The Federal Reserve cut rates once again, taking policy rates down to the 3.50-3.75% range. This was as expected, but the chatter before the meeting was that this would be a “hawkish cut”. On the contrary, as I’ll discuss below. But even otherwise, it’s hard to say a cut is hawkish when it comes on the back of a slew of rate cuts:

- The Fed has now cut 75 bps over the last 3 months

- The Fed has cut 175 bps over the last 15 months

The Fed’s taken the policy rate from a 5.25-5.50% range to 3.50-3.75% over 15 months. Meanwhile, inflation has moved sideways, while remaining elevated – the Fed’s preferred metric, the core personal consumption expenditures (PCE) index, is up 2.8% year-over-year, exactly where it was 15 months ago. I don’t know how you read that as anything but dovish.

While the Fed did push through a cut this meeting, the vote was not unanimous. There were 3 dissents (the vote was 9-3 in favor of the cut):

- 2 dissents in favor of no cut: Austan Goolsbee (Chicago Fed President) and Jeff Schmid (Kansas City Fed President)

- 1 dissent in favor of a 50 bps cut: Governor Stephen Miran (who is on “loan” from his role in the White House as Chair of the Council of Economic Advisors)

Three dissents are notable and stand out from how the Fed has been operating recently, especially under Fed Chair Jerome Powell. Since 1993, only 5 meetings have had 3 dissents, with the most recent in September 2019 (3 members voted against a 25 bps rate cut).

Now let’s dig into why the Fed’s signaling tilted dovish, especially relative to expectations going into the meeting.

The Fed’s Worried About The Labor Market

The reason the Fed has cut as much as it has over the last 15 months, let alone the last 3 months, is that it’s worried about the labor market. Their rationale for cutting 75 bps over the last 3 months is that labor market risks have risen. They believe the risks to their two mandates, stable and low inflation, and maximum employment, are in balance – risks to inflation are tilted to the upside while risks to employment are tilted to the downside. And since the policy rate was well above “neutral” (the rate that is neither too tight nor too accommodative), it only made sense to move the rate lower, and closer to that neutral rate.

Of course, Powell also said that it was a close call when the two sides of their mandate are in opposition, which is the source of dispersion of views across the committee, as each member weighs the risks differently, as well as their own forecast.

I believe that Powell clearly thinks job growth is really weak. The average monthly job growth since April is about 40,000/month, but he thinks that’s an overcount and the actual number is about -20,000/month. He’s likely basing this on the fact that job growth has been revised sharply lower over the last two years. At the same time, he noted that the supply of workers is low and so hiring is bound to be low as a result (mostly due to low immigration). However, an environment with negative job growth is something to be careful about, and Powell said that they want to make sure policy is not pushing down on job creation even further.

On the inflation front, Powell noted that tariffs have pushed up inflation this year. But he is encouraged that service inflation is pulling lower, mostly on the back of housing disinflation. I’d argue that core services, excluding housing inflation, are still running hot (see my prior blog), but they’re clearly looking past this.

