“Vaughn into the windup and his first offering …. Juuuuust a bit outside.” Harry Doyle (played by Bob Uecker) in the 1988 classic baseball movie Major League

First things first, how funny was Major League? I was just a kid when it came out, but I’d watch that movie over and over growing up and have many fond memories of laughing and laughing at the jokes. The quote above comes from the hilarious Bob Uecker (RIP to one of the best ever) when Rickey Vaughn throws a ball that misses the plate by several feet. If you haven’t seen the clip, find it.

The Worst Was Avoided

Which brings me to some of the calls we saw last March and April.

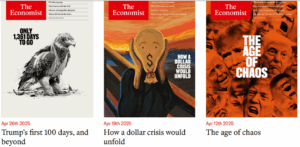

I grew up reading The Economist magazine, but lately they’ve taken a decidedly pessimistic view of the world, but maybe none so much as this image from March of President Trump literally lightening money on fire. Say what you want about our president, but this tells you a thing or two about the sentiment back then.

Then near the lows in April, Harry Dent came out and said a crash was coming and some highflying stocks would fall 99%. Yeah, that one was just a bit outside. You can read more about Harry Dent on your own. Just know he has been saying a crash is coming for many, many years amid one of the strongest and longest bull markets ever.

Lastly, the week of the lows in April, The Economist had this cover about chaos. All we’ve seen since then is a record six month rally and some of the least volatile moves in history. Juuuust a bit outside.

In fact, here’s a string of three straight covers, coming right off the rocket ship rally off the April lows. From a contrarian point of view, we love to see this, as it tell us a lot of bad news is priced in.

Listen, it wasn’t just The Economist or Harry Dent saying things like this back in March and April. It was everywhere. People I hadn’t heard of for twenty years were reaching out to tell me how President Trump was going to crash the market and send us straight to a recession. People were mad, sad, confused, and angry. But as we noted way back then, markets don’t care about any of this; all they care about is what is priced in and what isn’t priced in. If you are reading this then you know we were in a very lonely boat that said things weren’t as bad as they were telling us. We remained overweight equities and even when stocks were down nearly 20% said a huge rally and eventual new highs in 2025 were still likely. Sure enough, the worst so many were certain was going to happen never did and we are back to your regularly scheduled bull market.

Now What?

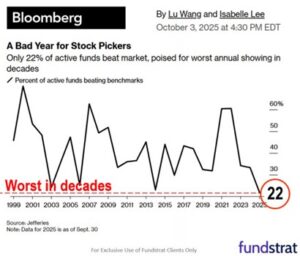

So what could happen now? We remain optimistic that a solid year-end rally is possible. Here’s a nice chart from Bloomberg and Tom Lee, Founder and Managing Director at Fundstrat. It shows that only 22% of active managers are beating the market this year, one of the lowest levels the past two decades. This shows money managers likely panicked back in April and missed the majority of the huge rally, so now they are ripe to add on any modest weakness, likely creating a solid bid in Q4.

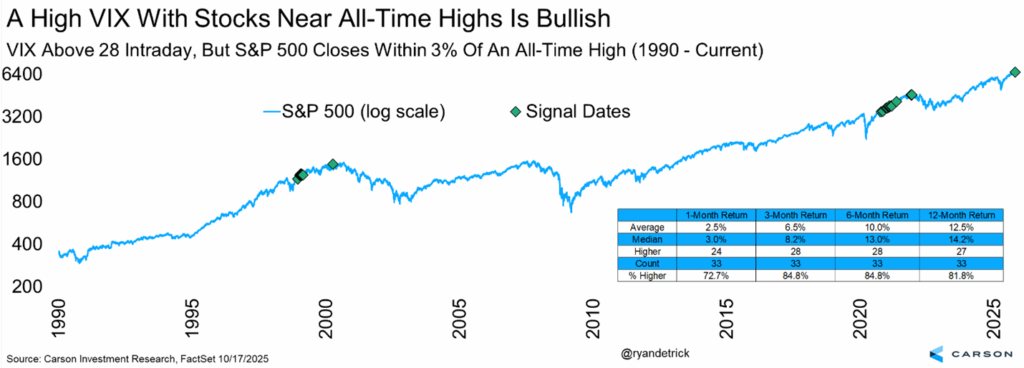

The action in the Volatility Index (VIX) the past few days has been historic as well. Last Friday, amid US/China trade worries, regional bank worries, and more, we saw the VIX spike to nearly 29, yet the S&P 500 closed within 3% of an all-time high. It is very rare to see fear spike with stocks near all-time highs. There were two other periods we saw this, in the late 1990s and after Covid. Both were excellent times for investors and we don’t think this time will be much different.

Oh, one more reason to think this rally has legs? Here’s the latest The Economist cover.

As always, thanks for reading—it truly is appreciated. We are super pumped to announce we are doing another Halloween livestream edition of Facts vs Feelings. Follow us on social media for more info, but you can sign up here to watch it all Halloween morning.

For more content by Ryan Detrick, Chief Market Strategist click here

8528058.1.-22OCT2025