“To see what is in front of one’s nose is a constant struggle.” George Orwell

The bull market rolls on, as the S&P 500 has now made 24 new all-time highs and is up 12% for the year, a long way from down 15% back in early April after the Liberation Day meltdown.

The bull market is on track to turn three in a month, and it’s no secret we’ve been in the bullish camp for many years now. But what about looking forward? In today’s blog, I’ll look at some of the clues that I believe strongly suggest that the bull market may have plenty of time left.

Age Is Just a Number

We didn’t know it at the time, but a vicious nine-month 25% bear market ended on October 12, 2022. Nearly three years later stocks are up close to 85%, but the big question is how much time is left? Of course, no one really knows, but we would side with this bull market lasting a lot longer than many out there expect.

Here’s a famous photo of John Cena and Jason Earles, who played the brother in Hannah Montana. The picture was taken back in 2009 when Cena joined the show. What makes this picture so famous is both were 31 years old! Which brings up the question, is this bull market younger than we think like the brother to Hanna or it is older like John Cena?

Happy Birthday

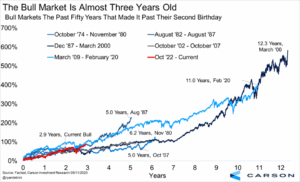

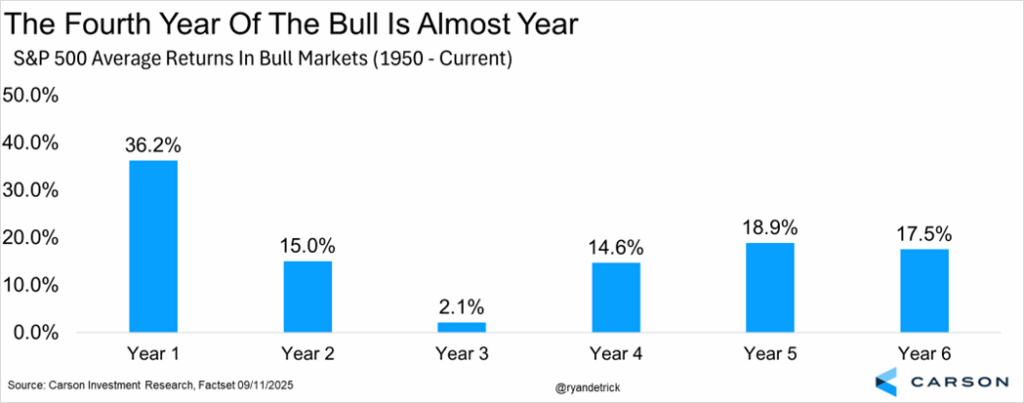

Here’s a chart we’ve shared many times the past few years, but we wanted to share it again. At the start of this year we noted why the third year of bull markets tended to be choppy and frustrating, which is why we were on record to expect some volatility at some point during the first half of the year. Well, we saw that and then some with the near bear market in April, but history says once you can get past that choppy third year, things tend to get better.

I’ve said many times that bull markets are like cruise ships—once they get moving they are very hard to stop, and very hard to turn around. Well, bull markets are similar. We found five other bull markets that made it past their second birthday going back 50 years and the average one made it eight years, with the shortest an impressive five years. The good news is the returns in year four tend to be quite impressive as well, something to look forward to if you are bullish. Or to paraphrase what Orwell said, we are in a bull market and it is right in front of our noses, but that can be hard to see sometimes.