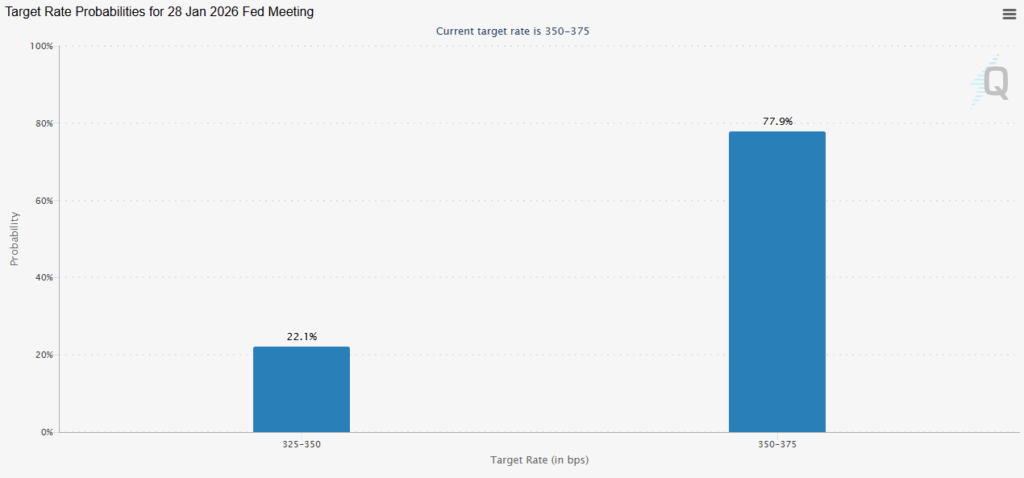

Looking ahead, Powell pointed out that they’ve already reduced rates a lot and we’re poised to receive a lot of economic data between now and the Fed’s January meeting. So, they’re going to be in “wait and see” mode. In fact, fed funds futures are now pricing in just 22% probability of a cut at the Fed’s January meeting.

The “Dot Plot” Leans Dovish

The “summary of economic projections (SEP)”, aka the “dot plot”, signaled a dovish outlook. The dot plot is updated every 3 months and the last update was in September. The SEP contains members’ projections of future policy rates and economic data like real GDP, unemployment, and inflation under appropriate monetary policy.

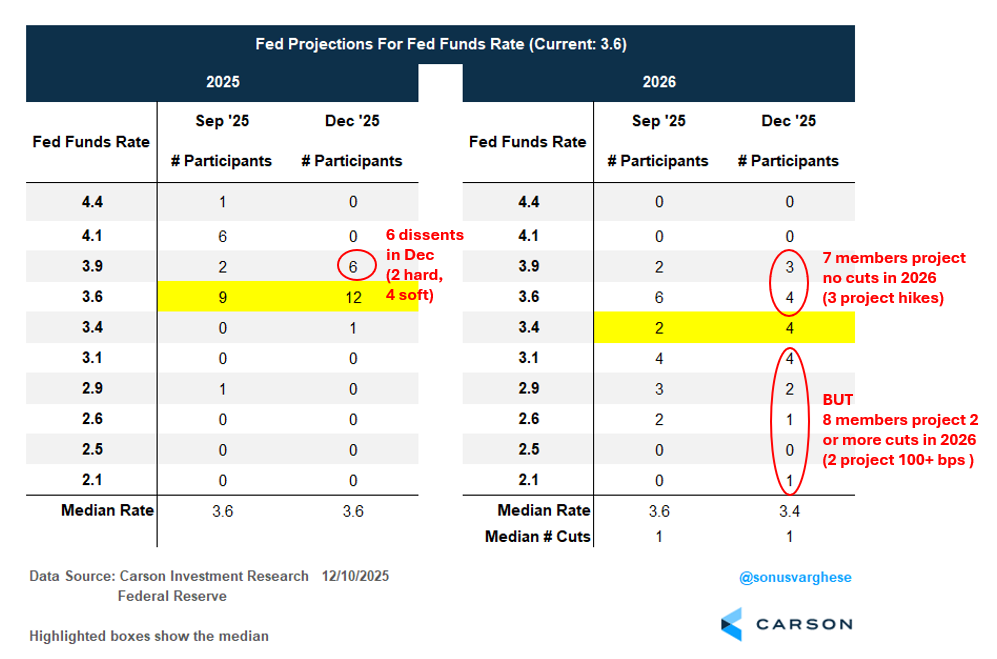

Six members disagreed with the Fed’s decision to cut rates in December. We got 4 “soft dissents” in addition to the 2 “hard dissents” (2 members who voted no) – as these 6 members projected a higher policy rate of 3.9% for 2025, above the policy rate of 3.6% that we’re at now (after the December cut). Still, this is a minority of the 19-member committee (though only 12 vote in any given meeting). A comfortable majority of 12 were on board with taking rates lower.

Perhaps more importantly, the signaling for 2026 leaned dovish.

