By Michael Barczak, CFA®, VP, Investment Due Diligence

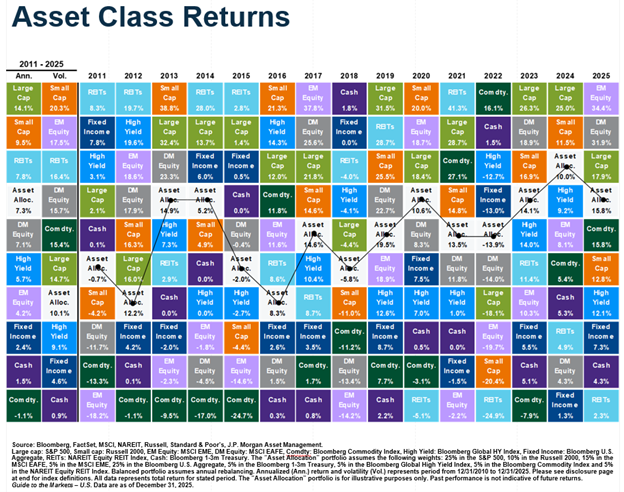

2025 was another extremely strong year for investors with markets posting above-average returns for US equities, international equities, and fixed income. As I look back on the year, three main trends really shine through for me.

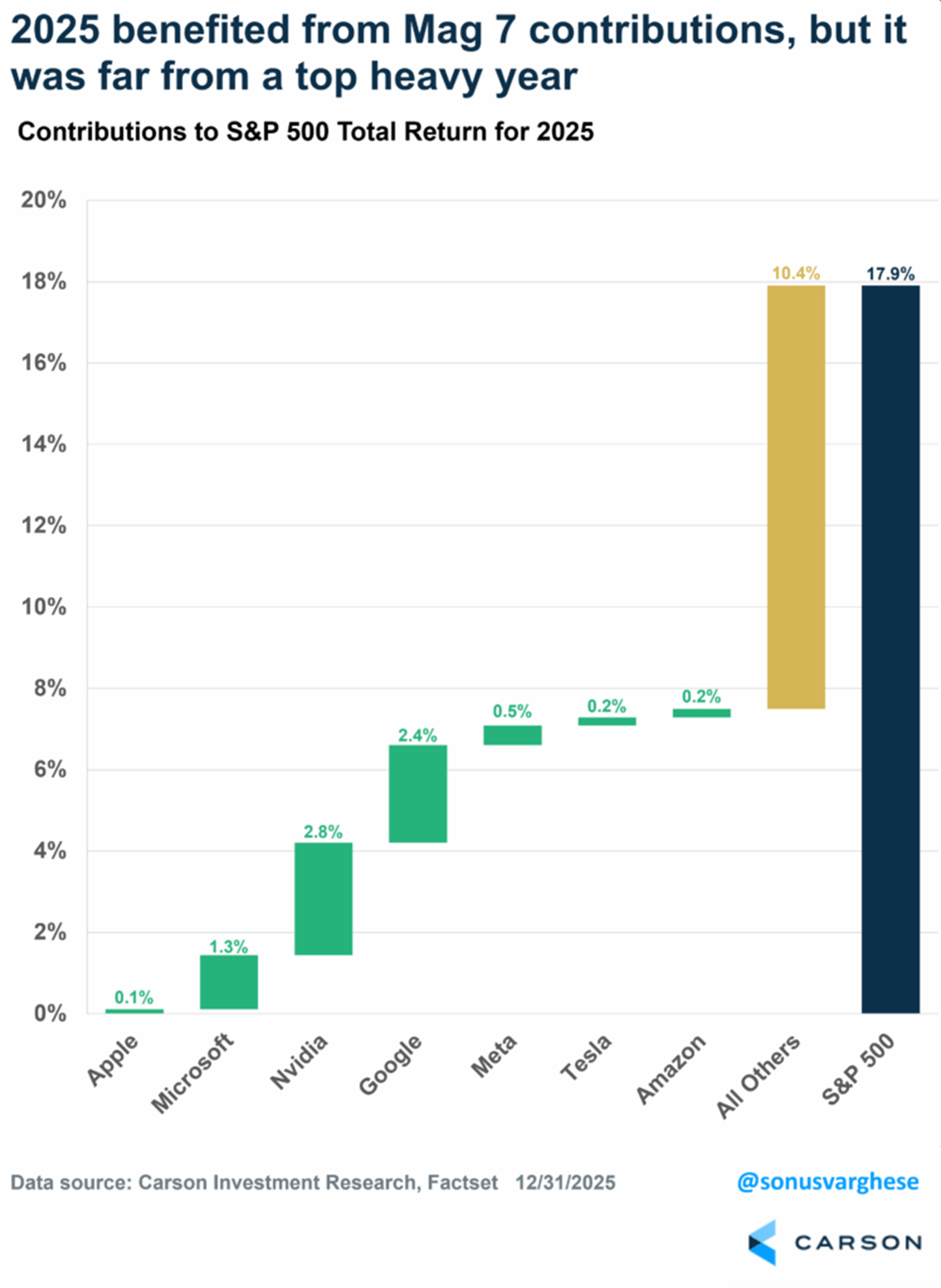

First, is that this was the year of the broadening. The “S&P 493” outperformed the Magnificent 7 for the first time since 2022 as the AI-centered tech rally cooled slightly and other sectors and industries with value-oriented styles began to heat up. While large caps continued to rule the roost, small caps began to narrow the gap on the back of lower interest rates, boosting Main Street. Small caps outperformed mid caps for the year, which have been caught in no-man’s land performance-wise. International also performed very well, with both developed and emerging markets outperforming their US counterparts. International benchmarks are more heavily allocated to, and derive more of their performance from, capital-intensive value-oriented sectors and industries, so they benefited from the same market broadening in addition to the US dollar weakening throughout the year.

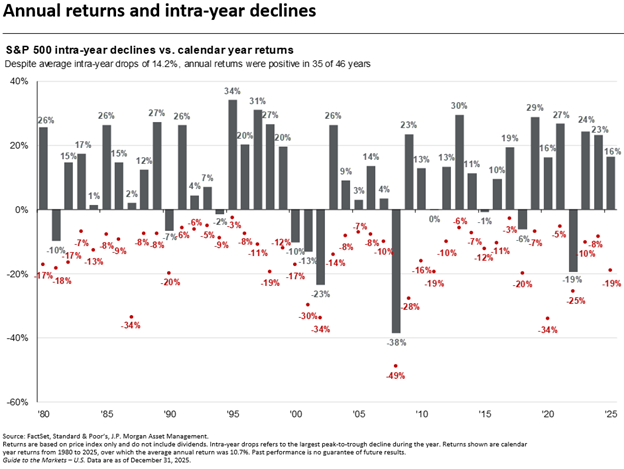

