“By many measures, for example, equity prices are fairly highly valued.” Jerome Powell, Tuesday, September 23, Speech to the Providence Chamber of Commerce

That recent comment by Fed Chair Jerome Powell helped spark the recent three-day selloff in equities. No, it wasn’t just that comment alone, but those words did add some worry for investors.

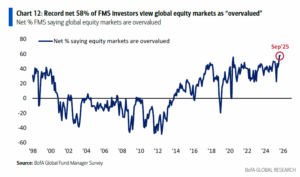

Powell isn’t the only one thinking this though, as the recent Bank of America Global Fund Manager Survey showed a record 58% of respondents viewed global equity markets as “overvalued.”

Irrational Exuberance 2.0?

The comments reminded many of us old timers of Alan Greenspan’s now infamous ‘irrational exuberance’ speech on December 5, 1996. All the S&P 500 did after that was double over the next three years, with the tech-heavy Nasdaq doubling several times into early 2000. Yes, stocks crashed soon after, but still, this famous quote from John Maynard Keynes rings a bell here: “Markets can remain irrational longer than you can remain solvent.”

Sonu Varghese, VP, Global Macro Strategist pushed back against some of the fear grabbing headlines in Is This Like 1929? Not Really. He noted stocks might be somewhat pricey, but that simply by itself isn’t ever a reason to avoid stocks, especially when we are in a bull market like now.

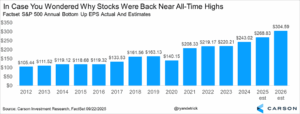

In fact, earnings growth has continued to justify the bull market gains we have seen. Here’s the latest S&P 500 earnings estimates from Factset. Up, up, and away comes to mind. Forward earnings are no more predictive than valuations, but they provide a powerful fundamental reason why markets have been advancing.

The More Things Change, the More They Stay the Same

Our friend Sam Ro, Founder of TKer, noted it isn’t all that rare for Powell to say stocks look pricey. Here are some recent comments to Congress via Powell in one of Sam’s must read notes from earlier this week:

- Smoothing through this volatility, valuations remained high relative to fundamentals in a range of markets, including those for equities, corporate debt, and residential real estate. – June 20, 2025

- Valuations remained high relative to fundamentals in a range of markets, including those for equity, corporate debt, and residential real estate. – February 7, 2025

- Valuations increased to levels that were high relative to fundamentals across major asset classes, with equity prices growing faster than expected earnings and residential property prices remaining high relative to market rents. – July 5, 2024

- Upward pressure on asset valuations continued, with real estate prices elevated relative to rents and high price-to-earnings ratios in equity markets. – March 1, 2024

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

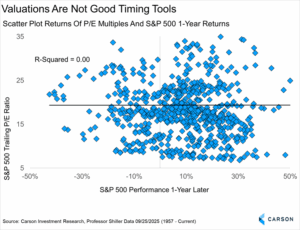

Valuations Aren’t Meant for Timing

What I’m about to say may trigger some readers, but valuations aren’t the best timing tool. As a matter of fact, they’re really not a timing tool at all and the data has backed that up, as I show below. Back in 2014 all we heard was how Robert Shiller’s cyclically adjusted price-to-earnings ratio (“CAPE”) was extremely pricey and doom was coming. Trust me, anyone with even a small bearish inclination was talking about it and they were worried that stocks were going to perform poorly over the next decade.

Some even called it “The New Normal,” which meant to expect lower than average returns. Heck, Bill Gross (aka the Bond King) said several years earlier in 2012 that ‘the cult of equity is dying,’ although I guess we shouldn’t be too frightened when a bond guy criticizes stocks. And he couldn’t have been more wrong—instead all we’ve seen is one of the greatest decades ever for stock investors.

Do valuations matter? Well, going out one year the answer is a resounding no, as the r-squared (the statistic that measures how much one variable helps explain another) between the price/earnings ratio and S&P 500 performance a year later is 0.00. In other words, there has been no relationship between valuations and S&P 500 returns over the next year. Yes, if you go out further (say five or 10 years) you will find more explanatory power. Still, if you were a bull like I was back in the mid-2010s it is hard not to remember how wrong those bears have been the past 10 years, so by no means is a ‘high’ valuation by itself a reason to avoid equities.

What To Do?

Listen, if you have to avoid US equities because you think they are too pricey, then do what you have to do. But we’d suggest looking a little deeper, as it is really the technology and communications groups that are pricey (and also the most profitable) and various other parts of the market are quite reasonable. If you want lower valuations, you can also diversify with a nice bucket of global equities. All year we’ve been beating the drum to have a diversified portfolio, versus simply being US large cap heavy, which has been the most rewarded part of the market the last decade.

Now What?

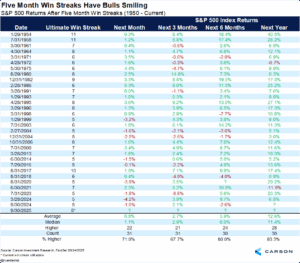

I’ll leave you with this bit of positive thinking. Should the S&P 500 finish higher in September, and it’s on a pretty good pace with just a few trading days to go, it will be up five consecutive months. It turns out five-month win streaks are historically quite bullish for continued strength. In fact, the S&P 500 gained a year later after a five-month win streak an incredible 28 out of 30 times.

8436543.1.-26SEPT2025

For more content by Ryan Detrick, Chief Market Strategist click here