Another quarter in the books, another quarter of losses for bonds. The Bloomberg US Aggregate Bond Index (“Agg”) fell 3.23%, which is the eighth worst quarter on record dating back to index inception in 1976. The index has now declined six of the last eight quarters with the two-year return -7.3% annualized. To be fair, the S&P 500 Index saw its fifth decline in the last eight quarter in Q3, falling -3.8% annualized over the same two years including dividends. But we want our bonds to provide ballast over periods of stock declines, not decline more sharply.

Only two days into the fourth quarter we’ve seen the sell-off continue, the Agg falling 1.5% and the 10-year Treasury yield climbing 0.23 percentage points to reach 4.80%. (Bond prices fall when yields rise.)

The Carson Investment Research team has been more cautious about the threat of rising yields than most other strategists, keeping our recommended interest rate sensitivity, or duration, well below our benchmark, even after modestly raising our target in May this year.

With the recent surge in yields, we are raising our target duration modestly higher again but still remain meaningfully short of our benchmark, with a target duration of 3.9 years.

There is a silver lining in recent yield increases…

- Although little consolation, the Agg was higher (just barely, up 0.6%) on a four-quarter rolling basis for the first time since the first quarter of 2021. While the Agg declined slightly in the second quarter, the first quarter of 2023 and the fourth quarter of 2022 held up ok (+1.9% and +3.0% respectively).

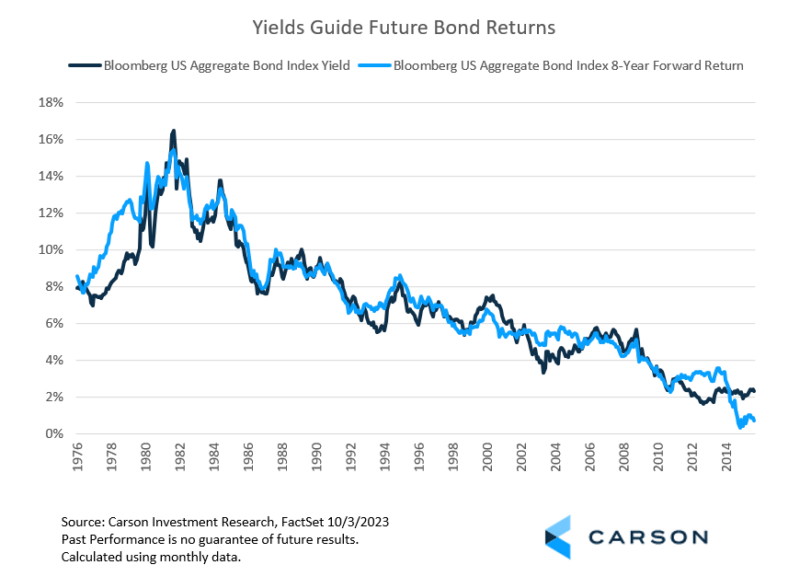

- The Agg’s yield to maturity, a strong predictor of longer run bond returns simply because of the way bonds work, has been climbing. Of course, that’s why bonds have been seeing losses, but bond losses now do point to stronger prospects in the future. The yield to maturity for the Agg at the end of the quarter was 5.39%, the highest end-of-quarter level since 2009. With the recent surge, the yield stood at 5.61% as of October 3. The average yield from 2010 – 2021 was just 2.34%. As shown in the chart below, annualized returns for the Agg over the next eight years tracks the yield at the beginning of the period fairly closely, coming within +/- 1 percentage point 74% of the time.

Some additional reasons high yields today provide a better bond outlook…

- Higher yields mean higher coupon payments to offset potential price losses from raising rates, making fixed income more resilient. Over the long run coupon payments are overwhelmingly the main driver of bond returns, not price changes, since every bond’s eventual price at maturity is fixed at the par value of the bond if it doesn’t default. That’s what makes bonds a “safer” investment. It doesn’t matter what the price is now—you know exactly what the price will be at maturity (outside default risk).

- With the most recent personal consumption expenditure (PCE) inflation reading, the Federal Reserve’s preferred measure, coming in muted, an additional rate hike looks increasingly unlikely. (Market odds sit around 25%.) That likely takes off some pressure from one key source that could push rates higher.

- While not a benefit to bonds, my colleague Sonu Varghese has highlighted that rising nominal Treasury yields (yields with inflation baked in) have been accompanied by rising real Treasury yields (yields with inflation taken out), often a sign that yields may be rising because of improved growth expectations. But rising growth expectations do seem increasingly baked in, making further gains on improved growth expectations less likely to be a meaningful driver of yields. A different driver of higher yields (for example renewed inflation concerns) could create more upward pressure, but the main driver over the last quarter, at least, doesn’t have the same energy it started with. Greater uncertainty about future yields and the possibility of a “higher for longer” Fed may also be contributing to higher yields.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In the near term we have been mindful of the attractiveness of short-term rates and the possibility that inflation concerns could last longer than expected, even if our base case is for continued disinflation, as well as market sentiment. We have also generally been fairly bullish on the economy. The main risks with short-term bonds is that you may have to settle for a lower rate if yields drop (reinvestment risk) and that you lose the added portfolio ballast if equity markets become volatile and bonds return to their role as a diversifier.

Weighing all these factors together, we are not ready to return to Agg-like duration yet. We are watching for when we believe reinvestment risk becomes elevated, which will largely be driven by when the Fed starts to lower rates. Since markets are forward looking, we would aim to be reasonably ahead of this move but are comfortable with just a step in that direction for now.

1923888-1023-A