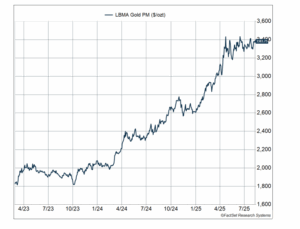

We’ve made no secret for our love for the shiny object over the last two and half years (and not just because my name is derived from the Hindi word “sona,” which means gold). I wrote about gold as a crisis hedge back in March 2023, amid the Silicon Valley Bank Crisis. We were amongst the few at the time to believe that crisis would pass without a recession and maintained our overweight to equities through it all. As it turns out the economy did more than fine in 2023 and 2024, and the bull market took off. But we weren’t 100% sure about that (in this business, you never should be), and at the time we wanted to hedge our equity allocation with a diversifier other than bonds. Gold fit the bill. In fact, it played the role almost too well—from March 31, 2023 through June 30, 2025, gold gained 66% versus 56% for the S&P 500 index (including dividends).

At the time, including gold in our portfolios was a tactical play. If we were wrong about a recession or if the bank crisis got worse, and there was a pullback in real interest rates, we wanted an asset that would diversify equities during a crisis. Gold has historically been inversely correlated with real rates (gold tends to rise as real rates fall, and vice versa).

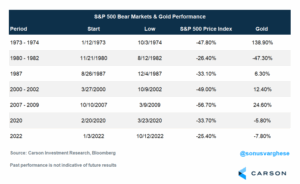

As you can see in the table below, gold has been a good diversifier during S&P 500 bear markets since the 1970s. I started here because that’s after President Nixon ended the dollar’s direct convertibility to gold (on August 15, 1971), freeing gold to float on open markets with the price determined by supply and demand rather than governments. This opened the door to gold investment, both physical and financial (including gold ETFs a few decades later).

What’s interesting in the chart below are the two periods (outside of 2020) when gold didn’t play a good diversification role: 1980–1982 and 2022. The commonality here is that real interest rates surged during both these periods, as the Federal Reserve looked to tame inflation.

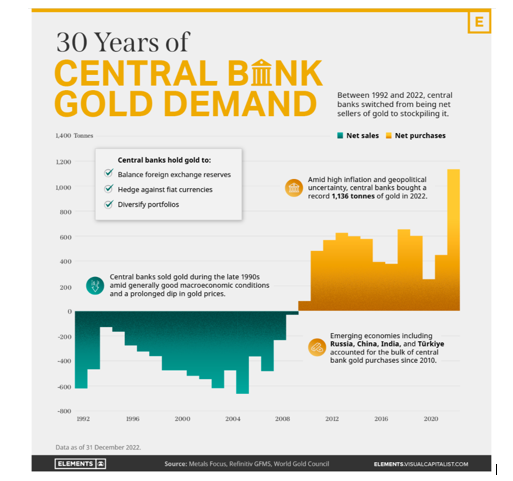

In 2023, real interest rates actually rose over the rest of the year (post SVB-crisis), as economic growth picked up. Gold went through a price consolidation phase for about a year, through April 2024. However, it surged over the rest of 2024 and the first quarter of 2025. We continued to hold our tactical gold allocation even as we remained bullish on the market and the economy. A big reason was that we also saw a lot of global central bank demand for gold, which actually started in 2022.

Central bank demand for gold continued through 2023 and 2024. Via data from the World Gold Council, here’s how much central bank net demand surged in recent years:

- 2010-2021 annual average: 473 tonnes

- 2022: 1,136 tonnes (a record high)

- 2023: 1,037 tonnes

- 2024: 1,045 tonnes

- 2025 H1: 415 tonnes (estimated)

Moreover, with the Chinese economy slowing, gold demand from Chinese households also surged as they looked for another savings vehicle that would replace real estate (which was crashing). I wrote about this last year.

For all these reasons, gold’s had an incredible run over the last two years. Almost too incredible, which is why it’s nice to see some consolidation on the price chart right now—the last time it did something similar was in 2023, after which it broke out. But as I noted above, these are tactical considerations, and the question is whether gold merits a long-term strategic allocation in a portfolio.

The Case for Gold as a Strategic Investment

Our strategic views have evolved over the last few years. We remain positive on the outlook for equities over a strategic timeframe (3-5 years), especially relative to other asset classes. But beyond the overall outlook for equities, our view is that:

- Inflation will be volatile going forward. This doesn’t mean average inflation will be much higher than 2%, but we’ll see more variability.

- The Fed will have to keep rates on the higher side to keep inflation close to their target of 2%

- Bonds will not work as well as they have been as a diversifier, i.e. the correlation between stocks and bonds will generally be higher than what we saw over the 2000-2020 period.

- This is not to say we don’t like bonds (we still think they will diversify amidst a deflationary recession) but we want to diversify our diversifiers

- Since we are roughly agnostic on US vs international growth prospects (just because there is too much uncertainty), we don’t want to be over-exposed to the US dollar (in contrast to the last decade, when the US outshone the rest of the world and being all in on the dollar worked well).

We’ve been writing about this for near on two years now in our outlooks, including most recently in our MidYear Outlook ’25. With the above in mind let’s walk through why gold fits well within our strategic outlook, and allocations.

