“Profitability is not an afterthought. It’s the foundation of our business.” – Jeff Bezos

Despite slowing sales growth, our on-going optimism about equities continues to be driven by fundamentals. We believe that improving profitability may continue to support earnings growth for some time to come as structural changes continue to drive efficiencies.

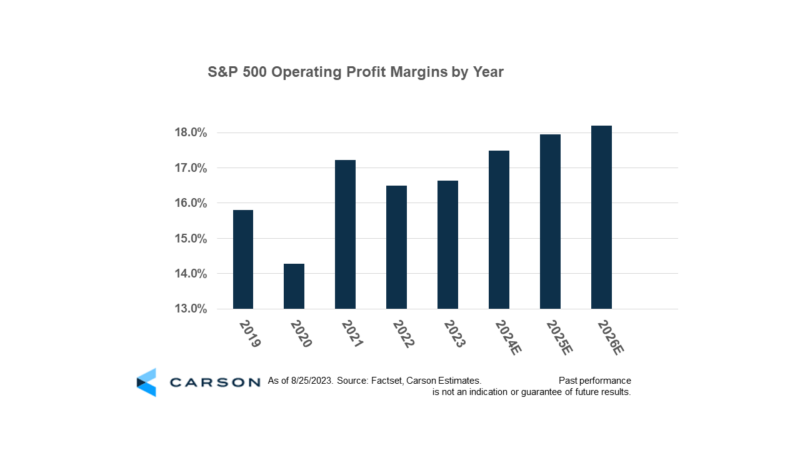

Profitability stands as a bedrock principle of corporate finance, as underscored by the words of Jeff Bezos. Corporate profit margins are expanding despite a seemingly endless sequence of headwinds. Many businesses have managed to pass on elevated costs, and then some, pushing 2021 margins to the highest level in decades. That year, characterized by insatiable demand, robust pricing, and a still-emerging inflationary backdrop, seemed an anomaly unto itself. In the extremely strong demand environment, businesses found themselves in the sweet spot where a combination of growing volumes and raising prices led to double-digit sales growth over the past few years. As companies struggled to meet unprecedented demand amidst a myriad of external pressures, margins have retreated modestly in 2022 but remained above pre-pandemic levels.

Growth slowed recently as many businesses realized they had pushed prices to the limits, resulting in sluggish demand. Sales growth is expected to land somewhere between 2-3% for the year. Potentially muted sales growth has investors focusing on profitability as the key to earnings growth. With supply chain disruptions and inflationary pressures gradually receding, investors are curious to know if these tailwinds will continue propelling profitability higher over the next few years. Analysts expect the S&P 500 profit margin to steadily rise as businesses are able to prune expenses and benefit from lower input costs. This ought to have a positive impact on earnings, and thus drive equities higher over coming years. With margins poised to eclipse recent highs, levels once deemed an anomaly are looking increasingly like the result of structural economic forces.

A significant catalyst behind this margin expansion trend is the phenomenon of mix shift – the change in the composition of the index, with a growing tilt towards more lucrative sectors such as Information technology. The technology sector now commands over a quarter of the S&P 500, which is a notable contrast to the mere 11% it held only a decade ago. This is even after names like Alphabet (Google) and Meta (Facebook) were relegated to the Communication Services sector in 2018. A retrospective glance to the turn of the century reveals that the index was dominated by the likes of General Electric, Exxon Mobil, Pfizer, and Citi Bank. Today, mega tech behemoths such as Apple, Microsoft, Amazon, and Alphabet loom large. These companies not only enjoy higher margins but are also much less cyclical.

While there are proponents of mean reversion who anticipate margins returning to historical norms, such a viewpoint seems dated and might no longer align with the evolving landscape. Certainly there will be fluctuations, but the profitability outlook for these giant tech-oriented firms remains fairly sunny. Following substantial investments in cloud computing and data centers, Amazon, Microsoft, and Google are expected to witness meaningful increases in profitability over coming years. Furthermore, the advent of artificial intelligence may usher in unprecedented efficiency gains, potentially rendering these companies increasingly profitable over time and thereby exerting a multi-year upward pressure on overall corporate margins.

However, this isn’t just a big tech story; there is an undercurrent of optimism that other sectors are poised to join the profit party. Notably, the industrial and consumer goods sectors emerge as big beneficiaries of improving supply chains and abating labor shortages. Though growth has moderated from the unsustainable heights observed while the world was reopening, it’s not necessarily a bad thing. Rather, in a normalized growth environment, businesses are able to better plan and operate more efficiently.

Better sales growth in 2024 and improved profitability may support further stock gains looking forward. Analysts expect S&P 500 sales will grow at approximately 5% in 2024, a healthy but manageable growth rate. As margins continue their expansion, earnings are set to gain momentum. With the growth and profitability algorithms realigning, it paints a favorable outlook for equities over the next few years.

1900496-0923-A