We have received several questions about the potential market impact of Hamas’ brutal terrorist attack on Israel, the Israeli response, and the on-going aftermath. Thinking about these kinds of issues is our job, but we are also well aware that these considerations are trivial compared to the events themselves and the lives they impact.

Looking at the numbers, after just a few trading days markets have been resilient overall. On Monday and Tuesday combined:

- The S&P 500 Index was up 1.2%.

- The more economically sensitive Russell 2000 Index of small cap stocks was up 1.7%.

- The MSCI EAFE Index of international developed stocks, which tends to be more sensitive to oil supply shocks in the Middle East, was up 2.2%.

- Oil (West Texas Intermediate) did jump on Monday but was down slightly Tuesday, with a still meaningful two-day gain of just under 4.5%.

- U.S. bond markets were closed Monday, but the 10-year Treasury yield declined sharply Tuesday, Treasuries’ role as a safe haven asset dominating any inflation fears from higher oil prices.

- Gold, sometimes also treated as a safe haven asset in the face of geopolitical risk, climbed 1.6%, a meaningful but not outsized move.

The reaction thus far has been somewhat benign compared to geopolitical shocks historically. Markets are a forward-looking and typically will look ahead to the economy recovering from the initial shock even as some uncertainty persists.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

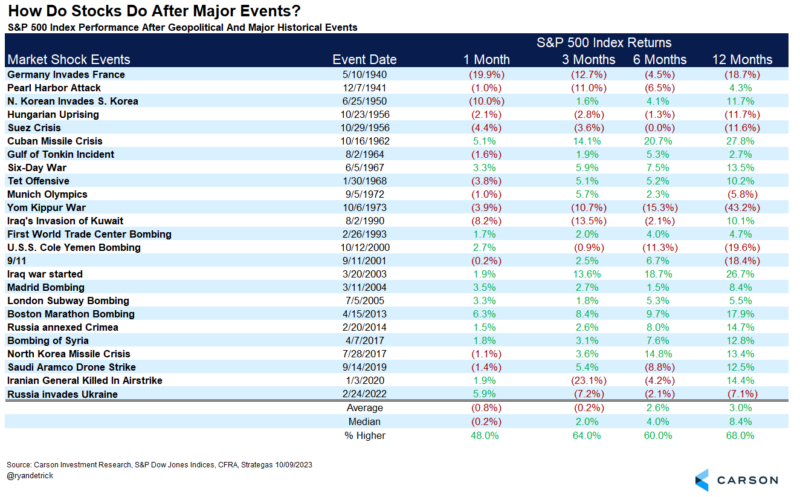

Looking at a list of similar historical events (that still vary in scale quite a lot) median performance over the next year is somewhat lower than historical returns. The average return is also weaker than the median return, signaling some asymmetrical downside risk. But context here is very important.

Keep in mind that much of the negative market behavior is likely not driven by the geopolitical event itself. For example, the U.S.S. Cole bombing was coincident with the tech bubble bursting in 2000. What stands out from the chart is not so much the downside risk of geopolitical events, but the coincidence of drawdowns and recessions independent of geopolitical risks. If you look at the major drawdowns, most take place during or near a recession, including 1956, 1973, and 2000-20001.

But there are cases where geopolitical risk played some role in the decline. For example, Russia’s invasion of Ukraine worsened already building inflationary pressures, eventually contributing to an aggressive Federal Reserve and weighing on equity markets. But that has been the exception rather than the rule. Markets saw strong gains despite the start of the Iraq invasion in 2003 and Israel’s Six-Day War in 1967. And, of course, the bigger picture beyond the more tactical 12-month time frame is that the markets have always recovered.

