“Rule one, politics usually don’t move markets and I hate talking about politics. Rule number two, never forget rule number one.” Ryan Detrick, Chief Market Strategist at Carson Group

With all of the latest news on Greenland, tariffs, the Federal Reserve, and more, I decided to take a look at politics and markets today. Let’s be super clear here — I hate talking about politics and in my career I’ve seen so many investors get worked up over politics and miss huge gains. And the effect has been completely bi-partisan —investors on the left and right are equally vulnerable, although obviously at different times. How many were convinced a recession was coming last April for instance? And as a result sold near major lows, because they saw on the Sunday morning talk shows how bad tariffs were going to be? Sadly, a lot did, including many investment managers, causing them to underperform benchmarks.

Let’s get to it.

Politics and Investing Don’t Mix

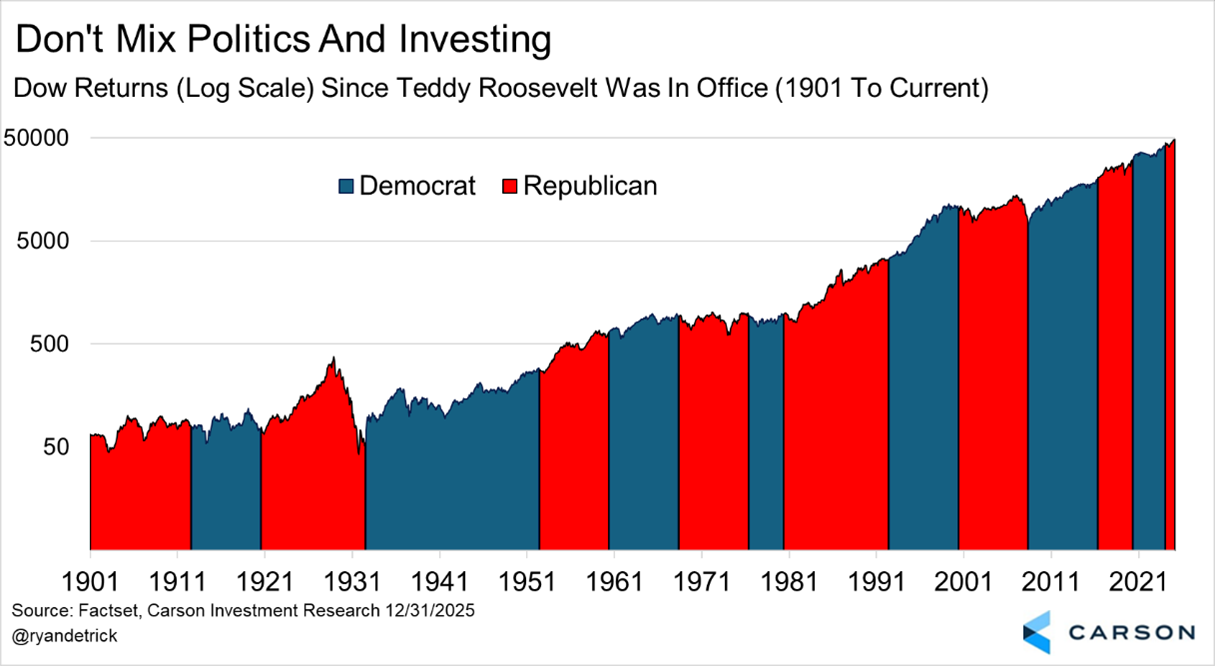

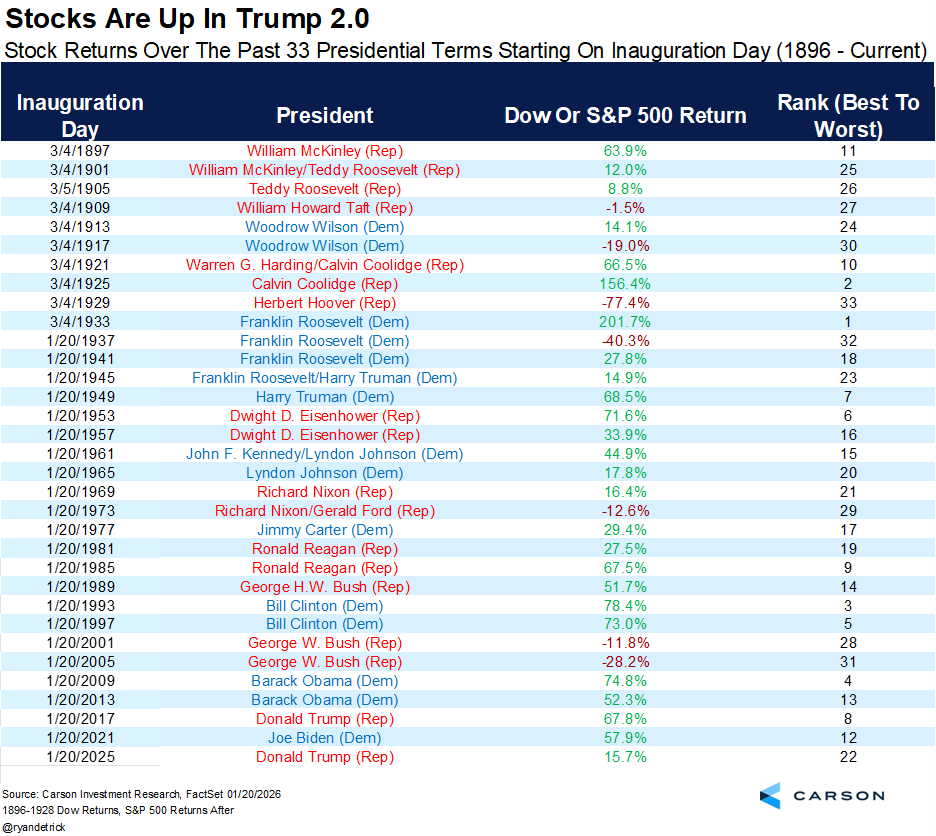

