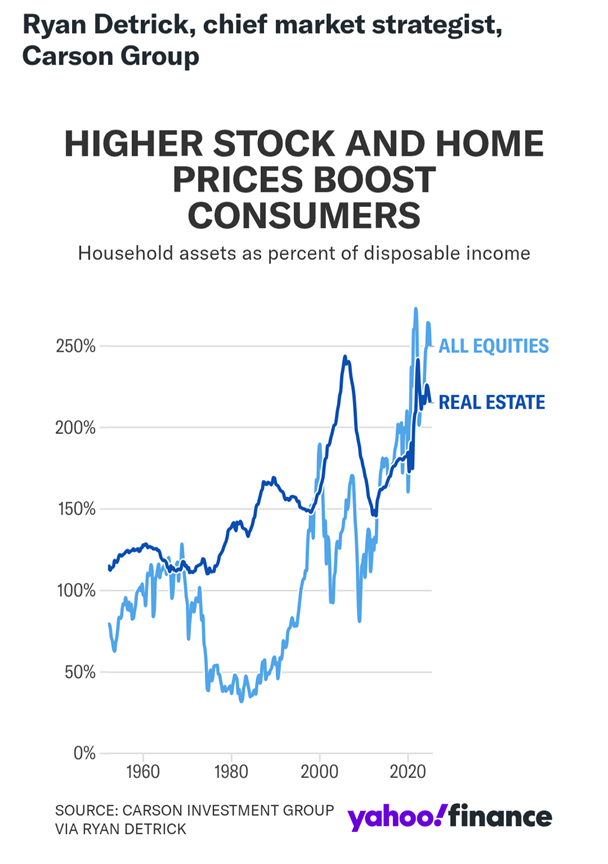

The chart I shared with Josh and team focused on the fact that the consumer is in excellent shape and households likely are worth as much now as they’ve ever been.

“Household balance sheets are as in as good a shape as ever, with lower liabilities and higher asset values as a percent of disposable income. Two big reasons driving this are rising home prices and surging stock prices over the last 5 years. This likely says households are in very solid shape as we head into [the second half of 2025].”

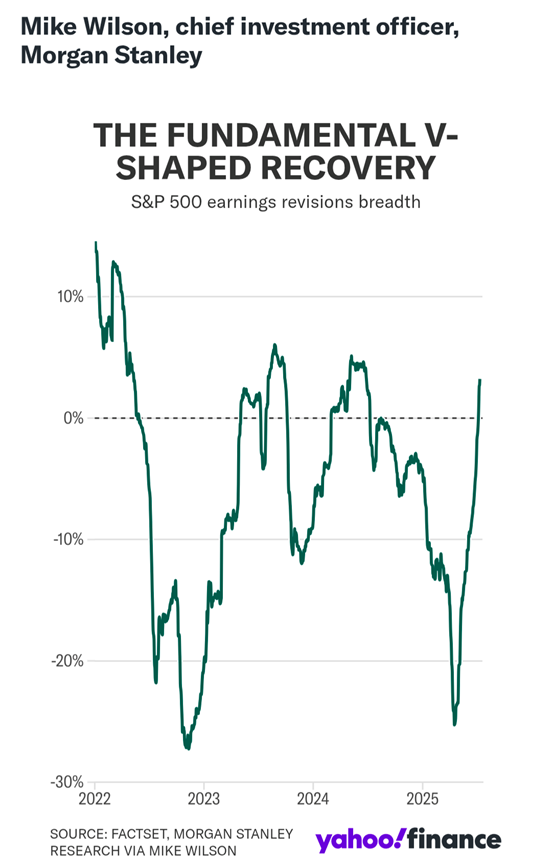

Next, Mike Wilson, CIO at Morgan Stanley, shows just how much earnings revisions have snapped back. You want to know why we are back to all-time highs? This is it.

“[This] chart shows the earnings revisions breadth for the S&P 500. It leads actual earnings estimates, and as you can see, we are currently experiencing one of the strongest V-shaped recoveries in history, rivaling the COVID rebound in 2020, the last time we were so out of consensus on the market. Many market participants do not appreciate how strong this very fundamental driver has been over the past several months, which helps to not only justify the rally to date, but also why we remain bullish on the next 6-12 months.” Mike Wilson, Chief Investment Officer, Morgan Stanley.

