Semiconductors have been one of the best performing groups of stocks in the past 6 months. The group’s fearless leader, Nvidia, continues to lead from the front, but a smaller corner of the semiconductor industry – memory providers – have shone even brighter. While recent price action in the stocks of memory providers has been powered by fundamentally encouraging deal announcements, this sort of relative price action does offer a hint of caution.

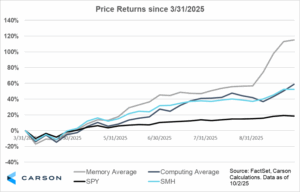

Semiconductors helped power ‘A Quarter for the History Books’ as my colleague, Ryan Detrick, Chief Market Strategist, coined. The group has been a market leader for much of the year. Over the past six months, SPY (the iShares S&P 500 ETF) returned 19.1% while SMH (the VanEck Semiconductor ETF) returned +54.3% over the same time period (FactSet data, from 3/31/2025 to 9/30/2025).

Within the industry, discerning investors can choose from subindustries such as ‘Computing’ semis (which often have more predictable demand patterns, though can vary wildly) and ‘Memory’ semis (which are more commodity-like and have gone through booms and busts). As shown in the chart below, ‘Computing’ stocks (which include NVDA, AMD and INTC for these purposes), have largely performed in line with the broader SMH. However, ‘Memory’ stocks (which include MU, WDC, STX, Samsung and SK Hynix [the latter two of which do not trade on American exchanges]) have roared higher as of late. ‘Computing’ stocks on average returned 59% over the past six months (ending 9/30/2025), while ‘Memory’ stocks on average returned an astounding 115% (FactSet data).

Note: These averages are constructed to include MU, WDC, STX, 000660-KR, and 005930-KR in ‘Memory’ and NVDA, AMD, and INTC in ‘Computing’

To be sure, the outsized return in ‘Memory’ stocks appears to be powered, at least in part, by a flurry of large deal announcements that may power future earnings to be higher than previously expected. Two in specific stand out to me:

- This past week saw OpenAI sign a Letter of Intent1 with SK Hynix and Samsung to strengthen their relationship with these key suppliers.

- Micron’s recent earnings report included commentary that the company “expects to lock in deals to sell out all of its chips for calendar 2026 in the coming months.”2

Both headlines may lead active investors to believe that the future earnings power of these companies will be higher than previously expected, at least in the short term.

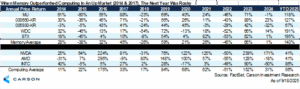

While it’s been a strong run in ‘Memory’ stocks, there may be a sign of caution produced by this type of relative performance. In ‘traditional’ semiconductor cycles (if those even exist!), memory stocks are typically the last stocks to join a rally and may signal ‘late stage behavior.’ As shown in the table below, there have been three years in the past decade where semiconductor stocks struggle: 2015, 2018, and 2022.

The weakness in semiconductors (and the broader market) in 2015 and 2018 were both preceded by ‘Memory’ providers seeing a higher return than ‘Computing’ providers, though 2022 sticks out as the anomaly to this pattern. 2025’s returns may be ominous should history rhyme – year to date returns show ‘Memory’ vastly outperforming ‘Computing’ and could signal the technology trade is in the later innings. Past performance is not indicative of future results, however, and investors may be well served to ask if this year’s returns are reflective of a shift in technological trends that render historical analogs ineffective.

Broader markets capped off a record quarter, and semiconductors were one of the stronger performers in this recent market run. The stocks of Memory companies, vital to AI data centers, have come alive in recent months and have vastly outperformed the broader semiconductor industry. However, historical analogs tell us that price action like this may invite some caution in the future, though only time will tell if this surge in semiconductors is here to last.

- https://www.cnbc.com/2025/10/02/sk-hynix-samsung-shares-openai-stargate-korea.html

- https://www.reuters.com/technology/micron-forecasts-first-quarter-revenue-above-estimates-2025-09-23/

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.