Similar to beer before liquor, politics and investing don’t mix. We’ve shared the chart below for years now and it is important to remember that stocks have bull markets and bear markets under both parties. I saw so many investors say they didn’t like President Obama and miss out on eight great years. Many didn’t like President Trump 1.0 and they missed out on four good years. Or didn’t like President Biden, again missing out on solid gains. Now we are back to Trump 2.0 and I’m hearing the same things. Bottom line, don’t mix politics and investing!

Midterm Years

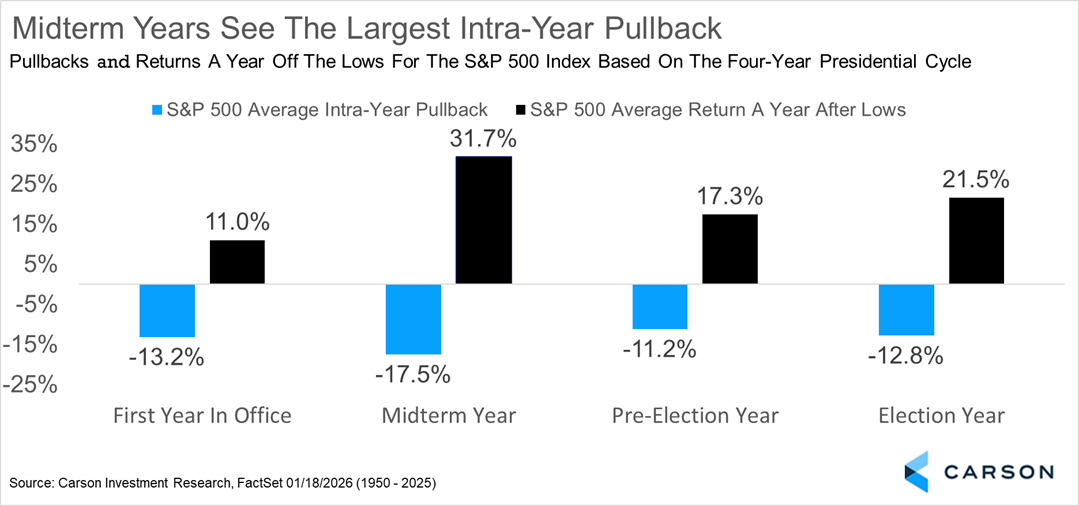

As we discussed in our recently released 2026 Market Outlook: Riding the Wave, midterm years can be rather volatile. Here’s a chart I just made that shows how the four-year presidential cycle looks. We still think this year will be a solid one for investors, but good to be aware.

Speaking of midterm years, no year in the four-year cycle sees a larger peak-to-trough pullback than the midterm year at 17.5%. Of course, a year off those lows, stocks have never been lower and are up more than 30% on average.

Who Is Better for Stocks?