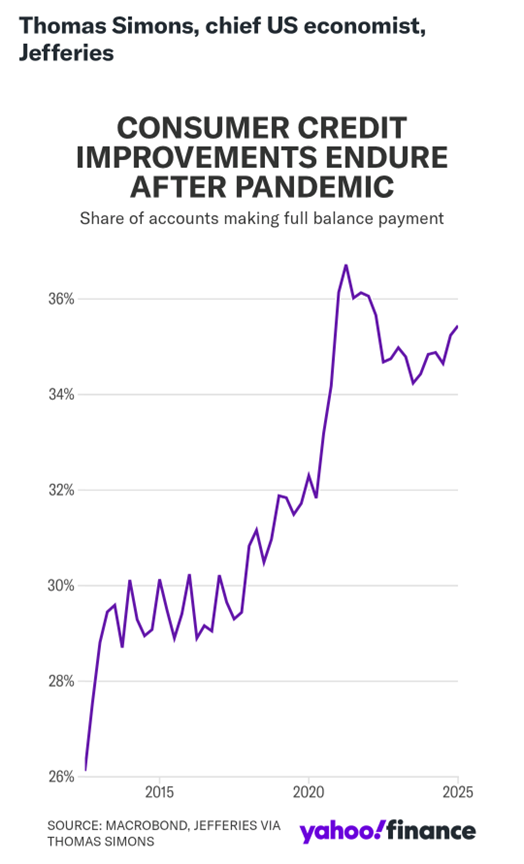

Next, Thomas Simons, Chief Economist at Simons, shows that most consumer credit might be better than we keep hearing.

“The Philly Fed’s survey on consumer credit conditions increased from 31.7% in Q4 2019 to almost 36.7% in mid-Q2 2021. Obviously, this is one of the consequences of the COVID stimulus checks and the forbearance on student loans, and it might be easy to dismiss the surge as temporary and insignificant in the long run. However, the share has since come down to about 35.4%, which [is] off the highs but still well above levels that we were used to before the pandemic. The same Philly Fed survey reports that there are 584 million open accounts, so the increase to 35.4% paying their full balance from 31.7% means that households have 21.6 million fewer open accounts accumulating interest charges. This is a key step on the way to being able to save money and accumulate wealth; a much more optimistic story than what we hear most of the time when it comes to consumer credit these days.” Thomas Simons, Chief US Economist, Jefferies.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

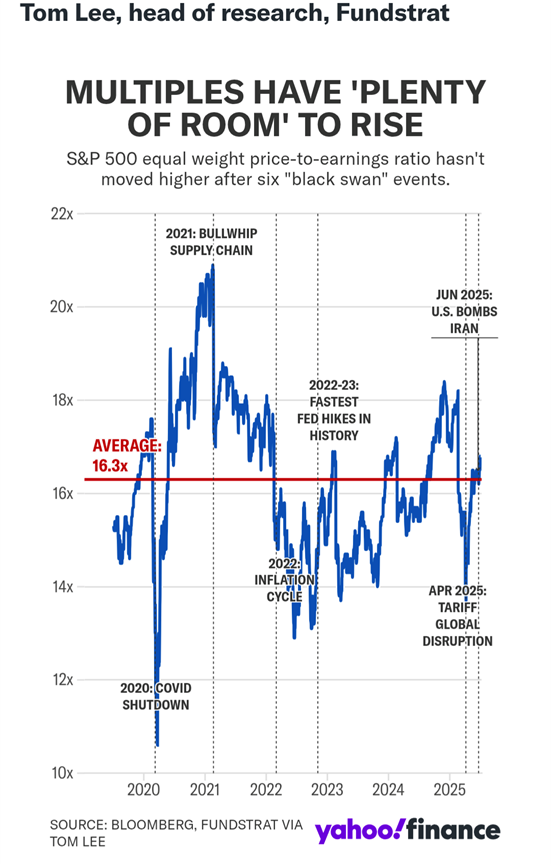

Our good friend Tom Lee, head of research at Fundstrat, shows that valuations aren’t stretched and have room to run.

“Over the past five years, the market has survived six black swan events. If this were a company that had survived six near-extinction events and continued to prosper, its stock would be assigned a higher multiple. However, the equal-weight S&P 500 P/E has actually declined from 17.6x (pre-COVID) to the current 16.9x. If the market is truly indestructible, there’s still plenty of room for multiples to rise.” Tom Lee, Head of Research, Fundstrat.

