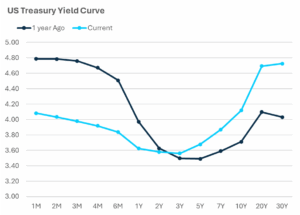

Navigating financial markets is always challenging, and this year has been no exception. Fixed income is an asset class that is often labeled as boring – which is realistically what we want it to be: boring and steady – but has been anything but. Over the past year, the U.S. Treasury yield curve has shifted from deeply inverted to now increasingly steep, with short-term T-bills falling from 4.8% down to 4.1%, while long-term rates are moving higher, from near 4% a year ago to briefly touching 5% in 2025. This pivot around the center of the yield curve has created hair-pulling conditions for anyone attempting to make a duration decision. Sticky inflation, mixed labor market signals, still-strong economic growth, and challenging domestic fiscal conditions have created a push-pull on economically sensitive yields, and is one of the reasons we are still underweight bonds outright.

Sources: FactSet, Carson Investment Research, 9/18/2025

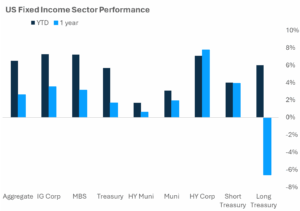

Despite the twisting and turning of the yield curve, bonds have still generally delivered modestly positive returns. This is the positive side of higher rates – the starting point for returns is that much higher, and the cushion provided by higher yields helps with interest rate volatility. Credit sectors have been positive this year on still strong earnings, as spreads have remained contained. That said, we remain somewhat skeptical of the risk-return profile of credit, as we continue to believe holding high quality bonds and taking risk in equities is the more appropriate strategy.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

One segment that has gained traction in the past few weeks has been municipal bonds. As rates come in, particularly on the short-end, competition for after-tax yield shifts. Anecdotally we are seeing more and more clients who have been in money market funds for years look for alternatives – especially tax-advantaged fixed income. This can make various parts of the muni bond market attractive, and in particular active managers who can take advantage of both tax-free and taxable structures depending on after-tax expectations.

Source: Morningstar, 9/18/2025

One way we have coped with this uncertainty in fixed income is by seeking alpha not through duration swings or high-yield timing, but by relying on trusted active managers to exploit market structure and fundamentals. We wrote about how active managers were handling this year back in May, and part of that analysis focused on how many core bond managers were implementing “steepener” trades that would take advantage of a decline in short-term interest rates and either stability or an increase in long-term rates. That has played out in a big way as I showed in the first chart and has been a tailwind for many managers – albeit just one of many ways active managers have been able to add value.

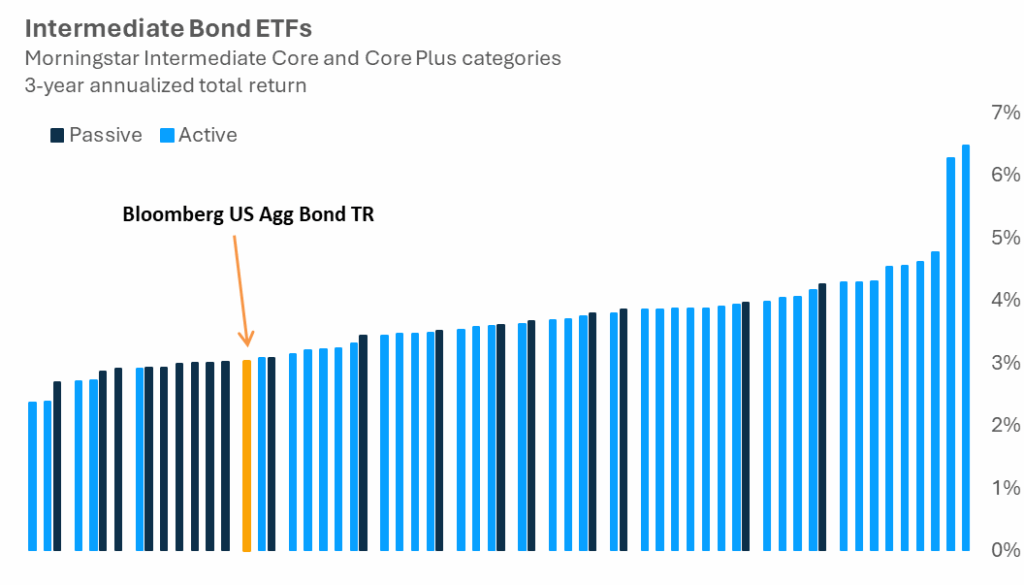

We also pointed out that active fixed income managers are generally better positioned to outperform their benchmark (in this case we will reference the Bloomberg U.S. Aggregate Bond Index) than their equity counterparts. Fixed income markets and indices function differently from equities and offer multiple opportunities to add incremental value. As shown in the chart above, over the past 3 years – which encompassed a range of market cycles – the majority of active ETFs (light blue) have outperformed the benchmark. Flexibility on duration, credit exposure, structural expertise, and bottom-up fundamental credit analysis all contribute to the incremental value add. Finding managers with specialized expertise and combining them can also prove lucrative, a strategy used throughout Carson portfolios. Bonds will be boring again someday, and that will be a good thing, but until then, leveraging industry experts to add value is something we find exciting.

For more content by Grant Engelbart, VP, Investment Strategist click here

8411660.1.-19SEPT2025A