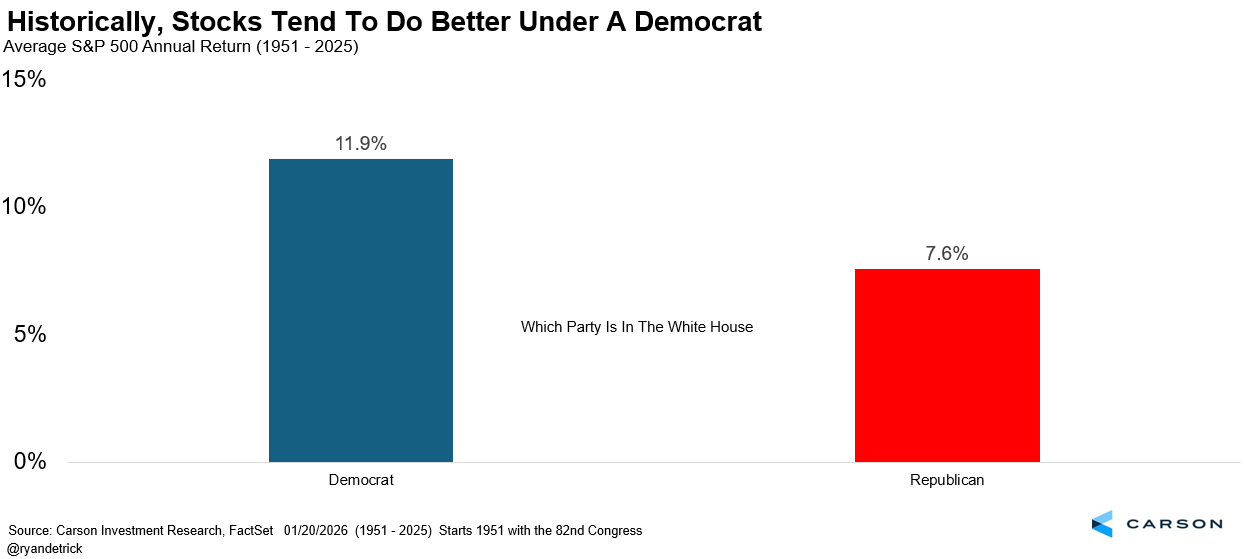

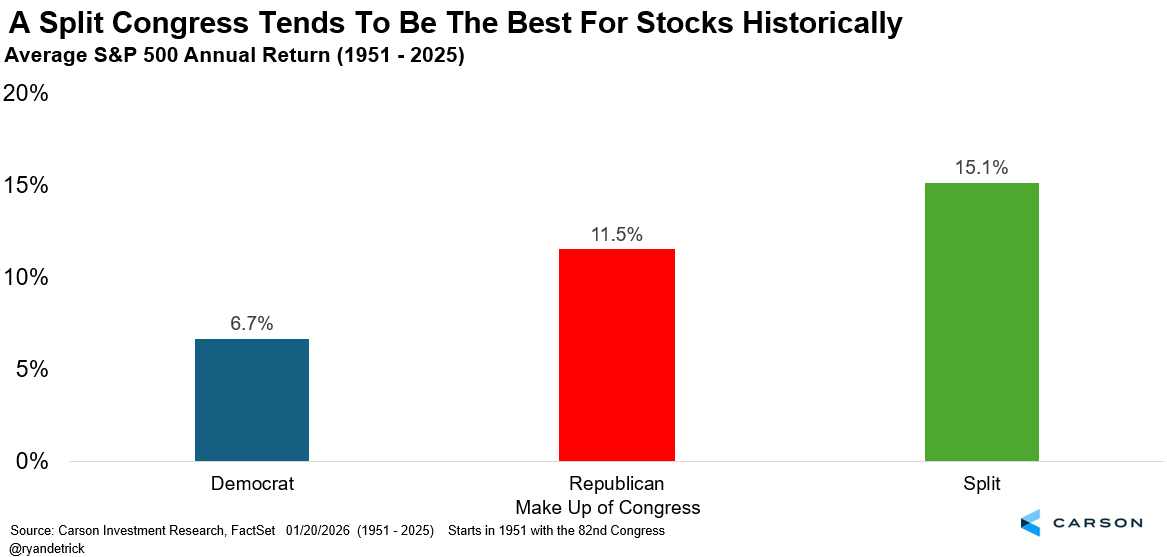

I know, I know. But who is better for stocks? Well, technically, it is when a Democrat is in the White House historically.

