We’ve been talking about the fiscal impulse from the individual tax cuts coming for a while now, and highlighted this as a potential tailwind in our 2026 Outlook: Riding the Wave. Here’s what we wrote in our Outlook:

“The One Big Beautiful Bill Act (OBBBA) is going to increase deficits by about $4 trillion over the next decade, including interest costs (the cost will rise to $5.5 trillion if tax cuts are extended beyond 2028, which is likely). That means the deficit is going to run at a whopping 6-8% of GDP for a few more years. The US government has never run this level of deficits (as a percent of GDP) in the middle of an economic expansion. Historically, the budget balance heads toward a surplus as expansion continues, but not now. That’s not great for the government’s balance sheet (more than half the deficit is interest costs), but the other side is that deficits eventually flow into corporate profits. That’s good for markets in the near term, especially since a lot of the tax cuts will be front-loaded. Tariff revenue will offset some of this but not all (assuming that the tariffs even stick around).

The positive impact of the tax bill, for the economy and even markets, will be felt as soon as 2026 begins. That’s because a lot of tax cuts were made retroactive to 2025. This includes new deductions on tips and for seniors’ income, and much larger deductions for state and local taxes (income and property taxes). A lot of households are going to see outsized tax refunds in the first half of 2026, which is likely to boost consumption (and markets, if households use some of the money to buy stocks).” -Carson Investment Research, 2026 Outlook: Riding the Wave

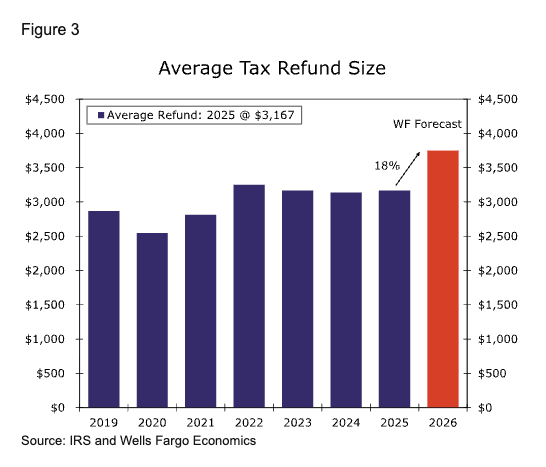

Here are a couple of interesting charts related to the outsized refunds households will receive once they file taxes this year.

This one is from Wells Fargo, via our friend Josh Schaeffer at Barrons. Wells Fargo projects the average tax refund will increase by 18% this year, from an average of $3,167 in 2025 to over $3,700. The above is obviously just an average and it could vary a lot across income groups.

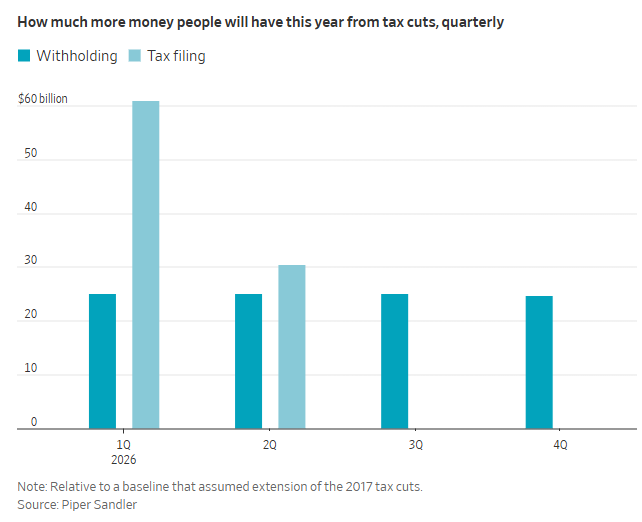

The Wall Street Journal looked at this “stimulus” from an aggregate perspective. While the tax cuts are retroactive to the start of 2025, tax withholding tables were also adjusted at the start of this year. As columnist Greg Ip points out, this will generate a “double-barreled” stimulus. Many workers will see both higher take-home this month and a refund on last year’s taxes when they file their returns. It’ll be the equivalent of injecting about $200 billion into the economy, potentially boosting annualized growth in the first half of 2026 by 0.5%-points.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Normally, tax refunds don’t result in a boost in consumption, since it’s baked into people’s expectations. But this year a lot of households will see outsized refunds, and that has the potential to boost spending in Q1 and Q2.

