Earlier this month, we addressed three key sectors to watch during this upcoming earnings season: Financials, Energy and Consumer Discretionary. Each of these three sectors are dealing with challenges (or tailwinds, in the case of Energy) of their own. But under the surface, we find that Communications Services and Technology may also come under scrutiny with ‘heightened expectations’ in anticipation of their quarterly results.

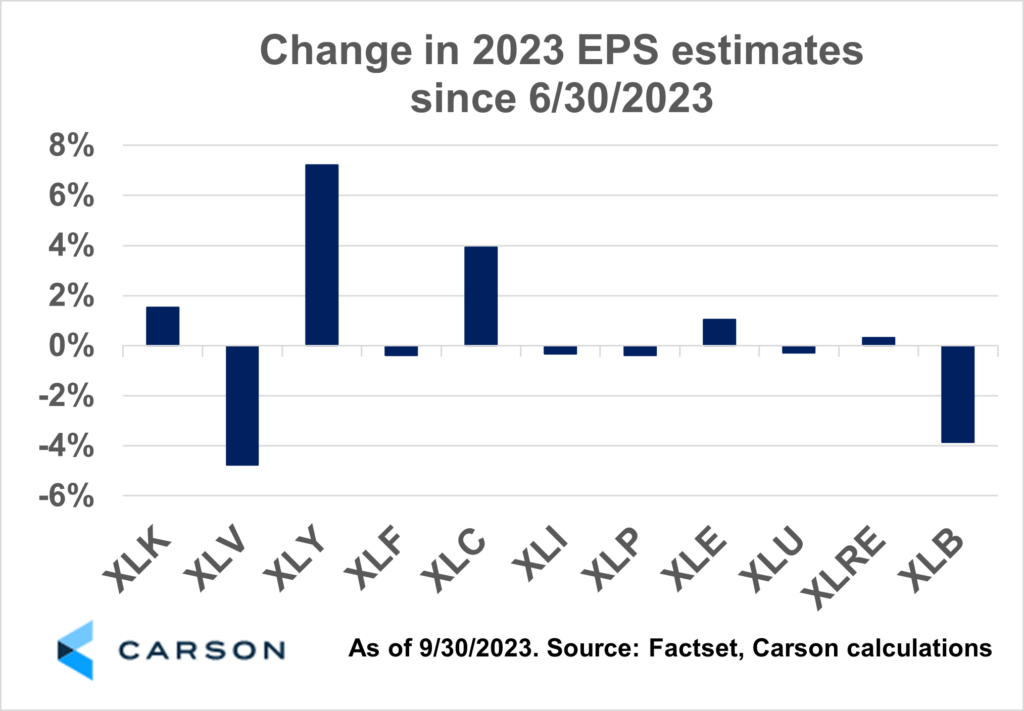

These sectors have been on a meteoric rise and have logged gains of more than 30% year to date. They’ve also witnessed continued EPS revisions higher since the end of the second quarter, with the chart below showing their outlooks were among the most improved during Q3, only behind Consumer Discretionary. However, markets are forward looking, and below we discuss the cross currents affecting these sectors that investors will likely digest during constituent earnings reports.

Technology: While housing AI powerhouses, such as Microsoft and Nvidia, the tech sector’s largest holding, Apple, notably lagged during the quarter, underperforming both broader indices and the tech sector itself. More than just normal gyrations around perceived valuation, Apple was impacted by a flurry of headlines in early September concerning China. In particular, Huawei debuted their Mate 60 Pro smartphone, the first 5G compatible smartphone produced by a China-native firm. Apple enjoyed healthy smartphone market share gains in China during the past years while Huawei struggled to add this innovation already present in newer iPhones. Investors will be eager to hear if this new competition dims what has been a bright spot for Apple’s historical growth.

Microsoft, the sector’s second-largest holding, has made remarkable strides to monetize the ‘AI hype’ seen at the beginning of the year. While ChatGPT continues to grab headlines and grow in capabilities (most recently image recognition and comprehension), Microsoft also announced a suite of enterprise-related AI tools bundled as ‘Microsoft CoPilot.’ This product is already in beta testing with some of Microsoft’s largest customers, and they’ve set a general release date for November 1, 2023. With such high forecasts for how large the AI software market will be, investors will need to understand how these first-to-market products will impact Microsoft’s revenue growth.

Communication Services: Shortly after the Writers Guild of America (‘WGA’) began striking on May 2nd, the Screen Actors Guild (‘SAG-AFTRA’) began striking on July 14th against the studios and streamers as well. We hope for a satisfactory outcome on both sides, and it appears a deal is close. Investors, however, will be keen to hear about both content delays and the increasing cost of labor as a result of these potential outcomes. With one of the world’s largest streaming corporations, Netflix, reporting on October 18th, investors won’t have to wait long.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The other large industry in this sector, internet advertisers, have been viewed favorably by the market since the start of the year, with stalwarts Google and Meta (formerly Facebook), up 48% and 150%, respectively, year to date through 9/30/2023. These advertising powerhouses have benefitted tremendously from a strong underlying economy – advertising budgets are often set as a percentage of revenue and, therefore, are likely to expand during a time of strong nominal GDP growth. While the economy is forecasted to ‘cool,’ our house views don’t anticipate a contraction of GDP. As investors may be expecting steady growth in advertising budgets, and therefore revenue growth in this sector, commentary around cost control will be crucial forward guidance to potentially accelerate earnings growth.

01939994-1023-A