In my previous blog, I discussed our longer-term strategic outlook, the core of which is that we remain optimistic about globally diversified equities. But even beyond equities, our view is that:

- Inflation will be volatile going forward. This doesn’t mean average inflation will be much higher than 2%, but we’ll see more volatility.

- The Fed will have to keep rates on the higher side to keep inflation close to their target.

- As a result, bonds will not work as well as a diversifier, i.e. the correlation between stocks and bonds will generally be higher than what we saw over the 2000-2020 period.

- Since we are roughly agnostic on US vs international growth prospects (just because there is too much uncertainty), we don’t want to be over-exposed to the US dollar (in contrast to the last decade, when the US outshone the rest of the world and being all in on the dollar worked well).

This is why our team now views gold as playing a key role in our strategic portfolios, including:

- Diversifying the portfolio while compounding returns

- Preserving wealth by protecting against inflation

- Playing the role of a crisis hedge, including during bear markets

- Working as a currency diversifier

This is not to say we don’t like bonds (we still think they will diversify amidst a deflationary recession) but we want to diversify our diversifiers, including gold and even managed futures, which can outperform during bouts of surging inflation.

But this does raise the question as to how to make room in the portfolio for all of these diversifiers, given we’re also overweight equities. How do we keep adequate exposure to bonds, even as we add gold and managed futures?

Enter Capital Efficiency

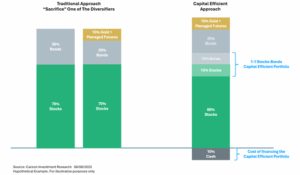

Say we have 65% of a portfolio allocated to stocks and 35% to bonds. A deflationary recession is unlikely in our view, but still possible, and so that is the level of bond exposure we think sufficient to diversify the equity overweight (relative to a 60% stocks, 40% bonds portfolio). Yet, given our strategic views we also want to include gold and managed futures in the portfolio. The only way to “make room” for that is to reduce the equity overweight, or the bond allocation, neither of which is something we want to do.

The good news is that we can do this using exchange-traded products (ETFs) like WisdomTree’s Efficient Core portfolios or Newfound/Resolve’s return stacked portfolios (full disclosure: we have been using these funds for years now). As an example, what this allows us to do is achieve $1 of exposure to equities, while also achieving $1 exposure to bonds. So, if we hypothetically allocate say, 10% of our equity allocation to a more capital efficient solution, we achieve 10% of equity exposure PLUS 10% of bond exposure. That frees up 10% of the bond allocation to allocate to gold and managed futures, since the direct bond allocation can be reduced from 35% to 25%.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Of course, the question is how capital efficiency, or “return-stacking,” is achieved. The answer is leverage, via futures contracts. Leverage is usually a dirty word in our business, mostly because it’s often used to amplify similar or identical bets and that can turn ugly when there’s volatility (example, investing a $1 in a stock, and borrowing $1 more to invest in the same stock). However, for capital efficiency, the extra dollar that is borrowed is invested instead in a typically uncorrelated asset (like bonds, or even managed futures).

There is also the question of financing rate for the money borrowed. Interest rates are much higher now, but as the folks at Newfound/Resolve explain, borrowing rates are much more competitive when you use futures. They also point out that as long as you expect risky assets (like stocks and bonds) to have a positive return in excess of cash, the level of interest rates should not matter to applying leverage to capture the risk premium (as you can do with futures).

As I wrote at the top, we’re optimistic about the outlook for stocks in 2025. But we also believe bonds are likely to outperform cash. Here’s a hypothetical illustration of how we seek to diversify our diversifiers using capital efficiency, as opposed to the traditional approach where we must sacrifice one of our diversifiers (either bonds or managed futures) to expand out to additional diversifying asset classes.

In addition to a more diversified portfolio, the hurdle rate on a “line item” basis is also lower when using capital efficiency (though we’d argue that portfolios should be evaluated as a whole, rather than on a line item basis). In the traditional approach, if you include alternative assets like gold and managed futures, you’ll eventually end up comparing them to stocks or bonds, depending on the funding source (the asset that was “sacrificed” for the alternative exposure). With capital efficiency, the alternative asset, bonds, and/or stocks (depending on which ordinarily would’ve been sacrificed to make room for the others) only have to do better than cash. That’s a smaller hurdle.

An Old Idea

Capital efficiency is not a new idea. It’s similar to one explained by Cliff Asness, co-founder of AQR Capital Management, in 1996. In a rather tongue-in-cheek response to the question “Why not 100% equities?”, he argued that an investor willing to bear the risk of 100% equities can do even better with a diversified portfolio. Asness used data from 1926 through 1993 to show that a levered 60/40 portfolio (1.55x) exhibited similar volatility to a 100% equity portfolio but had a higher return. Jeremy Schwartz, WisdomTree’s Director of Research, showed that the concept worked even out-of-sample between 1994 and 2018.

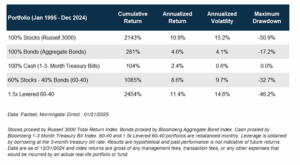

The following table compares returns, volatility, and drawdowns for portfolios of 100% stocks (Russell 3000), bonds, and cash to a 60/40 portfolio and a 1.5x levered 60/40 portfolio (with the 1-3 month Treasury rate used for financing). The period is the last 30 years, through 2024.

As the table illustrates, an investor comfortable with equity-like volatility would have been better off with the 1.5x levered 60/40, which has a higher return than equities with similar levels of volatility (hypothetically, looking back over the last 30 years). In fact, this is how we allocate to gold, managed futures, and even bonds in our most aggressive growth portfolios, without sacrificing equity exposure.

On the other hand, an investor could also use a levered strategy to create a more capital efficient portfolio. They could allocate two-thirds of capital to it—giving them 60/40 like exposure—and overlay alternative asset classes using part of the remaining capital, ideally dampening volatility and drawdowns. And as I noted earlier, this approach also lowers the “hurdle rate” for the alternative allocation, whether it’s managed futures, gold, or something else. These alternatives now only have to beat cash, instead of stocks and/or bonds.

We believe capital efficiency is an important portfolio construction tool, even more so when there’s uncertainty about the macro environment we are in. That leads to questions about which diversifier can potentially work best. Using a capital efficient portfolio helps answer that by saying “why not use all of them?”, without sacrificing the amount of exposure you want to any particular diversifier.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here

8289779.1.-08.15.25A