Competition is fierce right now in attracting and retaining top talent. Gone are the days of the onus being on job candidates to impress you – in this job market, you must also impress the candidates.

And good total compensation packages – salary, basic benefits, bonuses and commissions – aren’t going to impress them much.

But as a small business owner, you have great flexibility to provide competitive benefits and make your firm an attractive place to work.

First and foremost, you need offer a retirement benefit to your employees. You’re a financial advisor. You help people retire, and if you don’t prioritize that benefit in house, it’s not great. So, if you haven’t implemented a retirement package, stop reading, go do that, then come back and read the rest of this later. It’s that important.

Now we’re ready to dive deeper into benefits – not just the standard benefits you’re likely already providing.

The Importance of Benefits

Now more than ever, you’re seeing firms proactively go after talent to reach people who are passively open to new opportunities, in addition to those who are actively applying.

Quality benefits play a critical role in not just attracting talent, but in retaining talent as well. Firms are doing exactly what I’m telling my coaching members to do – plucking out great people, offering higher compensation – and in many cases, better benefits. And while compensation is a great way to attract and retain – review total compensation annually to make sure you’re staying competitive – overall benefits are extremely important.

This is because the next-generation talent is more focused on work-life harmony. They want to do something and work at a company they truly care about, they want to feel respected, and they want opportunities and benefits that matter to them.

HR Resources to Help with Benefits

Oftentimes advisors don’t have a dedicated HR professional, so human resources can feel overwhelming. But helpful resources are available to you.

First, lean on us, your executive business coaches, because we’re talking to advisors day in and day out. Also lean on your partner – whether it’s your broker-dealer, RIA, office of supervisory jurisdiction. You can also use resources from the Society of Human Resources Management. An annual membership to SHRM costs $229 a year and comes with access to its “Ask an HR Advisor” service, where you can pose questions to HR professionals as they arise. Subscribing to HR Magazine is also an option.

If you want to take it a step further there are Professional Employment Organizations (PEOs) to help administer your HR benefits. Not every PEO is created equal – you can use them for just payroll, or you could have a more robust HR representative – so outline what you need from a PEO and search accordingly. Searching PEOs that are accredited thorough The Employer Services Assurance Corporation (EASC) is a good place to start.

Buckets and Buckets of Benefits

For a long time, you were doing a fantastic job if you offered retirement plans, paid time off, insurance, parental and family leave, retirement planning and social events – and you likely got some tax benefits in return.

But benefits have evolved. More flexible workplaces and schedules have become the norm. Employee assistance programs (EAPs) and mental-health care are more important than they were in the past.

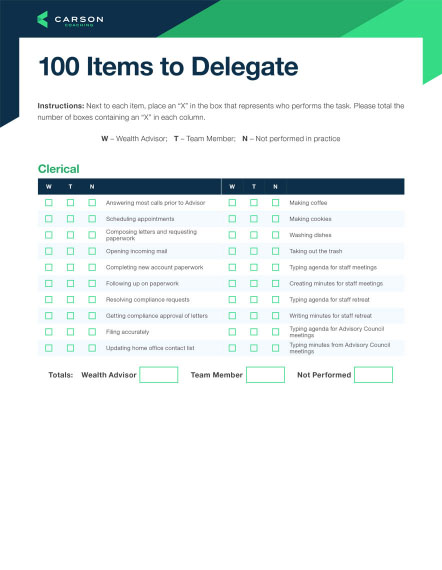

Here are the “buckets” to consider what you might want to add to your firm (or give yourself props for having them already):

Expanded Core Benefits

Benefits have expanded to include flex schedules, hybrid/remote work and even commuter benefits (see the IRS Employer’s Tax Guide to Fringe Benefits). For the latter, up to $280 per month for parking and $280 for mass transit can be excluded from employee’s taxable income. But another nice to have is something like giving your team members a $50 gas card when gas prices are outrageous or simply letting them work from home. For example, when gas prices were soaring earlier this year, Carson Group sent all stakeholders a $100 gift card to offset the costs.

Another valuable benefit is paid parental leave, which can be given to either parent so they can take time off after having or adopting a child without losing out on pay or time to bond with their little ones. Paid leave can range anywhere from 12 to 26 weeks, depending on the firm. HR Drive notes the longer the leave, the higher the retention among parents.

Education Benefits Now until January 1, 2026, firms can exclude up to $5,250 of tuition reimbursement and student loan assistance from taxable income. Anything beyond $5,250 becomes part of your employee’s compensation, and they’ll be taxed on it.

Professional Development

Professional development includes non-degree development programs, like certificates. Some companies put conferences and association dues under this umbrella too, but those are also good to have as standalone benefits.

Coaching and Mentoring

What we see happening with our Carson Partner firms is that they will pay for every salaried person in their office to have an executive business coach, which is so impactful. Whether it’s one-on-one coaching or group coaching, like Carson’s Emerging Advisor Growth Accelerator program, coaching is always a valuable benefit.

Conference Stipends

Conferences are a great way to connect with others and establish relationships across the industry, which can be difficult otherwise. This benefit is valuable to engaged employees.

Holistic Wellness Benefits

Consider offering dependent care, paid volunteer days or team volunteering activities, matching donations to non-profits, wellness reimbursements and discounts on memberships to health clubs or gyms. Some employers bring in yoga instructors a few times a month. Pet-friendly policies, subscriptions to industry publications or music streaming services like Spotify can be fun perks. Some firms even provide healthy food and beverages and discount programs for local services like car washes, dry cleaning, meal prep places and phone services, among other things.

Identify Theft Protection

Some firms offer this benefit to protect stakeholders’ identities.

How to Implement New Employee Benefits

The idea isn’t to say tomorrow you’ll do all this. Rather, take inventory of what you’re doing today, do a compensation study if you haven’t done one – or if it’s been more than a year – and see what’s important to your team members. You can use a program like Officevibe, which offers a free version for under 10 people, or SurveyMonkey.

Pick one or two benefits to implement at a time. Some of these don’t cost anything. For example, it doesn’t cost anything to let your stakeholders bring their pets to the office a few times a month. But for the higher-ticket items, I would encourage you to tap a broker like Mylo. Mylo is a marketplace that will help you find the best price for the benefit you’re considering.

You might not be in a situation where you can give a ton of money for dependent care, but maybe you can allow parents or caregivers to go home early and work flex hours. It’s also amazing what offering $100 a month to stakeholders to put toward their student loans can do – it’s not always about the dollar amount, it’s about the employees feeling acknowledged and cared for.

Insurance can also be expensive, but you can use tools like Health Reimbursement Agreements, where you provide a stipend to employees to seek out their own insurance plan on the marketplace.

In all this, however, it’s critical to connect with your company account or tax professional to ensure you’re making moves that make sense for your business.

It doesn’t have to be all or nothing. Good benefits that employees want help them feel valued in a way they might not feel otherwise. It lets them know you care about them as a whole person. It tells them you want to create an environment that encourages them to be healthy and happy.