“I am an optimist. It does not seem too much use being anything else.” -Winston Churchill

Did you know one of the worst bear markets in history ended 15 years ago this past Saturday? If you were there then you no doubt remember it. Bank stocks were outright collapsing, with many down 90%. The global economy was in shambles, and people were losing their jobs all around. Retirement funds had been demolished and there was very little hope.

What do I remember about the Great Financial Crisis (GFC)? I worked at a very small research shop at the time and every Friday they’d bring a couple people into a room to let them go. Eventually they mixed it up and let people go on other days, which was nice, since it got to the point you were sick to your stomach by the time Friday rolled around, as it could be your day.

But like all bad things, it eventually came to an end. The S&P 500 fell 57% from its October 2007 peak before bottoming on March 9, 2009, ending the GFC bear market. Between the tech bubble bear market earlier in the decade and the GFC, the 2000s went down as one of the worst decades for stock investors ever. Even worse than the 1930s!

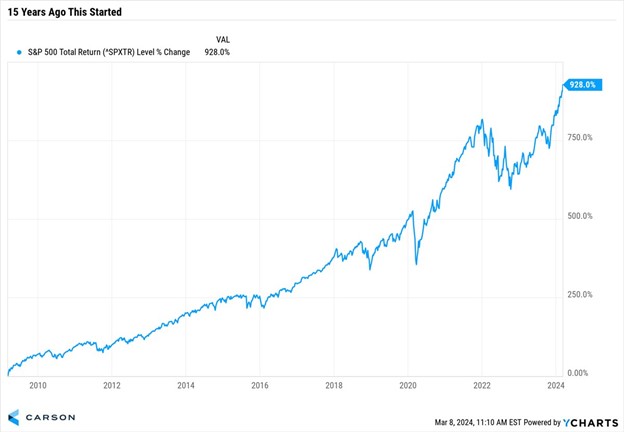

Benjamin Franklin once said, “There are no gains without pains.” In part due to that lost decade of the 2000s, we’ve been in the midst of incredible gains ever since. In fact, the S&P 500 is up more than 900% on a total return basis the past 15 years.

But let’s never forget, it wasn’t a straight line higher. We had many scares along the way. Near bear markets in 2011 and 2018, a 100-year pandemic accompanied by a 34% bear market in 2020 and then another 25% bear market in 2022 made it anything but an easy 15 years. Yet, in the midst of all of it, longer-term investors were once again rewarded for sticking to their long-term investment plans. They say the stock market is the only place where when things go on sale, people run out of the store screaming. Well, we saw a lot of screaming the past 15 years.

Here’s a TIME magazine cover that best summed up that time. Notice the date is March 9, 2009, the exact day of the low!

You don’t ever want to blindly invest based on magazine covers, but we do use magazine covers as potential contrarian indicators to get a good feel for what is priced in. Once something makes it to a magazine cover, chances are good markets have already taken it into account. TIME isn’t a financial publication, so when they have a very bearish or bullish cover, take note.

Seven months after the GFC bear ended, stocks were up nicely off the bottom and TIME came out with this all-time contrarian cover. They suggested it was time to retire the 401k, as who could possibly ever want to invest in stocks for their retirement again? At the time I saw this cover and said it was wildly bullish, as the cover captured the sentiment of so many people. That sentiment persisted for many years, as the memory of the GFC continued to haunt many investors.

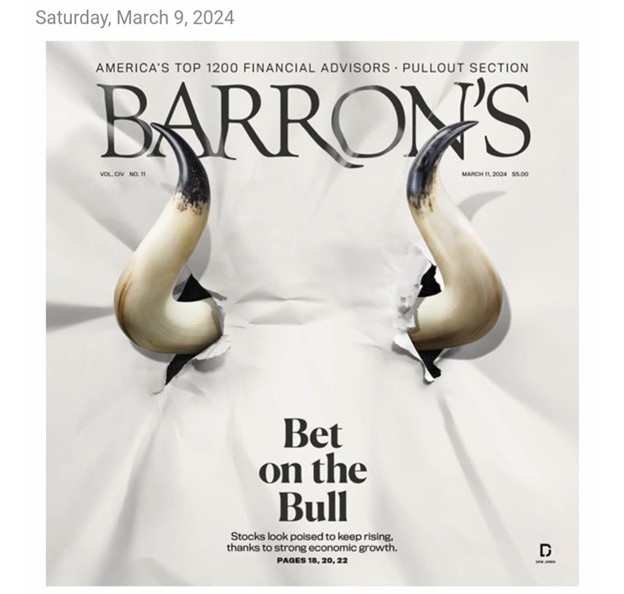

Which brings us to the latest cover in the financial publication Barron’s.

Quite the difference in sentiment, huh? Maybe a 900% total return rally will do that, but this cover caused a huge ruckus on social media with many claiming the bull is now over. First off, if you want to get specific, Barron’s didn’t put a bull on the cover, as it is only the horns. At the same time, Barron’s is a weekly financial magazine, so they have more opportunities to use bulls (and bears) on their covers. My take on Barron’s is they’ve made many good calls, so to me, this by itself isn’t some big contrarian warning.