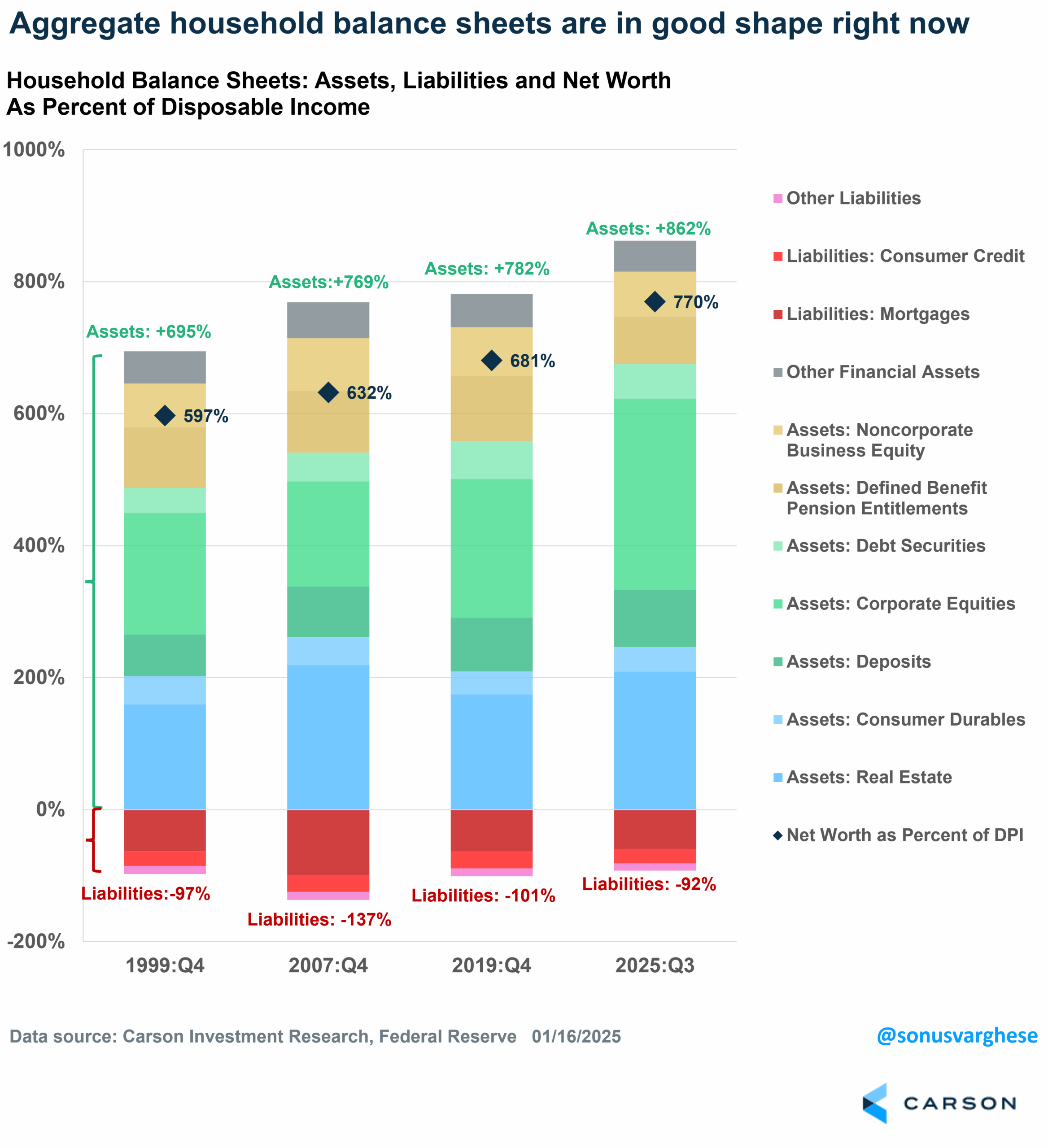

It’s the equivalent of getting a nice big check from the government, like in 2020 and 2021. Remember what happened with those? The majority was spent on goods and services, and even the stock market to a degree. A lot of it was used to pay down debt, which is why household balance sheets are still in good shape, with the lowest level of debt (relative to disposable income) we’ve seen in a long time. Household net worth in aggregate has surged to 770% of disposable income, up from 681% at the end of 2019. This is because assets have grown and liabilities have shrunk:

- Assets have jumped from 782% of disposable income at the end of 2019 to 862% as of 2025 Q3, thanks to rising stock prices (corporate equities have risen from 210% to 290%) and home values (real estate has increased from 175% to 209%, almost as high as it was in 2007 before the housing crash).

- Liabilities as a percent of disposable income have shrunk from 101% at the end of 2019 to 92% as of 2025 Q3 — that’s even below the 1999 level of 97% (which was before households went on a debt binge amid the housing bubble in the early-to-mid 2000s).

Household balance sheets are in the best shape we’ve seen for decades, both on the asset and liability side.