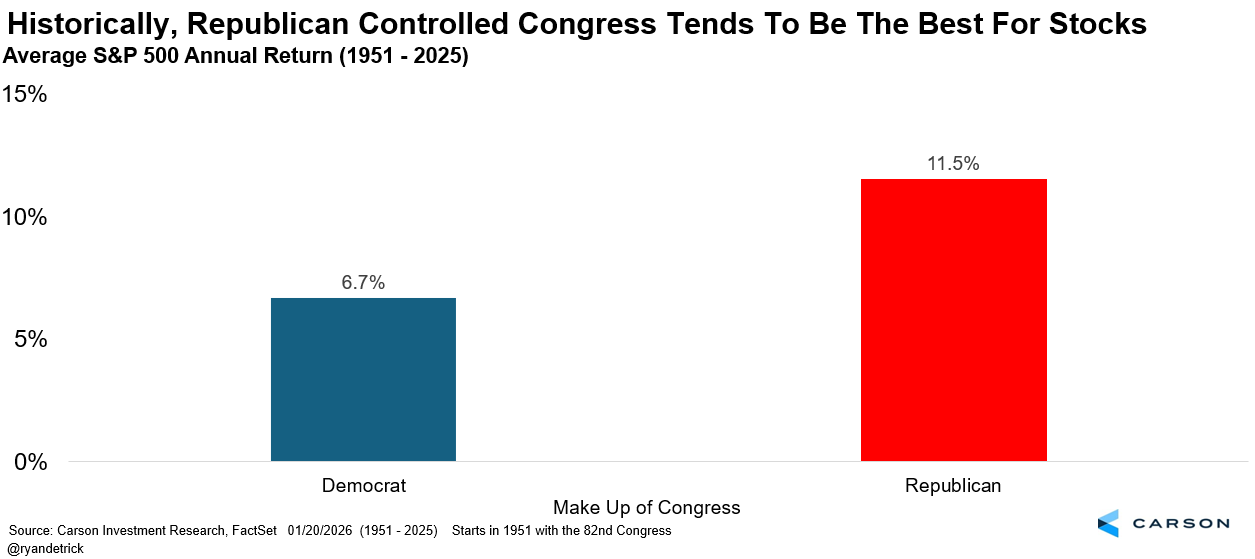

Now don’t worry, if you didn’t like that one, you love my next one. You could argue you can get more done with you control both chambers of Congress and under this scenario, stocks do much better under Republicans.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

History Dictates, A Split Congress Is the Best

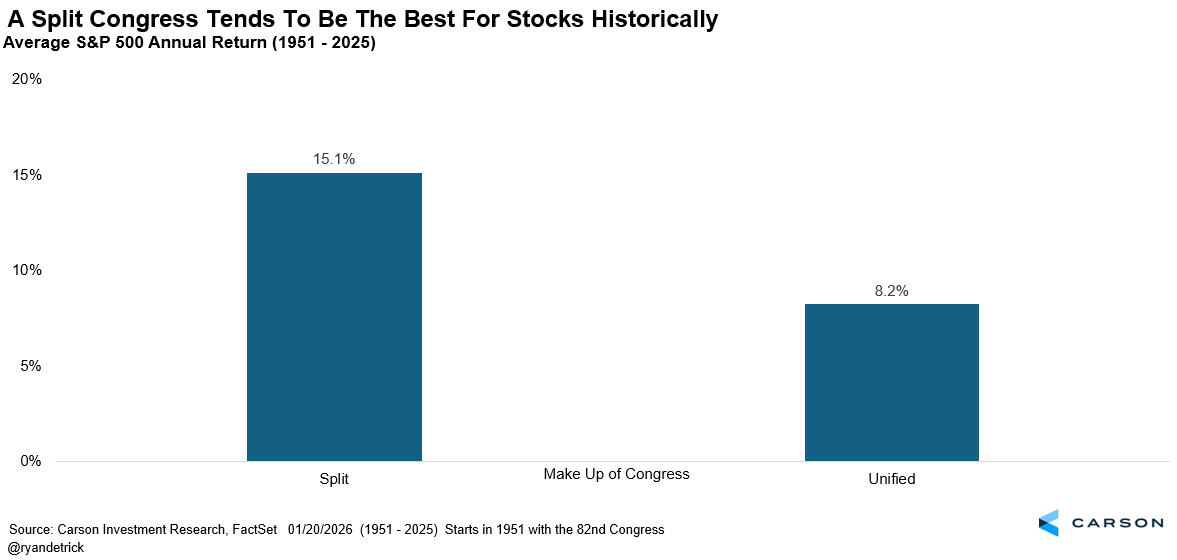

Here’s the thing though, it is when you have a split Congress that things tend to do even better.