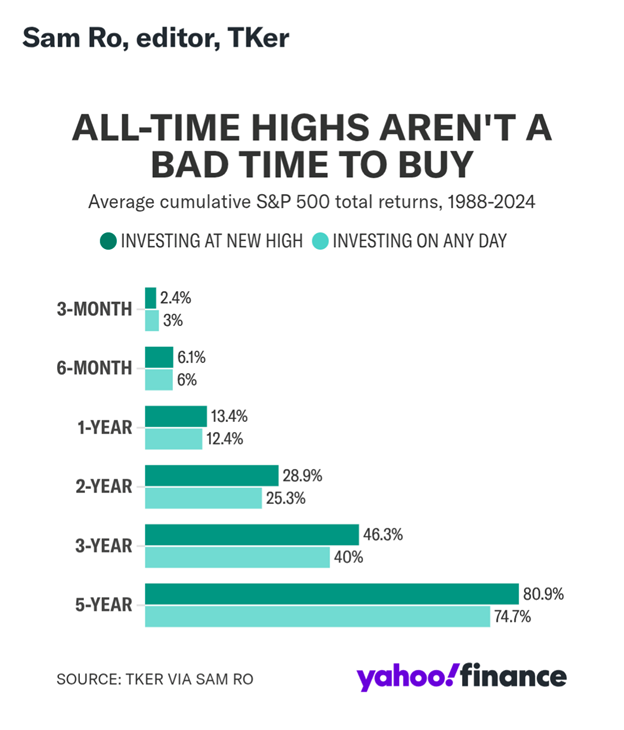

Sam Ro, founder and editor at TKer, reminds us that buying stocks at new highs isn’t a bad thing. Sam joined us on Facts vs Feelings recently, so you know we listen to what Sam has to say.

“Over 6-month, 1-year, 2-year, 3-year, and 5-year periods, the S&P 500 on average has generated positive returns. But as this data from JPMorgan Asset Management shows, investing specifically at all-time highs has actually generated higher average returns over these time horizons.” Sam Ro, Editor, Tker.

We hear a lot how there’s a ton of cash on the sidelines, but maybe that isn’t what it seems? Love this chart from Liz Ann Sonders, Chief Investment Strategist at Schwab, that shows a different angle here.

“A lot is made of the ‘cash on the sidelines’ story when observing assets in money market funds; however, as a share of total equity market value, it’s significantly more subdued.” Liz Ann Sonders, Chief Investment Strategist, Charles Schwab.

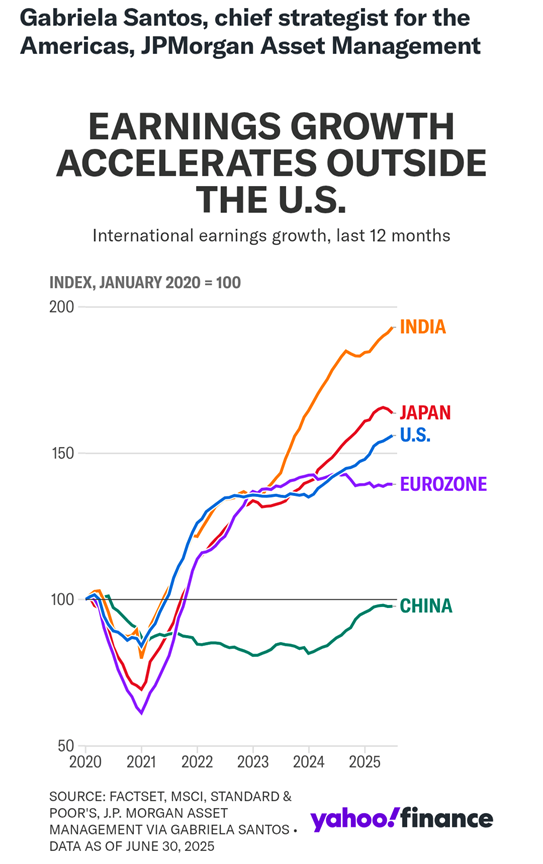

Lastly, Gabriela Santos, Chief Strategist for the Americas at JPMorgan Asset Management, shows us that earnings have been accelerating all over the globe.

“This chart shows how this year’s outperformance of 1,200bps by international stocks may have caught some investors by surprise — but it’s a long time coming and just the start. It’s a combination of ‘push and pull’: expensive U.S. valuations pushing investors to diversify and a pull from the rest of the world due to less earnings dispersion. Earnings in the Eurozone, Japan, and pockets of EM have been keeping up with or beating U.S. earnings this cycle, powered by the end of deflation and negative interest rates, a new focus on shareholder returns, and now further turbocharged by fiscal spending. It’s not about a global rotation due to the ‘end of U.S. exceptionalism’ altogether — it’s about a ‘normalization of U.S. exceptionalism’ from near record valuations and weights in portfolios.” Gabriela Santos, Chief Strategist for the Americas, JPMorgan Asset Management.

In conclusion, be sure to read the whole report when you have time, but thanks to Josh and the team for all the hard work that goes into something like this. Last month while in New York I dropped by the beautiful Yahoo Finance office to record a Stocks in Translation podcast with Allie Canal, Senior Reporter at Yahoo Finance, and Sydnee Freed, Senior Producer, Video podcast host at Yahoo Finance, and you can watch it all here.

The individuals mentioned herein are not affiliated with CWM, LLC. Opinions expressed by these individuals may not reflect that of CWM, LLC.

8265263.1.-08.08.25A

For more content by Ryan Detrick, Chief Market Strategist click here.