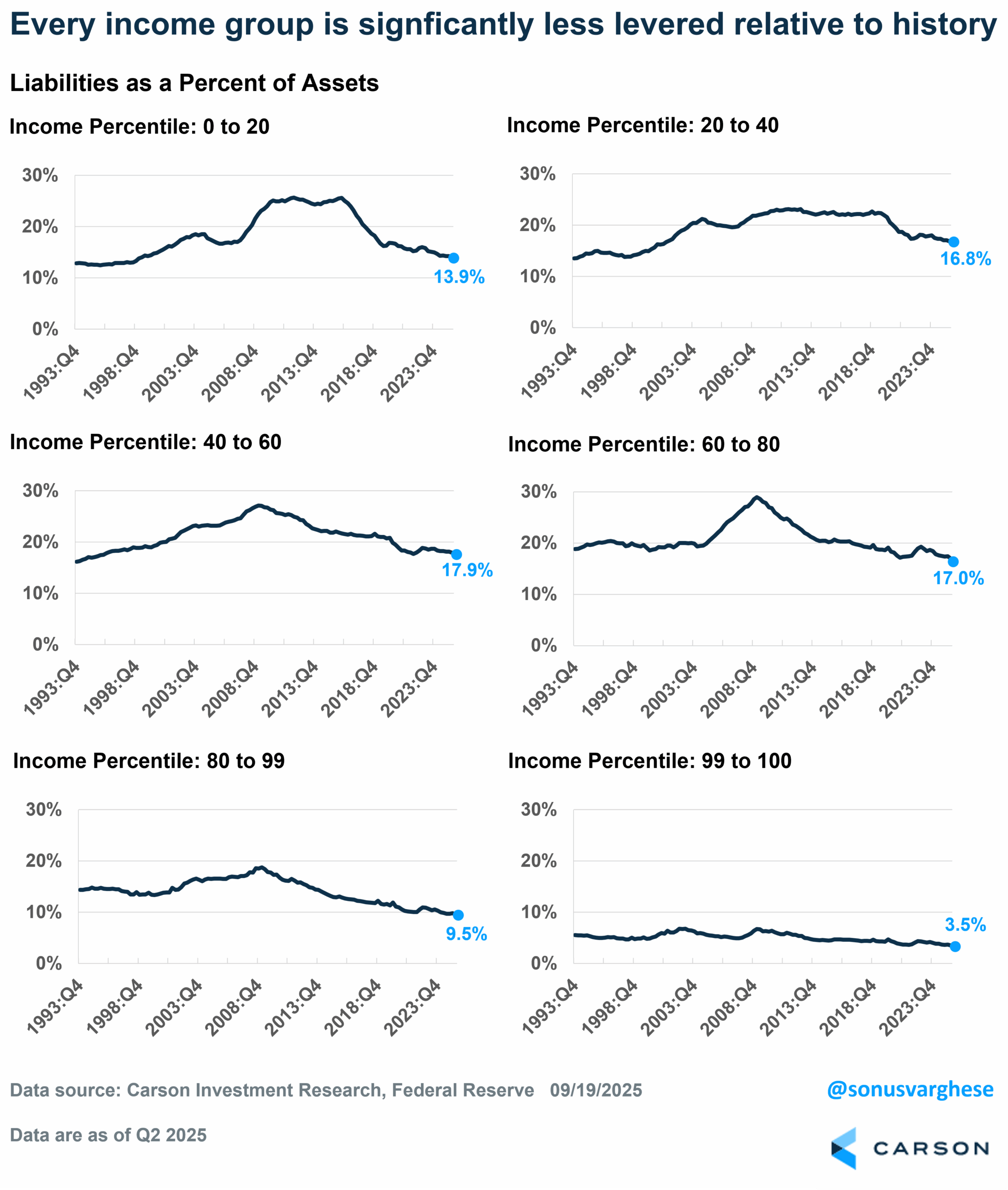

There’s always skepticism about the above chart because it shows the picture for all households, and there’s concern that the data may only capture wealthier households, which get more weight. Well, as it turns out, things look good even if you break assets vs liabilities by income percentile. Every quintile of income is currently less levered than they’ve been historically — liabilities as a percent of assets have been falling across all these income quintiles as you can see in the chart below.

All this to say, the OBBBA has a nice incoming tailwind for households in the form of tax cuts. Moreover, the OBBBA also has provisions allowing businesses to fully write off capital spending. That’s going to boost profits as well.

The message, as we wrote in our Outlook: “Don’t fight loose fiscal policy.”

On top of this we have a couple of other policy-led tailwinds:

- More rate cuts by the Fed, though this is now likely only after May.

- Less of a drag from tariffs, in contrast to last year.

One additional factor that will be less of a headwind in 2026 is student loan payments. Last year saw the resumption of student loan payments for the first time in five years (technically, they restarted in 2024, but borrowers were not reported to credit bureaus if they didn’t pay). As a result delinquencies surged to 20%, the highest in history. But this year, that is going to be less of a drag.

Ryan and I talked about this in our latest Facts vs Feelings episode, in addition to the rumble in Washington D.C. between the Trump administration and Fed Chair Jerome Powell. Take a listen.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

8718167.1. – 16JAN25A