Through generations of boom and bust in investing—granted all boom for those who think long term—there are terms and phrases that elicit positive and negative emotions. Perhaps the most famous and most widely cited is “this time is different” invoked during nearly every financial bubble or subsequent crisis. Don’t worry—I am not going to utter that phrase today. Instead, I want to discuss a couple of other concepts that do not always have the best reputation, but when used and managed correctly can be beneficial to portfolios.

Shorting

Inverse strategies such as shorting—or selling short—allow investors to attempt to profit when an asset (a stock, futures contract, etc.) declines in value, rather than by “going long” and benefiting from gains. For stocks, the process is nuanced. To short a stock, an investor must sell it—even without owning it first. Conceptually, this makes sense: if you buy a stock, you want it to go up; if you sell, you prefer it to go down (even if just for FOMO’s sake).

In practice, short selling requires borrowing shares from someone who owns them, usually arranged behind the scenes by your custodian, broker, or investment vehicle. The custodian locates shares from a securities lending program, loans them to the short seller, and receives compensation for the loan plus any dividends the stock pays. The short seller sells the borrowed shares, with the goal of buying them back later (“covering”) at a lower price.

On a standalone basis, this concept can be very scary. As we know, stocks tend to go up over time, and some can trade higher by a lot in a short period. When you go long a stock, you can only lose as much as you have invested, but when you sell a stock short, it can theoretically go up forever. This concept of ‘unlimited loss potential’ is real, though margin requirements trigger calls before losses become too large.

Although few professionals succeed with shorting as a standalone strategy, shorting can play a valuable role in hedged portfolios. Cash from selling borrowed shares can be used to buy long positions. When managed correctly, this creates a “market-neutral” portfolio, where gains in long positions offset losses in shorts (and vice versa). As long as long positions outperform shorts, the portfolio profits—often with less dependence on market direction. This concept has been done in many alternative and institutional strategies for a long time , including as a theoretical research tool in the work that Fama and French did decades ago on long-short factor portfolios. This can also be added on top of an existing invested portfolio to add an alternative source of alpha.

Leverage

Leverage is cited as a cause of financial issues perhaps more than any other word, second only to “greed.” Leverage is essentially the ratio of assets to borrowed money, or in the case of investing, borrowing money to magnify returns (in either direction).

The most common form of leverage is actually in most people’s largest asset—their homes—where we borrow via a mortgage to pay off an asset over time. The difference between buying a home with borrowed money and buying financial assets is that those financial assets are revalued every single trading day, and the degree of leverage that can be used can be a lot higher than the typical loan-to-value of a home.

Leverage amounts in the investment world can vary from 2-3x to nearly 50x+ in the case of certain futures contracts. (The traditional 20% down payment on a home means you are initially 5x leveraged.) Typically, leverage corresponds to the chances of losing all of your investment. You only “own” the part you paid for—the rest is borrowed, or as people often say informally with homes, “the bank owns it.” If you put 20% down on a home and the price drops 20%, you no longer have any equity in your home. Your initial investment is gone (for now); all that’s left is what’s owed the bank. With homes, as long as you continue to make mortgage payments that’s not an immediate problem. With liquid financial assets, you would probably face a “margin call” and have to pay off the loan immediately by selling the asset, which means you lose the full value of your initial investment. However, there are ways to use leverage to improve capital efficiency without the risk of ruin.

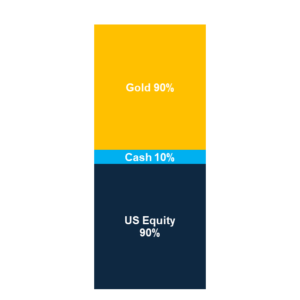

For example, the below chart shows how an investment product could get access to U.S. stocks, hold some cash on the side as collateral to buy gold futures (a pretty good trade this year so far!). This allows investors to add gold without selling all of their stock portfolio to do so, essentially a way to make space for diversifiers in portfolios. The collateral and futures contracts are managed inside of the investment product to maintain a consistent allocation, so if either component rises or falls significantly the portfolio is rebalanced to reflect the proper weighting.

It should be mentioned that this concept has the potential to add more risk by increasing overall exposure. However, if the various components that are added together are not perfectly correlated, that risk is not completely additive and there are diversification benefits. When used thoughtfully as part of a risk-managed portfolio, leverage can enhance efficiency and help portfolios “work harder” without a corresponding increase in risk.

There will always be instances in investing where financial engineering gets in the way of real-world results. Investors should always be skeptical of shorting, leverage, or anything promising unusually high returns with unusually low risk. That being said, the proper risk-managed dose of certain time-tested elements of finance, even if they initially raise questions, can meaningfully strengthen portfolios and investor results.

8482184.1.-09OCT25A

For more content by Grant Engelbart, VP, Investment Strategist click here