New Highs Aren’t Everywhere Yet

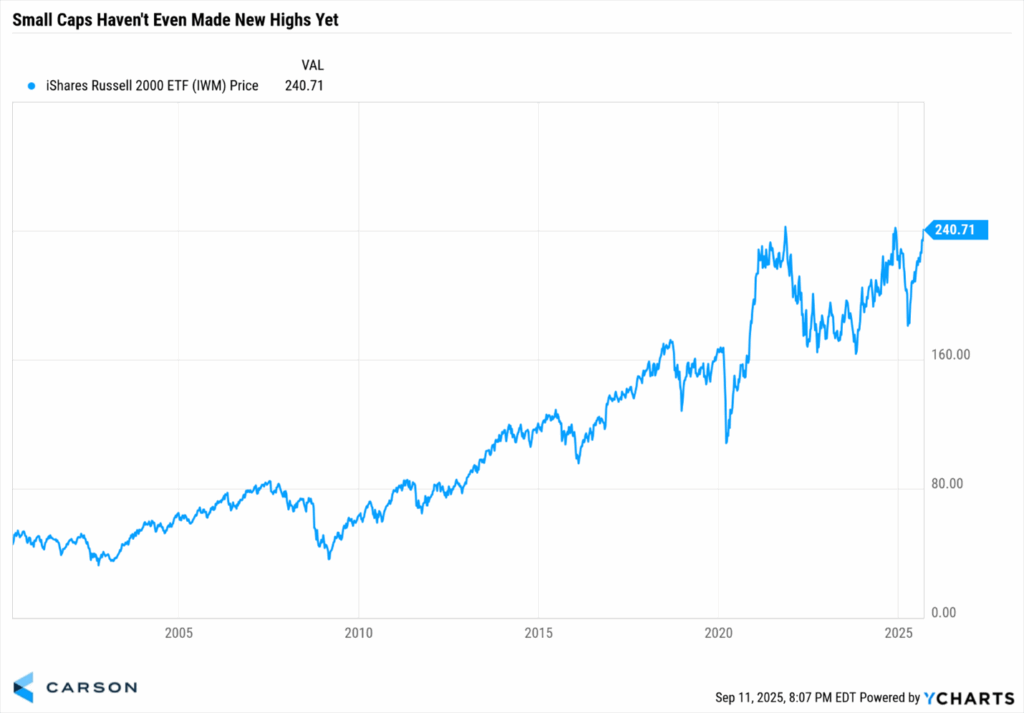

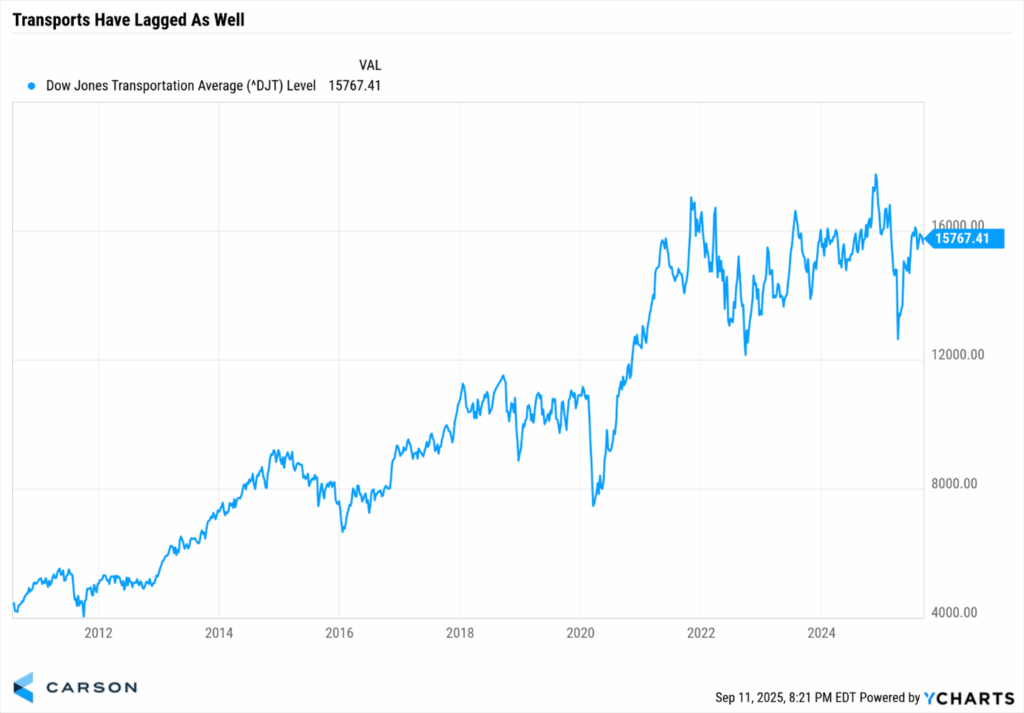

Yes, large cap US stocks have done very well, thanks to technology stocks leading the way. But peeling back the onion shows that many other markets still haven’t even made a new all-time high yet. We’ve long said that most areas of the market would need to hit a new high before this bull market likely ends, which means potential for more gains if the number of markets hitting new highs does actually broaden out.