Second, this was the year of the headline. In no particular order, we have seen the Fed, inflation, tariffs, a government shutdown, precious metals, geo-political crises, a K-shaped economy, and a potential AI bubble dominate the news cycle at one time or another. The constant barrage of headline risks throughout the year created an environment with significant volatility on an hourly, daily, and weekly basis.

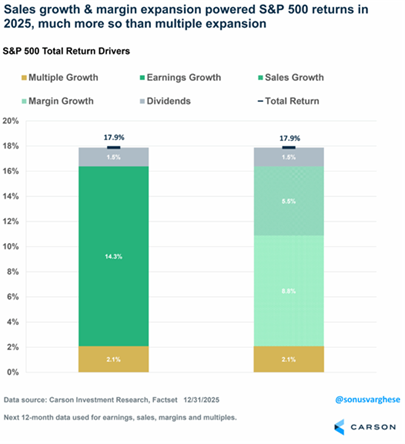

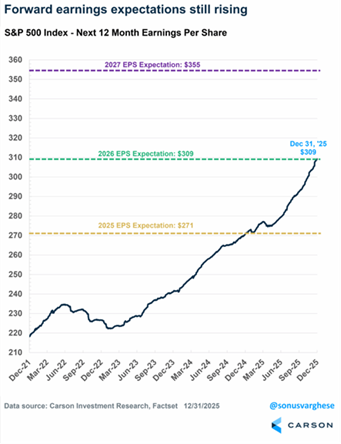

Finally, this was the year of the little engine that could. Beneath the volatility, there has been a consistent engine humming at the core of the economy: corporate earnings. Earnings growth made up the majority of market returns this year, and earnings are projected to continue to grow going forward. There are three main components of stock market returns:

1) corporate earnings, which is the end product of how well a company executes as a going concern

2) dividends, from a surplus in cash flows

3) multiple expansion, the expression of supply and demand dynamics in the market based on the price investors are willing to pay for a unit of corporate earnings

Our team believes that returns driven by earnings growth (rather than multiple expansion) are more sustainable in the long run, and history bears this out. Over time, stock gains are fundamentally driven by corporate earnings, which makes sense since stocks represent partial ownership of a company.

