“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.” -Peter Drucker

Last week, roughly 30% of the S&P 500 market cap reported earnings, and the spotlight was on Apple and Amazon. Despite the obligatory note of caution every CEO utters, I’m hearing companies talk a lot more about investing for future growth than about cost cutting, which is a notable improvement from the last few quarters. Management teams are cautious and there is a lot of noise clouding the outlook, but it’s hard to ignore how strong business is. Travel demand is insatiable, both Booking and Airbnb reporting record results and raising guidance for the year. Industrial investment remains strong, shares of Caterpillar rising to all-time highs after it crushed earnings estimates and offered an optimistic outlook.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Depending on who you listen to, the world may be awash in doom and gloom, but business is getting back to normal which bodes well for our House View’s overweight positioning on US equities.

Apple’s Services business stole the show, reaching a record $21.2 billion for the quarter. Services are expected to surpass $100 billion in annual sales in two years. An integral part of Apple’s profits, the Services segment boasts double the margin of hardware sales and is set to generate $60 billion in gross profit this year. Apple has plans to keep growing this business as it’s just beginning to leverage its base of more than 2 billion active devices. iPhone sales in China were a focus coming into the print and Apple delivered. China sales grew 8% in the quarter which was a big improvement after sales declined last quarter. iPhone sales in India hit a record, highlighting progress in the second largest smartphone market in the world and an underpenetrated opportunity for Apple. There is much enthusiasm for the recently announced Apple Vision Pro, the spatial computing headset. Tim Cook noted he uses it daily.

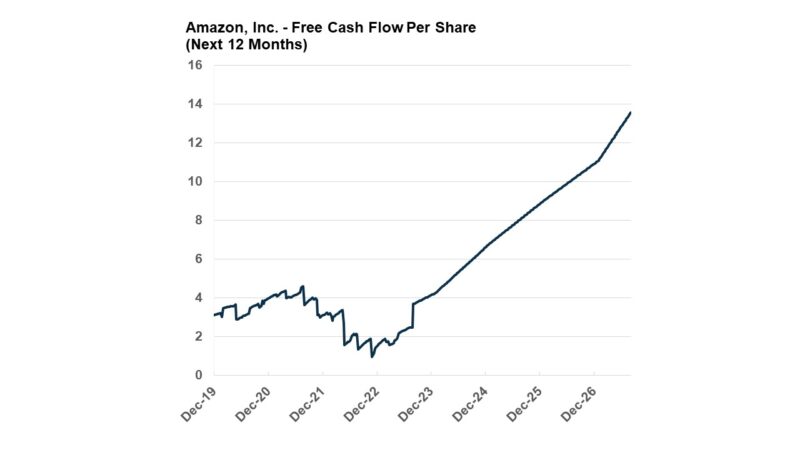

Amazon shares soared after the company announced that its AWS business stabilized and that a lot of AI applications will run on its cloud platform in the future. The company returned to double-digit sales growth and beat earnings expectations with effective cost controls. The acceleration is expected to continue into the third quarter. The growth and enormous profitability of its cloud business should help Amazon generate about $14 per share in free cash flow by 2027 (see chart), an estimate that scarcely reflects the incremental potential of artificial intelligence (AI). With growth accelerating and profitability increasing dramatically, the outlook for Amazon is compelling.

I feel the big takeaway from this earnings season is that business is getting back to normal, and that’s not a bad thing. Many companies sound cautious about the third quarter, but they have sounded cautious for over a year. In Q1 77% of S&P 500 companies beat earnings estimates despite the concerns, and thus far in the second quarter, 79% have beat estimates.

My colleagues on the Carson Investment Research Team, Ryan Detrick and Sonu Varghese, like to say on their Facts vs Feelings podcasts, follow the hard data not the soft.

As one CEO put it, you read the news and it doesn’t paint a rosy outlook, but you get to work, and we’re pretty busy. Companies aren’t overwhelmed by the reopening of the world like they had been; they’re busy like a “normal” year. A return to normal allows companies to optimize their businesses and improve profitability, which supports earnings growth in the second half of the year.

1860887-0823-A