A diversifier that can compound wealth and diversify portfolios

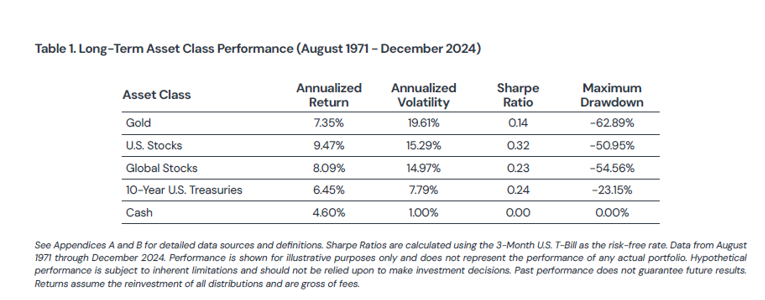

Our friends at Return Stacked Portfolio Solutions recently wrote a fantastic report on gold, showing that gold is not only a capital preserver, but also a wealth compounder. From 1971 to 2024, gold delivered an annualized return of 7.35%, transforming $100 into about $4,400. That’s less than the S&P 500’s 9.5% return, but better than 10-year US Treasuries and cash (short maturity Treasuries).

Source: Return Stacked Portfolio Solutions – 8.14.25

Gold has also been good asset to protect against inflation. It’s not been a perfect “hedge” amid short-term bursts of inflation, but gold has been able to maintain purchasing power over decades. And then some. Over the same 1971 to 2024 period, while $100 invested in gold grew to $4,400, the Consumer Price Index (CPI) climbed 768%. In other words, gold has easily outpaced inflation.

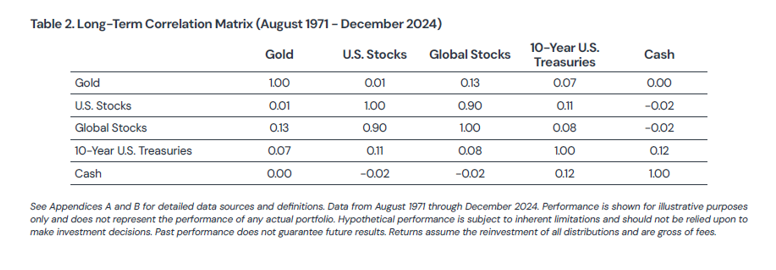

At the same time, as you can see in the table above, gold has historically been more volatile than stocks, and the period analyzed covers a pretty volatile period for stocks, including several bear markets. But what’s key is that gold has had low correlation to both stocks and bonds, as the table below illustrates. That gets to another favorable property of gold: its ability to diversify a portfolio, especially during periods of crisis and equity bear markets (as I discussed in the prior section).

Source: Return Stacked Portfolio Solutions – 8.14.25

A currency diversifier

The Trump administration is trying to remake the global trading system, with the eventual goal being to reduce the trade deficit. It’s an open question as to whether this will happen, and whether they have the will to see it through. But even if the average effective tariff rate rises to 15-20% (it was 2-3% at the beginning of 2025), imports are likely to fall. But this also means the rest of the world will have fewer dollars with which to buy US assets—in contrast to the last two decades when foreigners binged on, initially US debt (2000s and early 2010s), and subsequently on US stocks (since 2015). At the margin, it’s likely that foreign holdings of US debt, as a percent of overall Treasury debt, continues to fall (it’s been falling since 2014). Meanwhile, supply is going to explode thanks to deficits running around 6-8% for the next few years.

Moreover, fiscal spending in Europe (and perhaps in China) means foreigners may not have to look to the US for growth, or US safe assets for that matter (especially if the EU starts issuing a lot more debt). That doesn’t create a great outlook for the dollar, especially if US growth downshifts and growth abroad picks up. And as foreigners look for other non-US investments, demand for gold can potentially increase.

We’re not saying this is going to happen, or even that it is the base case—there’s a lot that is uncertain. But we want to be prepared. Hence our motivation to reduce over-exposure to the dollar. The easiest way to do this is to buy foreign assets—when you buy international stocks (or bonds) you are also exposed to the local currency, unless it’s explicitly hedged. However, we are already overweight equities and have a neutral stance on international vs US equities. Simply put, we don’t want to increase our international exposure further. Buying international stocks (or bonds), involves two bets: a bet on the local currency and a bet on the local stock markets (or local bonds).

On the other hand, gold works as a straight-out currency diversifier that is not tied to the economic fundamentals of any single country. The team at Return Stacked Portfolio Solutions showed that the historical data reveals a consistent inverse relationship between gold and the dollar: for every 1% of dollar weakness, gold has historically jumped 0.9% on average. The dollar’s movement doesn’t explain the entirety of gold’s price movement (just about 15%), but the negative correlation has persisted over five decades.

To summarize, we believe gold can play a key role in our strategic portfolios given our current long-term outlook, including:

- Diversifying the portfolio while compounding returns

- Preserving wealth by protecting against inflation

- Playing the role of a crisis hedge, including during bear markets

- Working as a currency diversifier

Ryan and I chatted with J.C. Parets, a popular market technician, on our latest Facts vs Feelings episode. Amongst a range of topics we covered, we spent some time talking about gold as well. Take a listen below:

8284224.1.-08.14.25A

For more content by Sonu Varghese, VP, Global Macro Strategist click here