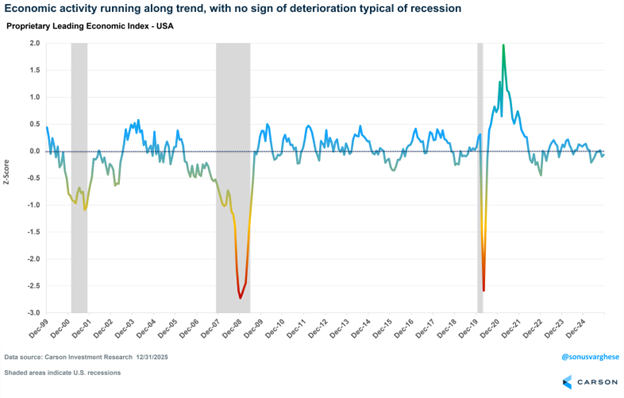

Carson’s proprietary Leading Economic Index (LEI) suggests that economic momentum remains near the long-term trend line (represented by 0 in the chart above), with no strong signs of expansion or contraction. The LEI has rebounded slightly from post-Liberation Day readings, which were below the trend line. The current landscape feels much like mid-2022, when recession fears were elevated but the economy avoided contraction. While the full impact of tariffs remains to be seen in the data, there is optimism that the economy can grow in 2026. Getting less uncertainty about tariffs, continued rate cuts from the Fed, and tax cuts for consumers retroactive to 2025 going into effect all look to be potential tailwinds for the economy.

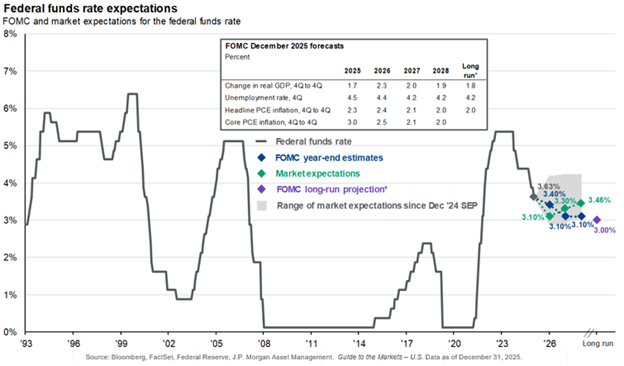

The Fed cut rates by 0.25% three times in 2025 in response to weakening labor-market data. This led to a significant steepening of the curve, with short-term rates coming down almost in lockstep with the Fed, while longer-term rates remained elevated. Longer rates remained stickier as markets continued to have concerns about the impact of tariffs on inflation. The FOMC’s long-run policy rate projection remains at 3.00%, with markets pricing in even higher rates than the FOMC’s projections well into the future (driven by inflationary and policy concerns from 2028 onward). Markets are currently pricing in another 2-3 rate cuts in 2026, although there is a much wider dispersion in potential outcomes. The Fed did shift its focus from inflation to the labor market in the second half of 2025 (which led to the beginning of rate cuts for the year), but that attention could swing back to inflation if readings become hot. Add in a healthy dose of geopolitical risk and the upcoming conclusion of Jerome Powell’s term as Fed chair, and there seem to be plenty of ingredients for volatility rising to the top of the market.

In summary, U.S. stocks delivered strong returns for 2025 yet again on the back of strong corporate earnings. US Large Caps continues to rule the roost, but 2025 saw markets start to broaden away from the predominantly Mag-7 driven markets of 2023 and 2024. The “S&P 493” outperformed the Mag-7 for the year (only 2 individual Mag-7 stocks, NVIDIA and Google, outperformed the S&P 500 on their own), leading to some healthy rotation in market leadership. Small-cap stocks even got in on the party, outperforming mid-caps, as rate cut expectations paint a rosier picture of freed up capital for Main Street.

International equities also posted excellent returns, with both developed and emerging markets outpacing the US. Global trade tensions continue to weigh on international markets, but a weakening US dollar helped buoy returns abroad for much of the year. International markets also tend to allocate more to, and be led by, value-oriented sectors from a performance perspective. This contrasts with a heavily concentrated US market towards tech and growth, leading to a more diversified return stream. As market leadership broadened worldwide, international equities benefited more from that trend.

Fixed income markets produced more modest but still positive returns for the year, with the yield curve steepening noticeably due to anticipated (and then realized) rate cuts depressing short-term rates, while inflation uncertainty kept the long end of the curve elevated. Performance was supported by declining yields, tightening spreads, and a favorable income environment. With higher starting yields than in recent years, fixed income continued to serve as both a stabilizer against equity volatility and a source of attractive income for investors. The bond market continues to be the truth serum of the economy at the crossroads between geopolitical risk, economic risk, fiscal policy, and monetary policy.

8728213.1. – 22JAN26A