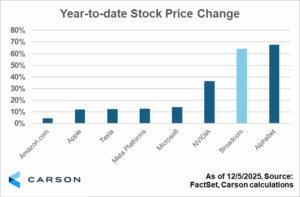

Investors referring to the ‘Magnificent 7’ ought to update their rolodex. Broadcom has quietly become the seventh largest stock in the S&P 500, surpassing Tesla. Perhaps ‘Elite 8’ is a better title for these stocks. Broadcom has marched higher this year, registering the second-best year to date stock price gain amongst the largest stocks in the market. This gain comes as investors have gained confidence in the company’s future growth trajectory.

Registering Gains

Broadcom’s market capitalization eclipsed $1.8 trillion this past week, surpassing Tesla’s roughly $1.5 trillion market cap, to firmly plant the company as one of the most valuable in the market (FactSet data, as of 12/5/2025). Broadcom is on pace to register the second largest stock price gain of the Elite 8 this year, up 64% for the year which trails behind only Alphabet’s 68% rise this year (FactSet data, as of 12/5/2025).

Broadcom’s gain has been mostly powered by an expanding multiple based on this year’s earnings estimates. The company entered the year trading at 36.5 times its FactSet consensus estimated 2025 earnings of $6.36 and is now trading at roughly 56.5 times its revised 2025 earnings of $6.75. That would be considered pricey for most stocks on a near-term basis, but its long-term trajectory may be what investors are more focused on.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Gaining Confidence

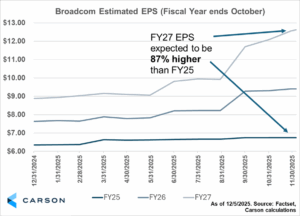

Broadcom’s multiple expansion this year may be reflective of investor’s confidence in the company’s future. Broadcom is expected to report $6.75 of EPS in their earnings report this

week, but FactSet’s consensus earnings estimates for the company’s next two fiscal years have boomed, as shown below.

Broadcom is expected to earn $9.41 in its fiscal year ending October 2026, which is 23% higher than the $7.63 estimate analysts had coming into 2025. Further, in their fiscal 2027, Broadcom is now expected to earn $12.62, up more than 42% from the $8.88 estimated earlier this year (all FactSet data, as of 12/5/25). All told, analysts expect EPS to nearly double in the next two years and this is perhaps a main reason why the stock’s near-term earnings multiple has expanded.

An Eye on Earnings

Investors this week will digest Broadcom’s latest earnings report, with the company due to release their report on Thursday afternoon. Broadcom is large supplier of Alphabet’s custom semiconductors, known as TPUs. And with reports that TPUs are in demand from both Alphabet and Meta to help run their AI data centers, Broadcom may be able to capture more demand than previously thought1. FactSet consensus estimates currently stand at $17.5 billion for Broadcom’s quarterly revenue, though the company’s forward-looking guidance may be just as important as their results.

‘Magnificent 7’ investors ought to get to know a new name – Broadcom. The company’s rise thus far in 2025 has propelled it to trade at a higher market cap than both Tesla and Meta at times, hinting that it may be here to stay. While the stock’s run in 2025 has been powered by an expansion of its earnings multiple, this move may reflect investors’ confidence in robust future earnings growth. The company’s earnings report due out later this week could seal Broadcom’s banner year.

Source: Reuters, 12/5/25, Meta in talks to spend billions on Google’s chips, The Information reports

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.

8651847.2-8DEC25A