Small caps haven’t made a new high since November 2021 for example , while transports have lagged as well. Although we still like large caps over small caps, there is nothing wrong with more new highs across the board as small caps and transports join the party. Looking at the two charts below you have to ask yourself, if we are in fact in a true bull market, wouldn’t these areas still have plenty of runway to move higher?

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

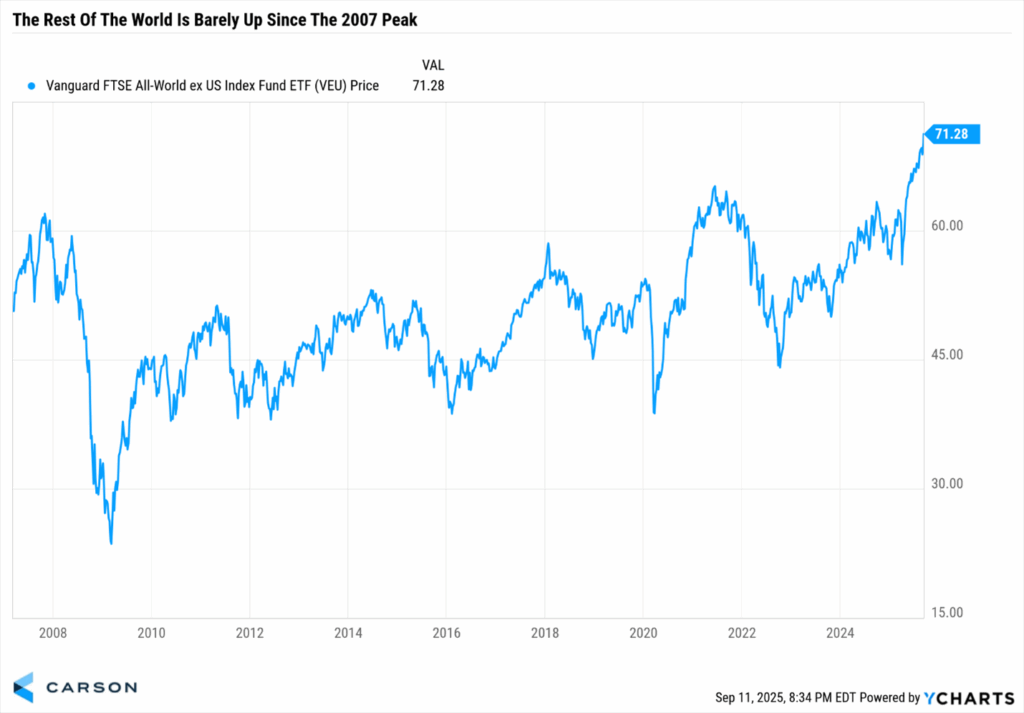

The US has had an incredible run, but looking around the globe gives a picture that this global bull market could only just be starting. Yes, we like the US a lot still, but we’ve moved more into Developed International in the models we run for our Carson Partners, as having a more diversified global portfolio this stage of the cycle makes a lot of sense.

Here’s the FTSE All-World ex US Index Fund and it shows the rest of the world isn’t up all that much since the peak in 2007. Many global markets are just this year breaking out above their 2007 levels, suggesting this global bull market could just be getting started.

Thanks for reading and for an awesome discussion about the economy, this bull market, and more, be sure to check out the latest Facts vs Feelings. Sure, I’m biased, but we did this one live from Excell and had two amazing guests. Enjoy!

For more content by Ryan Detrick, Chief Market Strategist click here

8387861.1.-12SEPT2025A