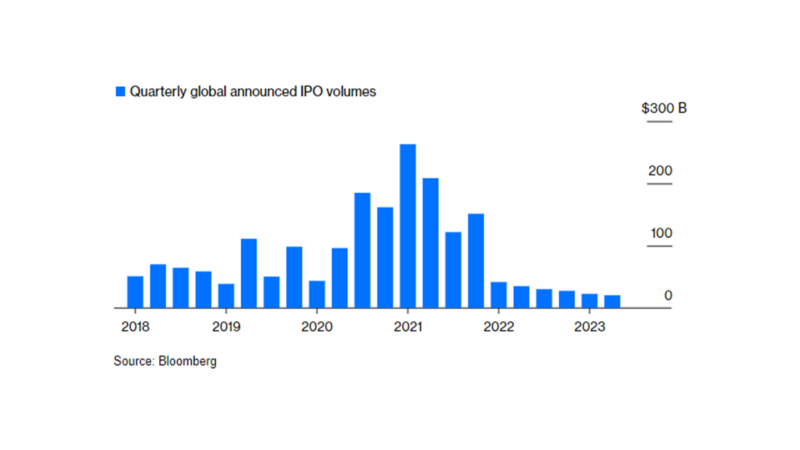

On Thursday, Arm Holdings (ticker: ARM) made, what some people may say, a triumphant entrance onto the public stage, securing its place as the year’s largest initial public offering (IPO). This not only marks the biggest public offering since Rivian Automotive’s debut in October 2021 but also offers a sign that the IPO market is thawing. The IPO market was notably soft during 2022 and this opportunity seemed to have nearly every Wall Street bank salivating for a piece of the deal. It bodes well for grocery delivery company Instacart and German footwear maker Birkenstock; both of which have recently announced plans to go public. This pivotal IPO coincides with a heightened spotlight on computer chips. While Arm Holdings may not be a household name, it quietly empowers many electronic devices you use daily.

Arm’s journey began in 1990 as a joint venture between Acorn Computers, Apple, and VLSI Technology. Its processor chips gained traction with mobile phones in the mid-90’s because of their exceptional energy efficiency. Arm chips consumed substantially less power than other chips, a crucial advantage when cell phone battery life was a make-or-break feature. As the mobile phone era evolved into smartphones that facilitate every aspect of our present-day existence, Arm chips grew ubiquitous. Today, 99% of smartphones worldwide rely on Arm-based processors.

The company was publicly traded until 2016 when SoftBank acquired it for $32 B. Under the visionary leadership of SoftBank’s CEO, Masayoshi Son, Arm’s mission expanded to encompass all consumer electronic devices. This transformation brought applications like laptops, GPS navigation, wireless controllers, and laptops within Arm’s reach (pun intended). The importance of energy efficiency is greater now than ever, and not only for portable battery-powered devices. Data centers, which power cloud computing and artificial intelligence, rely heavily on Arm’s energy-efficient chips. Vehicles have become sophisticated computers on wheels and will only become more high-tech with autonomous driving. Billions of small inexpensive devices, ranging from sensors to electric motor controllers, have evolved into functional computers; each requiring at least one processor chip. This trend has fueled the remarkable growth of Arm-based chips, which now exceed 250 billion deployed globally, and the outlook is even brighter.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Amidst surging demand for smart devices, that are reliant on microprocessors, Arm is strategically positioned to capitalize on its efficient chip technology. Arm’s core business involves selling the essential blueprints for microprocessor design and licensing instruction sets that govern the interaction between software programs and these chips. Leading tech companies like Nvidia, in turn, acquire a license for these chips and then build upon them with unique customizations and applications.

Arm’s footprint is global, with every major electronics manufacturer incorporating Arm-based products into their offerings. Looking ahead, management foresees the addressable market encompassing all processor infused chips, including Arm-based ones, reaching roughly $250 billion by 2025. The company makes it possible for AI to work everywhere, enables the future mobile experience, redefines what’s possible in cloud computing, and powers autonomous driving for the automotive industry.

We think the IPO was a resounding initial success, shares opened at $56.10 and soared nearly 25% on the first trading day. This rise propelled Arm’s valuation to nearly $70 billion. SoftBank remains the majority shareholder, retaining a 90% stake and maintaining significant influence over the company’s strategic direction. The company generated approximately $550 million in net profit during 2022, giving it an astonishing valuation of about 140x earnings. Like Nvidia, investors aren’t looking in the rearview mirror but ahead at the immense possibilities. They recognize the vast potential of artificial intelligence, cloud computing, autonomous driving, and many more groundbreaking applications that will define our future with the driving force of an efficient Arm processing unit at the core.

1903331-0923-A