Can you believe it? We made it to December! As we noted yesterday, we wouldn’t be surprised if we finished this year with some more green, but today we’ll look into the future and what could be in store in 2023.

First things first, let’s start with something simple. Stocks will likely be lower this year; we can all agree there. How likely is the S&P 500 to be down two years in a row? The bottom line, it is pretty rare for back-to-back yearly losses, and we don’t expect it to happen this time either. In fact, over the past 50 years, it has only happened twice. There was a three-year losing streak after the tech bubble burst in 2000, 2001, and 2002, then back-to-back losses during the vicious recession of 1973 and 1974. So it ‘could’ happen, but we don’t see many similarities between now and those two times, suggesting next year should be a bounce-back year for stocks.

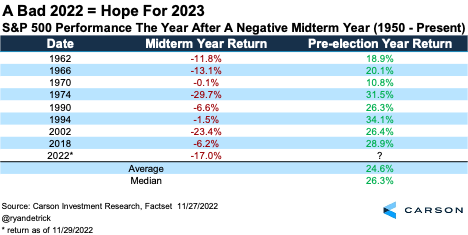

Another potential positive is that when the S&P 500 is lower during a midterm year (like we will likely see in 2022), the following year has been extremely strong. Since 1950, the year after a negative midterm year saw the S&P 500 higher all eight times, with a very impressive yearly return of 24.6%. Looking at the past 50 years, things are even better, as the ‘worst’ next year was 26.3%.

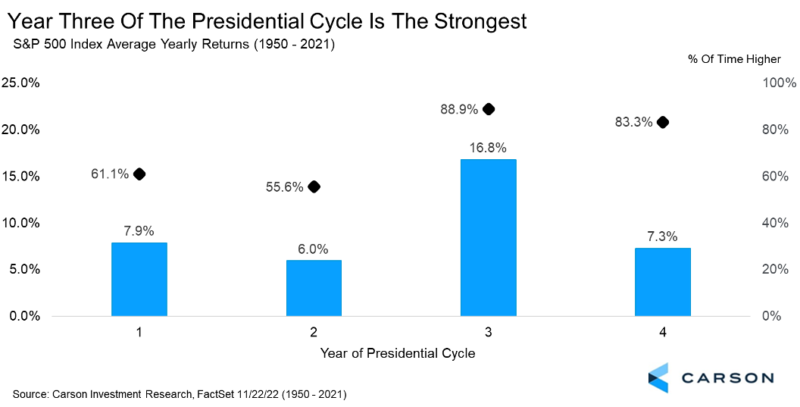

Thirdly, and somewhat similar to above, pre-election years historically are very strong for stocks, with the S&P 500 up 16.8% on average and higher 88.9% of the time. Midterm years are the worst, which clearly played out this year. All in all, that’s something for bulls to be excited about in 2023.

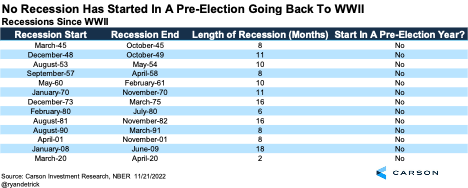

Fourth, we hear a lot about how a recession is coming in 2023, but we aren’t so sure. Sonu did a great job discussing some of this here and here.

The bottom line to us is that the consumer makes up 70% of the economy, and is still in good shape and spending. But could a recession start next year? Well, history would say it would be rare. That’s right, we found that out of the past 13 recessions, none started in a pre-election year. Full disclosure, we did see recessions begin in January in 1970 and 2008, so those were just a month away. But all in all, this is another potential positive for the bulls in 2023.

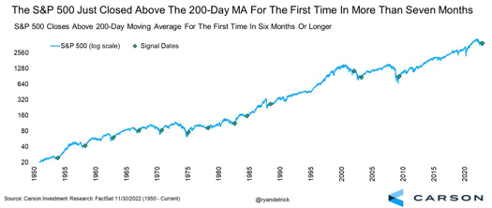

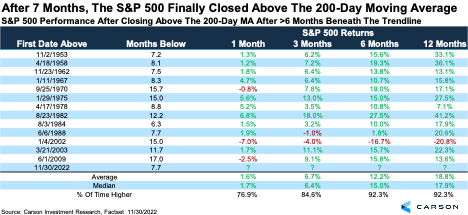

Lastly, stocks soared yesterday as investors realize that the Fed will likely end their series of aggressive rate hikes potentially quite soon. As a result of yesterday’s big move, the S&P 500 closed above its 200-day moving average for the first time in more than seven months. We took a look, and this could be potentially quite bullish.

As you can see here, previous times that saw streaks end at least six months beneath the 200-day moving average resulted in solid performance going forward. In fact, since 1950, only one out of 13 times stocks went on to make new lows, which was in 2002.

Here are the longest streaks beneath the 200-day moving average and what happened once the streak ended. Up 18.8% a year later and higher more than 92% of the time is one thing that could have bulls smiling in 2023.

For more of our latest thoughts on the market and economy, be sure to listen to episode 12 of the Facts vs. Feelings podcast with Sonu and me here. Happy holiday season, everyone!