- The median member projected one rate cut in 2026

- 7 members projected no cuts in 2026 (including three that projected a 25 bps hike)

- 4 members projected one rate cut in 2026

- BUT, a majority of 8 members projected two more rate cuts in 2026

You can see why the Fed leans towards the side of cutting rates, with most members (8) expecting two or more cuts. Plus, President Trump is probably going to nominate a new Fed Chair that is amenable to more rate cuts (Powell’s term ends in May).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The Fed Is Optimistic About The Economy, and Productivity

While the dot plot leans towards rate cuts, it’s worthwhile looking at the economic projections. This tells us their “rationale” for expecting more rate cuts, i.e. for “bad” reasons (to protect the labor market) or for “good” reasons (economic growth on the back of productivity growth).

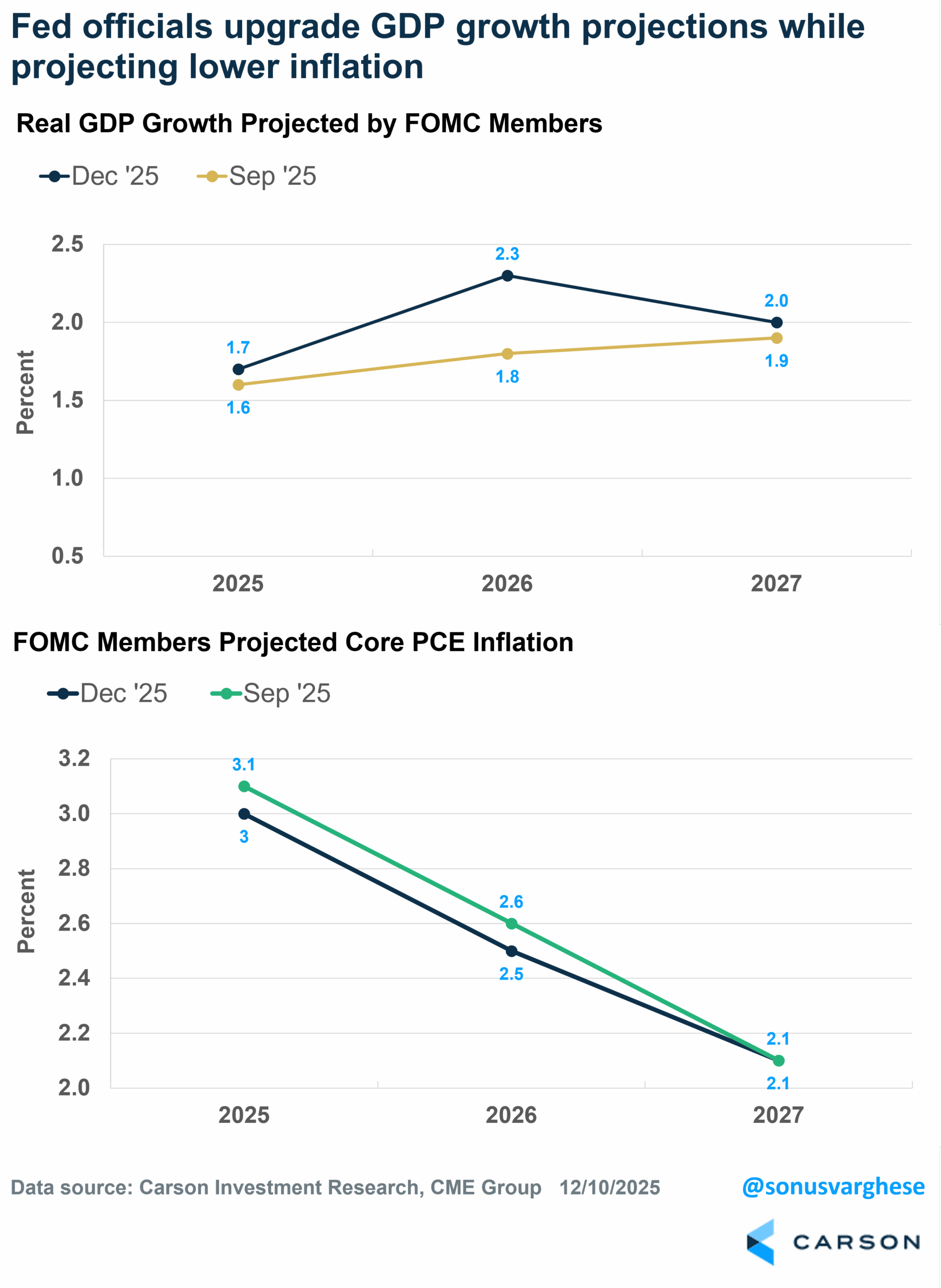

The biggest change, relative to September, was projections for real GDP growth

- 2025: Upgraded from 1.6% to 1.7%

- 2026: Upgraded from 1.8% to 2.3%

The upgrade to 2026 real GDP growth is a huge shift, and that’s the highest GDP growth projection they’ve ever made for 2026 (going back to December 2023). Powell pointed out that consumer spending is holding up, even as AI-related datacenter spending is boosting business investment, which is why they’re expecting a pickup in growth next year, especially as the tariff headwind fades.

By itself, an upgrade to GDP growth while 1) cutting rates, and 2) projecting more rate cuts, is dovish.

Fed members also projected slightly lower inflation (core PCE) than in September, with both 2025 and 2026 projections falling a tick to 3.0% and 2.5%, respectively. They still expect inflation to run above target for the next couple of years, but it’s notable (and dovish) that they project inflation to decline even as they cut rates.

Finally, projections of unemployment rate in 2025 and 2026 – this takes on outsized importance because the Fed’s rationale for cutting is that labor market risks have risen. Yet, the dot plot shows absolutely no changes to their unemployment rate projections. They expect the unemployment rate to hit 4.5% in 2025 (it’s 4.44% right now) and pull down to 4.4% in 2026 – the same projections as in September.

