“Indecision may or may not be my problem.” Jimmy Buffett

Stocks continue to trend higher, yet I’m noticing a few myths starting to show up that are meant to scare investors. In today’s blog, we are going myth busting!

Myth 1: No, Market Breadth Isn’t Bad

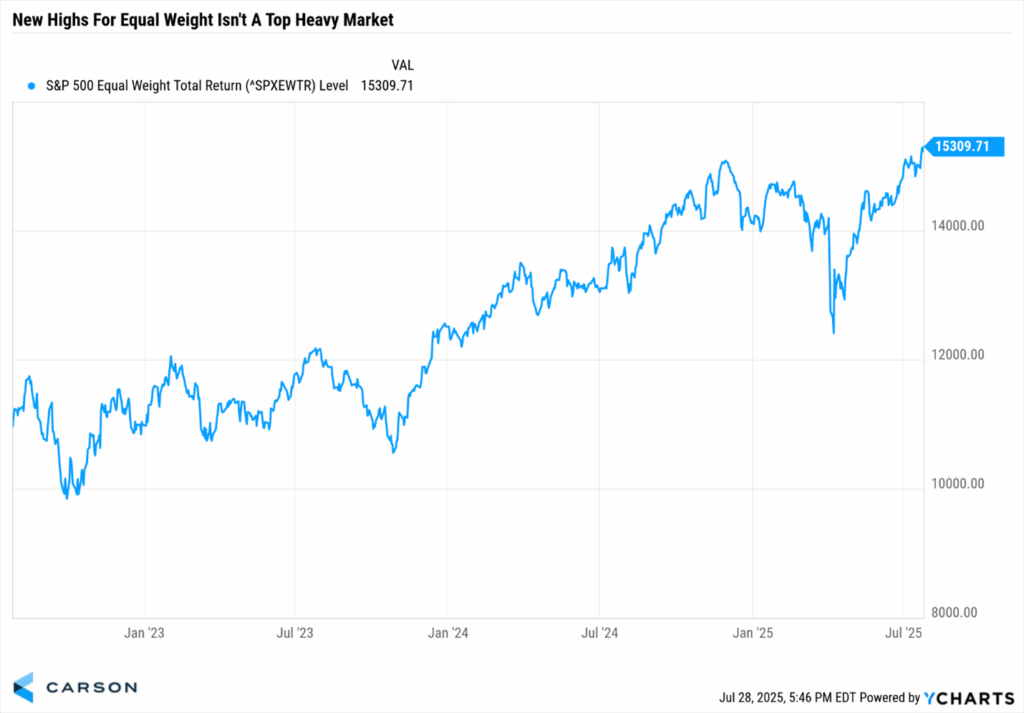

I’ll be honest, I don’t get where this one comes from, but it seems like every few weeks I hear about it and I’ve been hearing it more and more lately. There is a myth out there that the market is top heavy and only a few stocks are pulling things up. We’ve been hearing this one for years now and it simply isn’t true. Given the amazing returns we’ve seen the past few years, it’s hard to believe this continued worry doesn’t have a lot of holes, and it does.

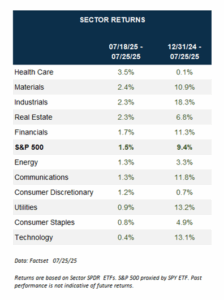

For starters, all 11 S&P 500 sectors are up year to date. Spoiler alert, each year you’ll have some groups do well and some lag—that is normal. But to see all 11 sectors up YTD tells you this is a healthy market, not to mention various countries making new highs. Heck, Japan is making new highs after 35 years as this global bull market continues. That isn’t weak breadth.

Then just last week we saw the S&P 500 equal weight index hit new highs, further showing breadth is anything but weak, as you wouldn’t see this if only a few stocks were going higher. On to the next myth.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Myth 2: Margin Debt Of $1 Trillion Is Bad

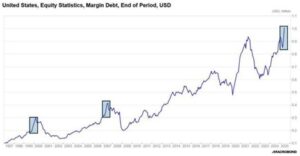

According to recent data from FINRA, the amount of margin debt is at a new record and above $1 trillion for the first time ever. Many claim this shows massive excesses and suggests a major bubble is about to pop, but once again, this isn’t true.

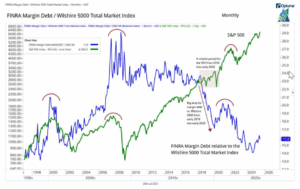

You see, this is another example of denominator blindness. The numerator might be high, but we have to consider the full picture. To get a more apples to apples comparison, let’s look at margin debt as a % of the overall market cap. Stephen Suttmeier of Suttmeier Technical Strategies put together this great chart that compares margin debt and the overall market cap of the US stock market.

Looking at it from this point of view shows a much different picture. Yes, margin debt might be ‘high,’ but compared with the market cap of the stock market we aren’t anywhere near past major peaks. The current 16% level is well off the 30% before the Great Financial Crisis or over 20% at the peak of the tech bubble. This is yet another myth that you shouldn’t get too worked up over. Now for the final myth.

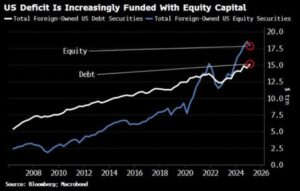

Myth 3: Foreigners Will Sell All of Our Debt

We’ve long heard that China owns a bunch of our debt and they could sell it to hurt us. But let’s look at some numbers. Back during the worst of the trade war we were again told that foreigners would sell our debt, as they didn’t want to own US based assets, but once again, the data shows this isn’t true and it is another myth.

Recent data from the Treasury showed that not only have foreign holders of our debt increased recently, they added US equity holdings as well. This is another sign that demand is higher for US assets and it was only a myth when they tried to scare you into thinking this wasn’t true.

Thanks for reading and I hope you can have some fun in the last couple weeks of summer!

For more content by Ryan Detrick, Chief Market Strategist click here

8224152.1.-07.29.25A