In fact, the past 13 times we had a split Congress, stocks were higher every single time! Maybe the best Washington is one that can’t get anything done? Or if you want to be more optimistic, one forced to compromise?

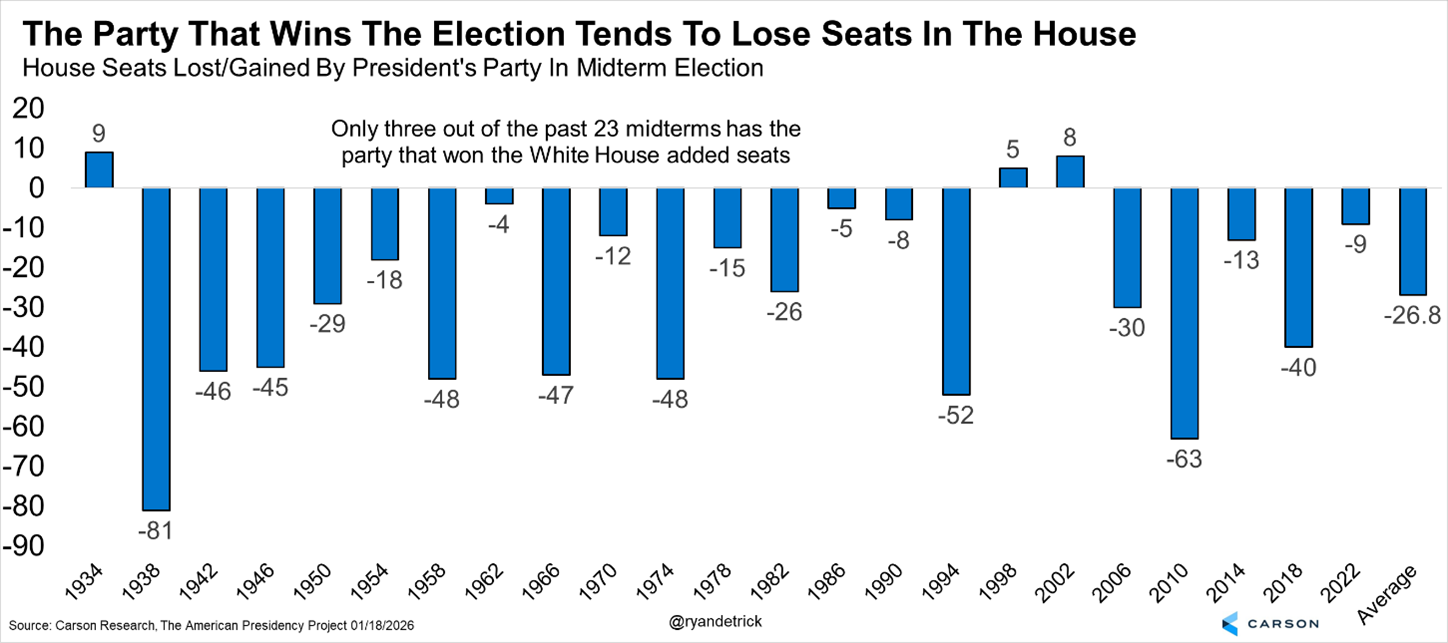

Which brings us to now. Please don’t shoot the messenger, but the Republicans currently have a historically small majority in the House and will likely lose the House in the midterms later this year. In fact, only three times the past 23 midterms did the party in the White House add seats and the average was a loss of nearly 27 seats.

Now, it is widely assumed the Republicans will keep control of the Senate, meaning we’ll have a split Congress after midterms. Here’s another one that shows split Congresses tend to see nearly twice as strong returns as a unified Congress.

One Year Under Trump 2.0

No politics blog would be complete without noting that yesterday completed the first year of President Trump’s second term. It was quite the roller coaster, but in the end, stocks were up a solid 16% one year into things.

Thanks as always for reading and for our latest thoughts on Greenland, earnings, market rotation, and so much more, be sure to watch our latest Facts vs Feelings podcast below.

For more content by Ryan Detrick, Chief Duplicate PostMarket Strategist click here.

8727774.1. – 21JAN26A