Nearly all S&P 500 companies have reported earnings for the second quarter of 2025, with the notable exception of Nvidia, which we will cover in detail next week. Spoiler alert: earnings results were quite solid despite the uncertainties. A.I. companies shined, particularly in the “Mag 7” (as we discuss here and here), but there were other notable positives from across the broader index.

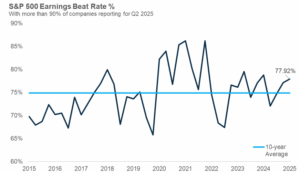

First and foremost, nearly 78% of companies so far have beat their earnings estimate (according to S&P). This is above average as shown in the chart below, but what is even more striking is the degree to which companies have exceeded estimates: companies that have beaten EPS estimates have done so by more than 8% – another above-average figure.

Sources: S&P Global, Carson Investment Research, 8/19/2025

We often remind readers that over the intermediate-to-long-term, earnings drive stock prices, and last quarter earnings jumped more than 11%! This is the third consecutive quarter of double-digit earnings growth. And despite a large contribution from the Mag 7 (earnings there grew 26% without NVDA reporting yet), the median stock in the index has seen 8% y/y earnings growth – a very healthy number. Companies are also reporting strong revenue figures, with beat rates similar to those of earnings (which is rare) and overall growth above 6% – again, very healthy fundamentals.

What has also been notable throughout the quarter has been the increase in forward guidance from companies. Nearly 60% of companies have raised their forward guidance for full-year EPS, something nearly unthinkable earlier this year when companies were withdrawing guidance completely in the wake of tariff uncertainty.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

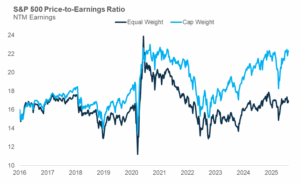

This strong continued growth in the stock market is, and should be, a reflection of the aforementioned strength in earnings growth. Despite this strong growth, we have seen stocks continue to trade at higher price-to-earnings (P/E) multiples, especially on a market cap-weighted basis. The chart below shows current price-to-next 12-month analyst predicted earnings for the S&P 500 and S&P 500 equal weight for the past 10 years. Valuations remain elevated at the index level but are more reasonable on an equal-weighted basis.

Sources: Factset, Carson Investment Research, 8/15/2025

Profit margins have also continued to climb, hinting that companies have at least in part weathered the full effects of higher prices. This also bodes well for future earnings growth, as profit margins give companies the cushion needed to extract earnings growth from revenues, even if revenue growth starts to slow.

Finally, another set of statistics that you didn’t know you needed – stocks are trading in ways that increasingly favor active management. The average correlation between index constituents is near lows, while stock dispersion (the difference between winners and losers) is rising. Market concentration captures most of the headlines, but the universe of stocks beyond the largest names offers ample opportunities for skilled active managers to find winners.

8305174.1-08.20.25A

For more content by Grant Engelbart, VP, Investment Strategist click here