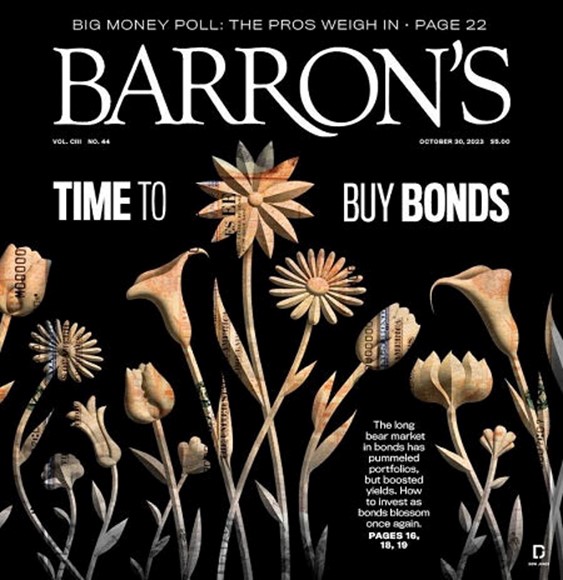

In late October for instance, they said to buy bonds, which was right in front of one of the greatest two-month rallies bonds have ever seen. You didn’t want to fade that one.

I did a quick Google search and found numerous covers with a bull on it in Barron’s the past decade. Here’s one of my favorites. After going nowhere for 13 years, stocks were just starting to break out to new highs and Barron’s was leading the charge in May 2013.

Speaking of May 2013, here’s a much younger version of myself that very same month, explaining to Maria Bartiromo and the quite bearish other guest, why we were going higher. The pushback I got for being a bull back then was never ending.

You have to remember, after the GFC people didn’t trust the stock market and for many years, and it was widely expected that a new bear was always right around the corner. I made a name for myself in 2009, 2010, 2011, 2012, and especially in 2013, as I was bullish when very few were. I’d go on CNBC all the time and the producer would ask if I was still bullish. When I answered yes, they’d always reply with something like, “Good, because I have a bear, but can’t find another bull to come on TV.” That was a signal to me all by itself that the rally had plenty of room to run.

In March 2024 there’s no question being bullish isn’t so lonely anymore. I’m seeing many of the more vocal bears from last year turn into bulls now (and they are doing their best to change the narrative on just how wildly wrong they were last year). No question this is a bit of a near-term warning. Various sentiment polls are flashing extreme optimism and put/call ratios are in the complacency range as well. None of this is end-of-the-world stuff, but it does say the bar is set quite high and any disappointment could lead to a well-deserved pause or break.

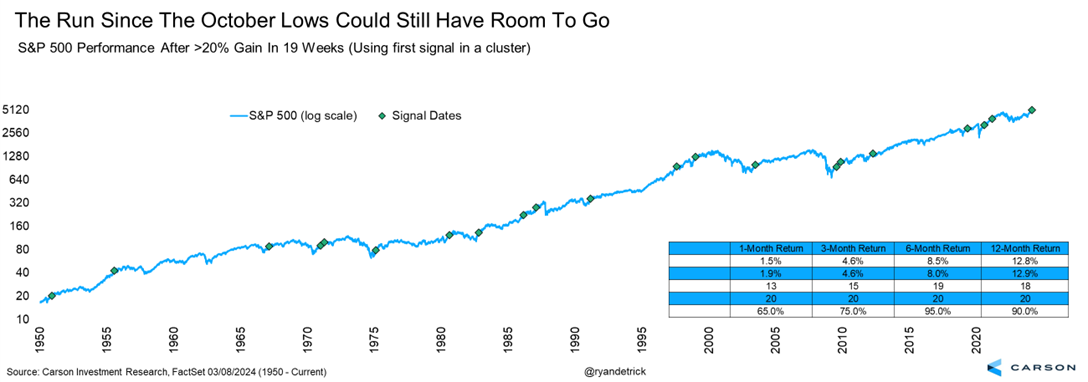

Let’s remember, the S&P 500 is up 16 of the past 19 weeks and up close to 25% since late October. 25% is a great year, let alone only 19 weeks! I found 20 other times the index gained at least 20% in 19 weeks and 6 months later the S&P 500 was higher 19 times and a year later 18 times. Even if we see near-term weakness, the overall bull market is likely alive and well.

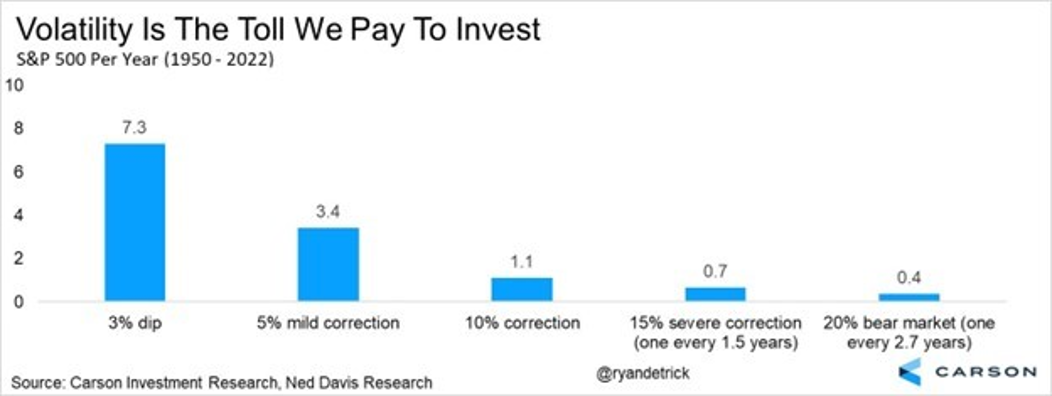

Let’s wrap it up with one of our favorite charts. As good as things have been lately, this won’t continue. Even the best years tend to see multiple scary moments. Stocks gained 25% last year, yet a year ago this month we saw a regional bank crisis that caused many legit worries. We also had a standard 10% correction in late October which caused incredible amounts of fear. Volatility is the toll we pay for stock’s upside, and we haven’t had to pay that toll for a while now. Just have this in mind when the inevitable pullback comes. Volatility is normal, and even sometimes desirable, in a healthy market.

For more content by Ryan Detrick, Chief Market Strategist click here.

02152902-0324-A