“I know one thing, that I know nothing.” Socrates

The S&P 500 was down five days in a row heading into Friday of last week, although the losses were fairly minor with only one day down more than 0.5% (and that one barely). Then Jerome Powell opened the door for a rate cut in September and the bulls stepped up in a historic way. Sonu Varghese, VP Global Macro Strategist, wrote about why Powell opened the door to rate cuts here, but today we’ll take a look at what the market did and what it could mean.

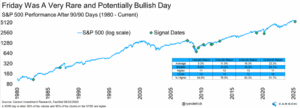

Friday Was Rare and Potentially Very Bullish

Friday was a rare “90/90 day,” which means more than 90% of the stocks on the New York Stock Exchange (NYSE) were higher, with more than 90% of the volume on the NYSE higher as well. Historically, we’ve seen this type of day near major lows, with the last two times coming off the near-bear market lows in April and off the COVID bear market low in 2020.

Looking at the data, we found that the S&P was higher a year later 11 out of 12 times after a 90/90 day, with an average gain of more than 23% on average. The shorter-term returns are much better than average as well. We’ve long said this is still a major bull market, and Friday’s action does little to change our tune.

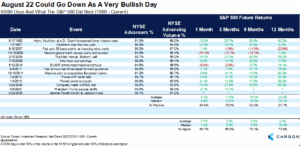

Here’s all the dates and returns in table form. What stands out to us is most of those recent times were around a policy change. Well, Powell had been pushing back against rate hikes pretty hard, but he now appears to be more dovish. Did history just repeat itself?

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Thanks for reading and I was honored to join Morgan Brennan on CNBC’s The Exchange on Friday to discuss this and more. You can watch it all here!

For more content by Ryan Detrick, Chief Market Strategist click here

8325897.1.-08.26.25A