On the face of it, it’s puzzling to a lot of people that the Fed didn’t raise its unemployment rate projections. But there are two reasons why, and it gets to the “bet” the Fed is making

- One: they think they’ve lowered rates enough to stem a further increase in the unemployment rate (they’re also penciled in another cut in 2026)

- Two: higher economic growth in 2026 will boost the job market, and lower unemployment

The Fed is essentially betting on productivity growth – with productivity growth, you can have higher economic growth, a stronger labor market, and lower inflation. And that allows for lower interest rates. It’s really as simple as that, though there is nothing “simple” about this forecast (and it’s important to remember that it is just a forecast). In any case, this is a dovish outlook.

Markets currently expect the Fed to cut twice in 2026, versus the Fed’s projection of one cut worth 0.25%-points. This probably reflects the views of the majority of Fed members on 2+ cuts in 2026 (8 of 19), and a new Fed chair who comes in with the view that rates need to be cut further.

Interestingly, market pricing diverges wildly from the Fed’s projections after 2027. While Fed members expect inflation to return to target and policy rates to remain at their neutral rate of 3%, investors don’t buy that. Market pricing points to rate hikes from 2028 onwards, presumably as inflation remains a problem (which the Fed ignores for the next couple of years).

In fact, by the end of the decade, markets are pricing a policy rate of 4%, above where they are today. It appears that investors believe we’re in a relatively high inflationary environment right now – even if inflation averages 2% over the next 5 years, it’s likely to be volatile. That’s our view as well. For 2026 specifically, our view is that we get re-acceleration and inflationary growth, rather than the Fed’s forecast of disinflationary growth (due to productivity gains).

The dovish tilt from the Fed, on the back of a much more positive outlook for the economy, is positive for stocks. And right in time for a year-end rally, though we believe the outlook for stocks in 2026 is also positive amid several tailwinds – keep an eye out for our 2026 Outlook.

Ryan and I talked about a lot of this in our latest Facts vs Feelings episode. Take a listen below.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

8661561.1. – 11DEC25A