Despite several Middle Eastern conflicts that did not lead to market drawdowns, the Yom Kippur War in 1973 played at least some role in the ensuing market sell-off, but we believe the current circumstances are quite different. In October 1973, an Arab coalition led by Egypt and Syria launched a surprise attack against Israel on Judaism’s holiest day, Yom Kippur. After detecting Soviet resupply to Syria and Egypt, the U.S. began a massive resupply of Israel. The oil cartel OPEC responded by declaring an oil embargo against the U.S. and other countries. In 1973, the U.S. had grown increasingly dependent on foreign oil. As a result of the embargo, oil prices tripled and the added strain on the economy was one of the causes of the recession.

While there are several themes in play related to the current conflict, times have changed significantly.

- Hamas has tried to expand the conflict by implicating Iran’s support, much as the Yom Kippur War also became a Cold War flashpoint. The claims have been treated as suspect thus far by U.S. and Israeli military intelligence but the issue is unresolved. Nevertheless, Iran is not the cold war Soviet Union and Russia itself is depleted by its ongoing war in Ukraine.

- While there are various degrees of tensions between Israel and its neighbors, as of now the scope of the conflict is relatively narrow, focused geographically on Gaza.

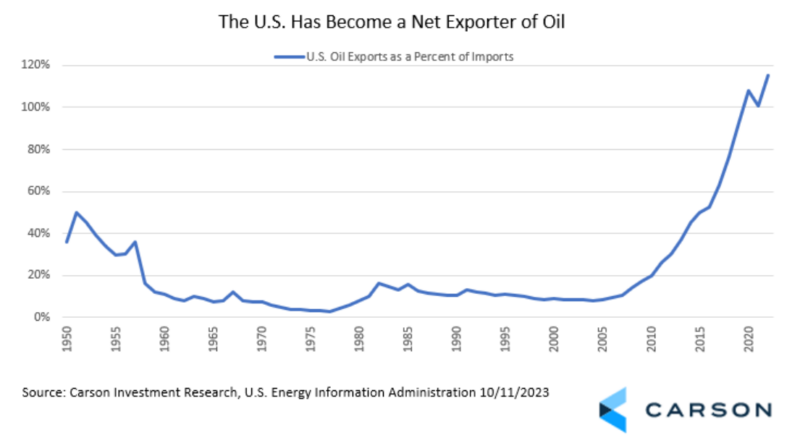

- The dependency of the U.S. on foreign oil is dramatically different than it was in 1973. In the 1970s the amount of oil demand that could be met through domestic production was in decline. Today, U.S. production alone could meet almost all of the domestic demand. In fact, the U.S. is able to export a little under half its oil, actually making it a net oil exporter. As seen in the chart below, in 1973, oil exports were 4% of imports. In 2022, they were 115% of imports.

- In addition, Canada, not OPEC, is the largest source of foreign oil, and accounts for approximately four times the imports from all of OPEC.

Two risks do remain:

- There is, of course, the possibility for the conflict to expand and the Middle East remains a sensitive region. We view this as unlikely but still uncertain at the margin.

- The largest economic vulnerability for now is similar to the Ukraine conflict. Central banks, businesses, and consumers remain sensitive to inflation risk even as disinflation continues to be the primary path that prices have been following. As a result, broader sensitivity to higher oil prices may be more acute than usual. And even if OPEC’s role has diminished, particularly in the U.S., oil supply and demand is still a global phenomenon. But keep in mind that we are still well off peak oil prices from the last year and consumers have remained resilient even at higher price levels. The most salient impact of oil prices on American is via gas prices, and the good news is that prices at the pump have been falling recently despite the run-up in oil. Shrinking refining margins means pump prices are likely to fall even further. That’s a tailwind for American households, and consumption.

The Carson Investment Research team has not changed its overall market outlook in response to the conflict, although we continue to monitor the situation closely. We remain overweight equities but do favor the energy sector. In addition, we remain cautious on rates but have recommended adding duration (interest rate sensitivity) to bond portfolios as rates climbed sharply higher, although our recommended positioning remains below the duration of the Bloomberg U.S. Aggregate Bond Index. Most importantly, we think the U.S. economy can continue to avoid recession on the resilience of the U.S. consumer.

1931854-1023-A