Microsoft’s latest quarterly earnings report revealed that the company’s AI offerings are powering growth beyond what the company expected. Azure, Microsoft’s cloud computing business, continues to exceed expectations and post accelerating revenue growth rates. Many “AI-native” companies, including OpenAI, rely on Azure’s unique product portfolio to help train and advance their offerings. By providing the infrastructure that powers much of the AI-boom, Microsoft has captured an outsized share of one of the world’s fastest-growing industries.

Azure is Accelerating

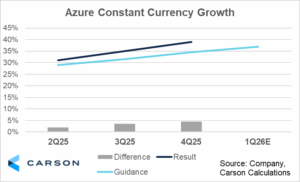

Microsoft’s latest results were highlighted by better-than-expected growth in Azure, its cloud computing segment. On a constant currency basis, Azure grew revenue by 39% in the quarter, compared to the company’s guidance of 34.5% (company data). This 4.5 percentage point revenue growth beat was quite impressive compared to recent history. As shown in the chart below, Azure ‘only’ beat revenue growth guidance by 3.5% last quarter, and by 2.0% in the quarter before that. The company’s ability to beat revenue growth expectations when guiding for accelerating revenue growth underscores the strength of demand for Azure.

Beating revenue expectations is often a sign of a robust demand environment. Looking ahead, Microsoft has guided for 37% Azure growth next quarter, suggesting that momentum is likely to continue. CFO Amy Hood noted the imbalance between capacity and demand, stating: “While we brought additional data center capacity online, demand remains higher than supply… In January, I thought we’d be in better supply/demand shape by June. And now I’m saying I hope I’m in better shape by December.” In just six months, Azure’s AI-focused services have scaled so rapidly that demand is surpassing Microsoft’s ability to expand infrastructure.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Rising Market Share

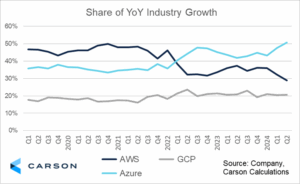

Azure’s AI-product focus has also accelerated market share gains. Many “AI-native” firms have built their operations using Azure to take advantage of tailor-made tools other hyperscalers may not yet have. In specific, OpenAI, one of the largest AI-native companies, uses Azure to train and deploy its large language models. This partnership has proven highly beneficial: as ChatGPT usage has surged, so too has Microsoft’s revenue from supporting its underlying infrastructure. Microsoft has experienced a step-change higher in market share among the “big three” cloud providers (Amazon AWS and Google GCP being the others). Before the AI wave in late 2022, Microsoft averaged about 35% of new industry revenue (company disclosures, Carson calculations). Since early 2023, that figure has risen to 45% (and registered above 50% this quarter), highlighting Azure’s growing dominance in an AI-centric world.

Microsoft’s latest earnings illustrate how central AI has become to its growth trajectory. Azure’s accelerating revenue, consistently strong beats against guidance, and rising market share underscore the company’s unique position in the cloud market. The surge in demand, particularly from AI-native companies like OpenAI, has pushed Microsoft’s infrastructure to its limits—a clear sign of both strength and opportunity. With guidance pointing to further growth and AI adoption still in its early stages, Microsoft appears well positioned to remain a leader in cloud computing.

8295187.1.-08.18.25A

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here