Six of the magnificent seven stocks have reported earnings: Apple, Tesla, Alphabet, Microsoft, Amazon, and Meta. They are buzzing about the seventh, Nvidia. Companies are scrambling to get their hands on Nvidia’s computing chips as if they were Wonka Bars that might have golden tickets. They are spending enormous sums of money to harness AI’s potential, or promise. The AI revolution is being spurred by a breakthrough in computing technology, enabled by Nvidia’s latest chips that are magnitudes more capable than prior generations. Nvidia CEO Jesen Huang expects the company could sell $250 billion worth of its chips annually, a tenfold increase in sales, as it caters to the insatiable demand of its customers.

The top customers are pouring unprecedented amounts of capital into the AI arms race. The largest spenders are the tech giants that pioneered the cloud: Amazon, Microsoft, and Google. The cloud is the gateway through which the world accesses AI, and these providers are in a frenzied competition to meet the burgeoning demand that artificial intelligence has placed on cloud infrastructure. The companies reported that the growth of their combined cloud businesses, which generate more than $200 billion in annual sales, accelerated to a nearly 24% pace in the quarter.

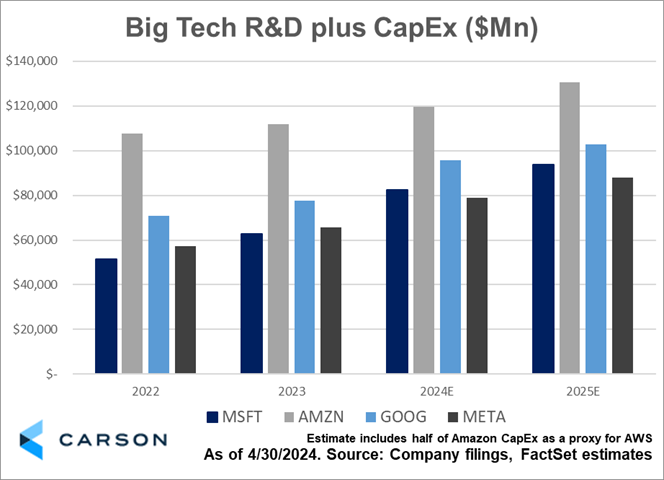

This year, each of these companies is projected to invest nearly $100 billion in their businesses, with a substantial portion earmarked for cloud computing and AI-related initiatives. While not a cloud provider, Meta has ambitious AI-related goals and is spending to keep pace with the competition as well. The sheer magnitude of these investments is unprecedented and reflects the scale of the opportunity, and level of competition, in this space. Despite the dramatic increase in spending, Alphabet, Microsoft, and Amazon are all still grappling with the challenge of meeting the skyrocketing demand of their customers. Microsoft’s CFO, Amy Hood, acknowledged the struggle, noting that “near-term AI demand is a bit higher than our available capacity.” Demand for AI-based solutions is already broad based, and the struggle for the infrastructure to keep pace illustrates why these companies are spending with such a voracious appetite.

Investors are understandably keen to understand the timing and scale of returns stemming from the massive investments in AI and related infrastructure. Generative AI is still a very nascent technology and scaled profits will likely remain elusive for a period of time, though investors will increasingly seek emerging signals of profitability and business use cases.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For skeptics with a bearish outlook, or those harboring bitterness from missing early opportunities in AI, the exponential rise in spending may evoke concerns. Top companies are hurtling towards an annual investment pace of more than $500 billion in coming years, dwarfing the investment fervor of the dotcom era by more than tenfold. Amidst escalating costs and fierce competition, there’s a looming fear that if the AI race fails to yield significant returns. Ultimately no one may win.

However, bulls can point to AI usage exploding, ushering in fresh business prospects and avenues to enhance existing operations across all sectors of the economy. Microsoft’s Open AI Service, used by over 65% of Fortune 500 firms, is empowering organizations to harness generative AI for the first time. From farmers to financiers, doctors to lawyers, AI is unlocking opportunities at an accelerating pace.

Remarkable strides in autonomous driving and drug discovery are already yielding substantial benefits, despite being in their infancy. Moreover, one of AI’s most promising near-term opportunities lies within the core operations of the companies investing in it. Google and Facebook have both noted dramatic enhancements in their core advertising businesses, while Amazon’s profitability has surged, thanks to AI-driven improvements. And let’s not overlook the soaring demand for cloud computing, further fueling the momentum driving investment behind AI.

Artificial intelligence stands as a transformative force poised to revolutionize every facet of our world. Industry leaders are embarking on a journey of unprecedented investment, scaling efforts to harness AI’s capabilities and bridge the gap between science fiction and reality. This era parallels historical moments of innovation, reminiscent of the advent of the internet or electrification of society, where groundbreaking technologies fundamentally reshaped human existence. Yet, as with those pivotal advancements, the true extent of AI’s potential remains tantalizingly unknown, leaving us to trust that today’s monumental spending will deliver a future brimming with possibilities yet to be unlocked.

For more content by Jake Bleicher, Portfolio Manager click here.

02227174-0524-A