Why Private Credit Is Misjudged in Public Markets

By Kevin Bruce, CFA®, CFP, Analyst, Alternative Due Diligence

Recent headlines have reignited a familiar critique. When private credit vehicles enter public markets, they often trade at persistent discounts. For some observers, this raises uncomfortable questions about private asset valuation itself, how real it ever was, how accurate it may be, and whether private markets merely obscure risks that public markets expose.

Some critics go further, portraying private assets as financial cockroaches, thriving only in the dark and devalued once the lights turn on. That framing may be emotionally satisfying.

It also appears to be structurally wrong. The issue is not that private credit loses value when it goes public. The issue is that it is being evaluated by the wrong market.

McLarens and Minivans

Both a McLaren and a minivan are automobiles. Both provide transportation. Both have value. But what they are designed to do, and what they are optimized for, differs dramatically.

A McLaren is built for speed, agility, and performance in environments where immediacy, visibility, and optionality matter. A minivan is built for reliability, capacity, and predictability, supporting daily transportation, family logistics, and long-distance travel with minimal surprises.

If a minivan were evaluated using racecar criteria such as speed, handling, and lap times, it would fail immediately. That would not make it a poor vehicle. It would simply mean it was being judged by standards it was never designed to meet.

The reverse is also true. A race car evaluated by minivan criteria such as seating capacity, durability, and daily usability would fail just as decisively. Neither vehicle is broken.

Each fails only when evaluated using the wrong criteria.

Private Credit Is Debt and Should Be Valued as Such

Economically, private credit valuation belongs in the bond market, not the equity market. Private credit is not an ambiguous asset class. It is overwhelmingly composed of loans. These are contractual instruments with stated interest payments, defined maturities, and underwriting focused on downside protection rather than upside optionality.

Bond markets evaluate assets primarily on the borrower’s ability to pay, including cash flow coverage, credit quality, interest rate sensitivity, and probability of repayment. Equity markets, by contrast, evaluate assets based on growth potential, volatility, liquidity, and what another investor might pay in the future.

Neither framework is superior, in my opinion. Each is appropriate only for the instruments it was designed to evaluate.

Just as evaluating a minivan by race car standards produces a misleading result, valuing an investment using the wrong market framework can lead to equally flawed conclusions.

Evidence From Public Markets

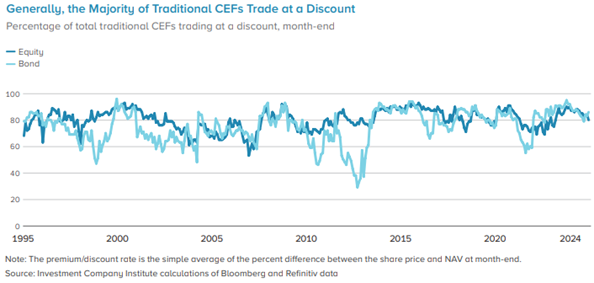

This dynamic is not unique to private credit. Across public markets, bond-like instruments that trade on equity exchanges, such as closed end bond funds, loan funds, and other income-oriented vehicles, frequently trade at persistent discounts to their underlying value.

These discounts often persist even when the underlying bonds continue to perform, cash flows remain stable, and credit losses are limited. The common thread is not asset quality, but market structure. When fixed income instruments are priced in equity markets, valuation reflects liquidity preferences, volatility, and sentiment rather than yield, duration, and ability to pay.

The discount is therefore a feature of the pricing venue, not a verdict on the credit itself.

Source: ICI Research Perspective

Mispricing and Failure Exist in Every Market

All markets, public and private, debt and equity, can contain assets that are mispriced and investments that fail to perform. Bonds default. Stocks collapse. Both private and public investments can disappoint.

Asset pricing is inherently probabilistic, as it relies on expectations about future events that no market participant can know with certainty. The existence of mispricing or underperformance does not invalidate an asset class. It reflects the reality that capital markets price risk under uncertainty, not with perfect foresight.

Private credit is no exception. Some loans may fail. Some underwriting may miss. But isolated failures do not define the economics of the entire asset class any more than bankrupt equities define public stocks or defaulted bonds define fixed income.

Utility, Not Market Price, in Portfolio Context

Ultimately, in portfolio construction, the relevant question is not an investment’s daily market price but its utility within the broader allocation.

In economics, a utility function describes how an investor ranks outcomes based on preferences such as risk tolerance, time horizon, liquidity needs, and income requirements. In my opinion, assets are most appropriately evaluated by how effectively they contribute to portfolio objectives over time, not by how they trade on any given day.

Private credit exists to deliver predictable contractual cash flow over time with controlled risk. Its value lies in what it does within a total portfolio, not in how it fluctuates in secondary markets.

When private credit is judged primarily by equity market dynamics such as price volatility, sentiment, or relative trading value, its utility is obscured. The asset has not failed. The measurement framework has.

Conclusion

I don’t think private credit is broken. Its economics do not deteriorate simply because it is viewed through public market lenses. What breaks is the narrative when contractual, bond like assets are judged using equity market criteria. McLarens belong on the track.

Minivans belong on the road. And private credit belongs in a bond framework, even when it is public.

8758099.1. – 5FEB2026A