“When you hit the sweet spot, it’s not the club that sings—it’s your soul.” – Ben Hogan

What a first half it was, as the S&P 500 was down close to 20% at the April lows and incredibly came back to new highs already, one of the fastest recoveries ever.

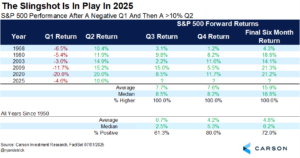

We’ve discussed why this market may be like a slingshot (or a ball under water) and here’s another way to show why the shakeout and recovery in the first half could be a good sign for the bulls for the rest of 2025.

We found five other times that stocks were lower in the first quarter, then up more than 10% in the second quarter. The third and fourth quarters were higher every single time, with the rest of the year up nearly 16% on average. No, we don’t think stocks will do quite that well the final six months, but this does little to change our opinion the bulls should continue to do well the rest of this year.

Don’t Fear a Big Quarter

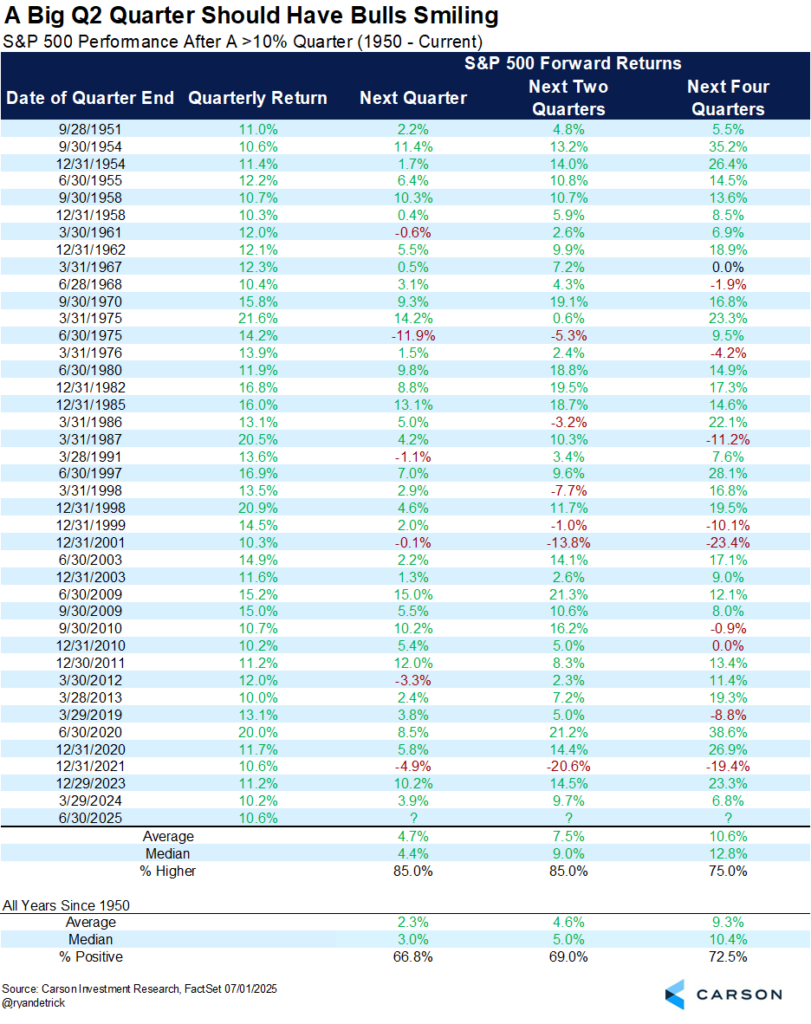

Stocks gained more than 10% in the second quarter, for one of the best quarters ever and the best since a 11.2% gain the fourth quarter of 2023.

What could be next? Well, it is a sample size of one, but after the last 10% quarter in late 2023 all that happened next was another 10% quarterly gain in the first quarter of 2024.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Taking this a bit further, we found all 40 quarters that gained double digits and the following quarter was up a very impressive 4.7% on average and higher 85% of the time, well above the average quarterly gain of 2.3% and higher about 67% of the time. In other words, just because stocks did well last quarter doesn’t mean this current quarter can’t be strong.

The Sweet Spot

The S&P 500 gains an average of 4.3% the first half of the year, which makes the 5.5% gain in the first half of 2025 better than an average year.

Some of the worst second halves to a year ever have taken place after bad first halves. Years like 2000, 2001, 2002, and 2008 all were down the first six months and saw continued weakness the rest of the year. The other side to this is years like 1975, 1983, 1986, and 1987, which all saw huge gains the first half of the year, only to see weak returns the rest of the year, as the rubber band was quite stretched.

This gets us to this year, which we are calling the sweet spot, not up too much or down too much.

We found that years that were up 5–10% at the midpoint of the year actually tended to do quite well the rest of the year, higher a very impressive 13 out of 15 times and up 6.4% on average, better than the average final six months of 4.8%.

This very well could be the sweet spot for stronger performance and likely higher prices the rest of this year.

Thanks for reading and stay tuned, as we are set to release our Midyear Outlook on Thursday! We’ve put a ton of work into it and we know you’ll love it.

Lastly, I joined a very pregnant Kelly Evans on CNBC’s Power Lunch last week to discuss many of the ideas in this blog and you can watch it all below.

For more content by Ryan Detrick, Chief Market Strategist click here

8148100.1.-07.08.25A